Anticipation Builds as Apple Prepares for Fourth Quarter Earnings

Technology leader Apple AAPL is on the verge of announcing its fourth-quarter fiscal 2024 earnings after the market closes on Oct. 31. With Apple representing nearly 7% of the total market capital for the technology sector on the S&P 500 Index, reviewing its financial health prior to this announcement is crucial.

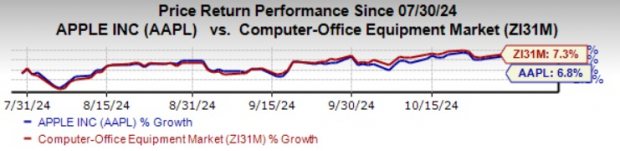

Over the past three months, Apple has seen a gain of about 7%, which falls short of the industry’s growth rate of 7.3%. However, a stronger than expected earnings report could enhance its performance (see: all the Technology ETFs here).

Image Source: Zacks Investment Research

ETFs Tied to Apple Under the Microscope

Several Exchange-Traded Funds (ETFs) prominently feature Apple. The Vanguard Information Technology ETF VGT, MSCI Information Technology Index ETF FTEC, iShares US Technology ETF IYW, and Technology Select Sector SPDR Fund XLK all have Apple as their leading company with substantial allocations. These ETFs hold a Zacks ETF Rank of #1 (Strong Buy) or #2 (Buy).

Understanding Apple’s Earnings Outlook

Currently, Apple has an Earnings ESP of -10.37% and maintains a Zacks Rank of #3 (Hold). This combination suggests that a positive Earnings ESP paired with a Zacks Rank of #1 (Strong Buy), #2 (Buy), or #3 increases the likelihood of a strong earnings report.

In the past week, Apple experienced a slight decrease in earnings estimates by 5 cents for the upcoming fiscal quarter. The company has a history of exceeding earnings expectations, with an average surprise of 3.79% in the last four quarters. The Zacks Consensus Estimate anticipates a modest year-over-year increase of 2% for earnings and a 5.5% rise in revenues (read: Should You Buy Apple ETFs as the Stock Hovers Around a Record High?).

Apple Stock Performance and Analyst Insights

The analysis shows that analysts give Apple a recommendation score of 1.86 on a scale of 1 to 5, indicating a positive outlook. This score has increased from 1.76 a month earlier, based on input from 32 brokerage firms. Currently, 18 analysts classify it as Strong Buy and 4 as Buy. The average short-term price target is $241.67, ranging from a low of $184.00 to a high of $300.00.

Despite a healthy Growth Score of B, Apple’s rank sits within the lower tier of the Zacks Industry (bottom 18%). Currently, the company’s stock trades at a premium with a forward P/E ratio of 31.16, which significantly exceeds the industry average of 14.98.

Looking Ahead: Apple’s Revenue Growth

In the third quarter of fiscal 2024, Apple returned to revenue growth, successfully launching four new iPhone 16 models powered by AI. These new devices are likely to drive a significant upgrade cycle, thereby boosting company performance and restoring investor confidence. Notably, initial sales of the iPhone 16 in China increased by 20% within the first three weeks compared to the iPhone 15 series, according to Bloomberg (read: What Lies Ahead of Apple Stock & ETFs: Up or Down?).

As a result, Apple’s stock is nearing a new high, bolstered by rising interest in the new iPhone 16. Preliminary figures from International Data Corporation indicate a 3.5% year-over-year growth in shipments during the third quarter, driven by strong demand for existing models and the recent launch of the iPhone 16 lineup. Furthermore, Apple has regained some market presence in China, achieving a 15.6% share in the third quarter—an impressive turnaround after slipping to sixth place in the previous quarter.

Looking ahead, Apple expects revenue growth in the fourth quarter to match the 5% growth rate seen in the third quarter.

Launch of Apple Intelligence

This week, Apple introduced Apple Intelligence, a collection of AI tools available on select devices through its recent software update for iPhones, iPads, and Macs. Users of any iPhone 16, iPhone 15 Pro, and Pro Max can access these AI features for free by updating to iOS 18.1. Apple Intelligence is also supported on eligible iPad and Mac models with iPadOS 18.1 and macOS Sequoia 15.

Key ETFs Highlighting Apple

Vanguard Information Technology ETF (VGT) – Apple constitutes 16.1% of the fund.

MSCI Information Technology Index ETF (FTEC) – Apple has a 15.8% allocation within this ETF.

iShares US Technology ETF (IYW) – Apple makes up 15.5% of this fund.

Technology Select Sector SPDR Fund (XLK) – Apple holds a 14.6% share in this ETF.

Stay Updated on ETFs

Zacks offers a free Fund Newsletter that provides weekly updates on important news, analysis, and top-performing ETFs.

Apple Inc. (AAPL): Free Stock Analysis Report

For more insights, click here to read the article on Zacks.com.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.