Nvidia’s Growth Trajectory: Is It Still a Solid Investment?

Nvidia (NASDAQ: NVDA) has quickly risen to become one of the largest companies worldwide, boasting a market capitalization that exceeds $3 trillion. This rise is part of a larger trend where various AI stocks are seeing significant value increases.

But does this mean Nvidia’s stock is still a worthy investment? Recent research from The Motley Fool on AI adoption rates suggests a strong affirmative. The statistics provided below may surprise many investors.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Learn More »

The AI Revolution: Just Getting Started

There’s significant buzz surrounding the current AI boom, but it’s crucial to understand that its true revolution is only beginning. This process will likely span decades, creating substantial opportunities for investors who choose to stay the course. The adoption statistics featured in The Fool’s recent report illustrate this.

In the U.S., the current AI adoption rate for businesses is merely 6.8%. However, projections for the next six months indicate an increase to 9.3%, marking a 37% growth. Despite this anticipated growth, the overall adoption of AI will still fall below 10%. “These figures may seem modest given AI’s frequently touted transformative potential,” the report notes. This underlines the point that while AI is widely discussed, its actual integration in businesses remains low. This gap will likely close over time, but the journey will take many years, possibly decades.

The Fool’s findings align with research from global consultancy McKinsey, forecasting substantial growth in the AI market by 2040. Their low-end projection shows AI software and services revenue climbing from $85 billion in 2022 to a staggering $1.5 trillion by 2040. On the high end, revenues could soar to $4.6 trillion.

Focusing specifically on generative AI, McKinsey anticipates it could contribute between $2.6 trillion and $4.4 trillion in economic growth as businesses increasingly adopt this technology. This situation presents a unique growth opportunity in history. However, does this indicate that Nvidia’s stock is a buy?

Considering an Investment in Nvidia

Recognizing a growth market differs from investing within one. Stocks with significant potential often come with valuations that reflect that promise. Consequently, although Nvidia’s growth rate appears impressive, its current valuation may offset some of that anticipated growth.

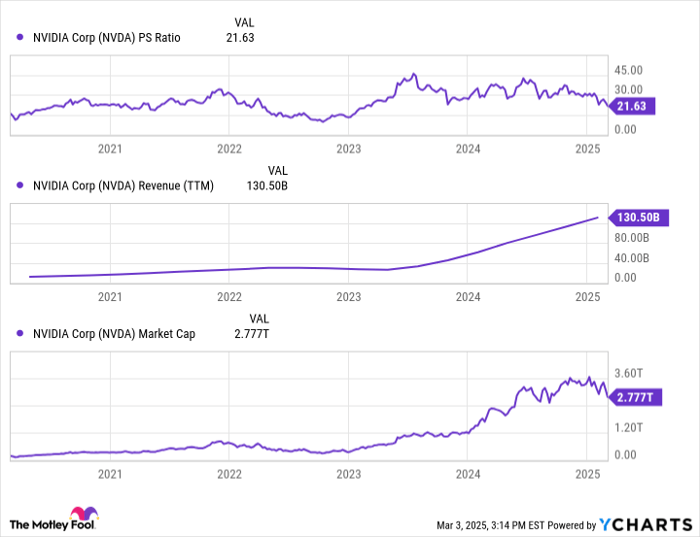

Nvidia finds itself in an intriguing position. Its price-to-sales (P/S) multiple stands at 21.6, which is notably high for a company of its size. Nevertheless, its revenue evidences a robust growth trajectory, and considering the statistics mentioned, it’s reasonable to expect Nvidia to sustain this trend for years ahead.

Is Nvidia stock worth purchasing?

NVDA PS Ratio data by YCharts; TTM = trailing 12 months.

Growth stocks such as Nvidia can be highly volatile in the short term. Earlier this year, it lost hundreds of billions in market capitalization due to a broader industry correction. A significant rebound is equally probable.

However, investors looking to capitalize on the rising adoption of AI should not be discouraged by short-term fluctuations. Nvidia’s position as a leader in AI graphic processing units—due to strategic decisions like the launch of its CUDA developer suite in 2006—provides a strong foundation. The company is well-placed to succeed in the expansive market for years to come. Over extended periods, even elevated multiples can appear undervalued.

Nvidia remains a compelling choice for those looking to gain from the AI revolution, and patience may yield substantial long-term rewards.

Seize This Second Chance at a Lucrative Opportunity

Have you ever felt you missed out on investing in top-performing stocks? You may want to pay attention now.

On rare occasions, our expert team of analysts issues a “Double Down” Stock recommendation for companies they believe are poised for growth. If you’re concerned that you’ve missed your opportunity to invest, this could be the perfect moment to act. The numbers reflect this:

- Nvidia: if you invested $1,000 when we last doubled down in 2009, you’d have $292,207!*

- Apple: if you invested $1,000 when we doubled down in 2008, you’d have $45,326!*

- Netflix: if you invested $1,000 when we doubled down in 2004, you’d have $480,568!*

Currently, we’re issuing “Double Down” alerts for three outstanding companies, and this opportunity might not present itself again anytime soon.

Continue »

*Stock Advisor returns as of March 3, 2025

Ryan Vanzo has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Nvidia. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.