Copart Prepares for Strong Q3 FY’25 Earnings Report

Copart (NASDAQ: CPRT), a leading online auto auction platform specializing in auto salvaging, is scheduled to release its Q3 FY’25 earnings on May 22. This quarter is expected to show a continued upward trend in volumes as the company capitalizes on favorable market conditions. Consensus forecasts suggest revenue will reach approximately $1.23 billion, representing a 9% increase year-over-year. Additionally, earnings per share are predicted to be $0.42, a $0.03 rise compared to last year. Recent growth in the business has been driven by a greater supply of vehicles being scrapped, largely due to natural disasters. Rising vehicle repair costs and the increasing complexity of new cars have prompted insurance firms to declare more vehicles as totaled rather than opting for repairs, which serves as a positive factor for Copart.

Currently, Copart holds a market capitalization of $61 billion. Over the last twelve months, its revenue amounted to $4.5 billion, with operational profitability reflected in $1.6 billion in operating profits and a net income of $1.5 billion.

Copart’s Historical Earnings Reaction Performance

Looking at historical earnings data, here are some insights regarding one-day post-earnings returns:

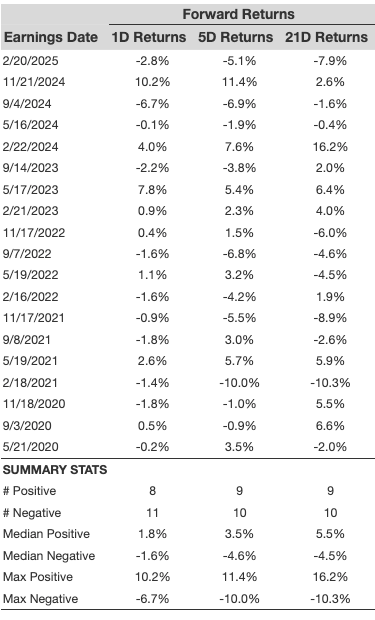

- Over the past five years, there are 19 documented earnings data points, resulting in 8 positive and 11 negative one-day returns. This indicates that positive returns occurred approximately 42% of the time.

- However, if we narrow the analysis to the past three years, this percentage increases to 55%.

- The median positive return was 1.8%, while the median negative return was -1.6%.

Further data on observed five-day (5D) and twenty-one-day (21D) post-earnings returns are compiled in the table below.

Correlation Between Short-Term and Medium-Term Returns

Understanding the correlation between short-term and medium-term returns after earnings can present a less risky trading strategy. If, for example, one-day (1D) and five-day (5D) returns show a high correlation, traders might consider going long for the subsequent five days following a positive 1D return. Correlation data based on both five-year and three-year history can provide useful insights for making such decisions.

Influence of Peer Performance on Post-Earnings Returns

The performance of Copart’s peers can significantly affect post-earnings stock reactions. Market reactions may start building up even before the official earnings announcement. Historical data comparing Copart’s stock performance with that of its peers that reported earnings prior to Copart indicate noteworthy performance patterns.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.