Bristol Myers Squibb’s Earnings Report Insights and Market Reactions

Bristol Myers Squibb (NYSE:BMY) is set to announce its earnings report on Thursday, April 24, 2025. Historically, BMY stock has tended to react negatively following earnings announcements. Over the past five years, there has been a negative one-day return in 55% of instances, with a median decrease of 3.0% and a maximum single-day drop of 8.5%.

Trading Strategies Based on Historical Performance

For event-driven traders, understanding these historical patterns may provide a strategic advantage. The actual market reaction will depend on reported results in comparison to consensus estimates and market expectations. Two main strategies can be derived: First, traders can assess the historical likelihood of a negative reaction and position themselves ahead of the earnings release. Second, they may evaluate the relationship between short-term and medium-term returns following the announcement to guide their trading choices.

Current Earnings Estimates and Company Performance

Current consensus estimates suggest earnings per share of $1.51 on revenues of $10.73 billion. This reflects a significant recovery from the loss per share of $4.40 on revenues of $11.87 billion reported for the same period last year. A closer look at the drivers reveals that Bristol Myers Squibb’s growth portfolio—featuring drugs like Reblozyl, Opdualag, Breyanzi, and Camzyos—is expected to deliver strong performance. However, the legacy portfolio is likely to weigh down total sales due to persistent declines in Revlimid and Sprycel sales.

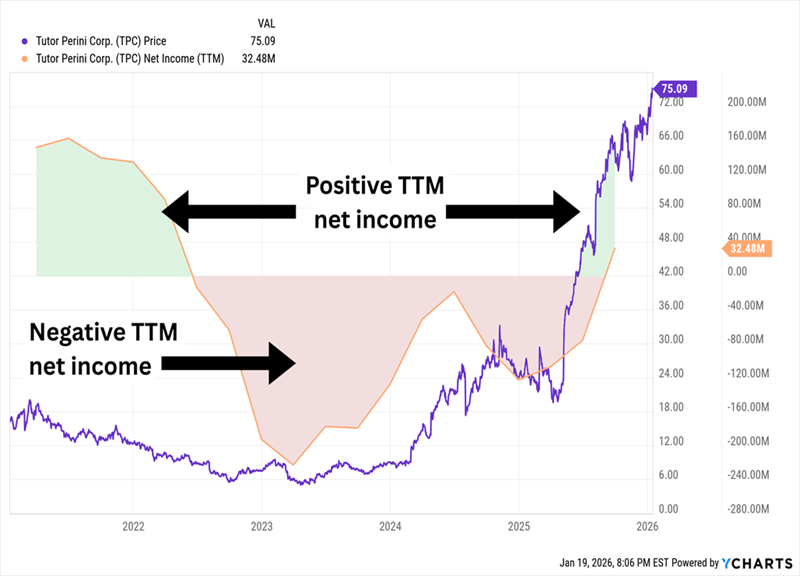

Historical Earnings Return Patterns

Examining the one-day (1D) post-earnings returns reveals the following:

- In the last five years, there were 20 recorded earnings events, with 9 positive and 11 negative one-day returns, indicating positive returns approximately 45% of the time.

- This figure rises to 55% when assessing the last three years.

- The median for the 9 positive returns was 2.2%, while the 11 negative returns had a median of -3.0%.

Further data on observed 5-Day (5D) and 21-Day (21D) returns post earnings are outlined in the accompanying table.

BMY 1D, 5D, and 21D post-earnings return

Understanding Correlations in Returns

Utilizing a strategy based on understanding correlations between short-term and medium-term returns post earnings can mitigate risk. Traders may identify pairs that exhibit strong correlations and execute trades accordingly. For instance, if the correlation between one-day (1D) and five-day (5D) returns is high, traders could opt for a long position following positive 1D returns. The correlation details in this analysis are rooted in five-year and three-year histories.

BMY Correlation Between 1D, 5D and 21D Historical Returns

Impact of Peer Performance on Stock Reactions

Peer performance can notably influence Bristol Myers Squibb’s stock reaction following earnings disclosures. Investors may start pricing in expected reactions even before the earnings are announced. The following session compares Bristol-Myers Squibb’s historical stock performance post-earnings to that of peers who reported earnings shortly beforehand, ensuring fair analysis by comparing the one-day (1D) returns.

BMY Correlation With Peer earnings

Systematic Strategies & Rules-Based Wealth Management

Trefis employs systematic portfolio management methods that enhance risk control through a blend of high-quality selections and proactive hedging strategies.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.