Antero Midstream Corp Offers Attractive Dividend Yield Above 5%

In analysis from Dividend Channel, on Wednesday, shares of Antero Midstream Corp (Symbol: AM) traded with a yield exceeding 5% based on its quarterly dividend of $0.90 annually. The shares were observed as low as $17.98 during the trading session. For investors, dividends remain crucial because they represent a significant portion of the total returns in the stock market historically.

For instance, if you had bought shares of the iShares Russell 3000 ETF (IWV) on May 31, 2000, at a cost of $78.27 each, you would have found that by May 31, 2012, the share price had declined slightly to $77.79—a negligible loss of $0.48 or 0.6% over twelve years. However, during that timeframe, you would have accumulated $10.77 in dividends per share, effectively enhancing your overall return to 13.15%. Even with dividends reinvested, the average annual total return hovers around just 1.0%. In this context, a sustainable yield above 5% from Antero Midstream becomes particularly appealing.

As a member of the Russell 3000, Antero Midstream Corp ranks among the largest 3,000 companies in the U.S. stock market, further emphasizing its significant role within the investment landscape. However, it’s essential to note that dividend amounts are not guaranteed; they often fluctuate alongside each company’s profitability.

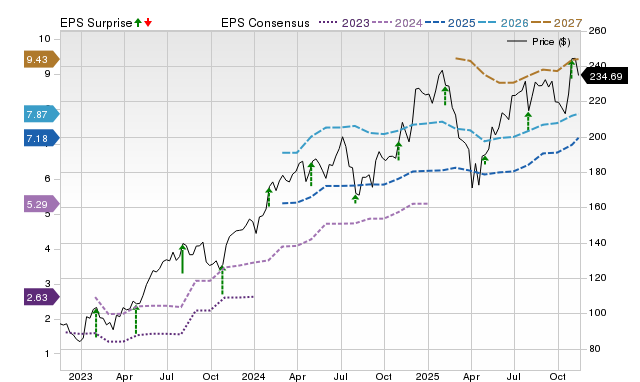

To better evaluate the sustainability of Antero Midstream’s recent dividend, investors can examine the historical dividend chart for AM below, providing insights into whether a 5% annual yield is a reasonable expectation.

Free report: Top 8%+ Dividends (paid monthly)

![]() Click here to discover which 9 other dividend stocks have recently become available at favorable prices »

Click here to discover which 9 other dividend stocks have recently become available at favorable prices »

Additional Resources:

- Institutional Holders of EVUS

- Institutional Holders of GKOS

- Top Ten Hedge Funds Holding MIFI

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.