Tech Giants Set to Report Earnings Amid Market Uncertainty

As earnings season heats up, attention turns to the major tech players. Microsoft (MSFT), Meta Platforms (META), Apple (AAPL), and Amazon (AMZN)—the core of the “Magnificent 7”—are scheduled to release their results this week. Investors are keen for insights as these companies represent substantial market capitalizations, influencing trends in AI, e-commerce, advertising, and cloud services.

Following recent market volatility driven by fiscal unpredictability, tariff issues, inflation concerns, and geopolitical instability, clarity is needed. Will these tech titans secure strong numbers to instill confidence in investors?

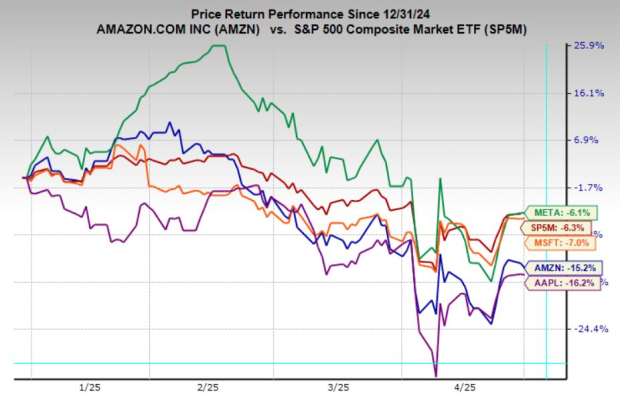

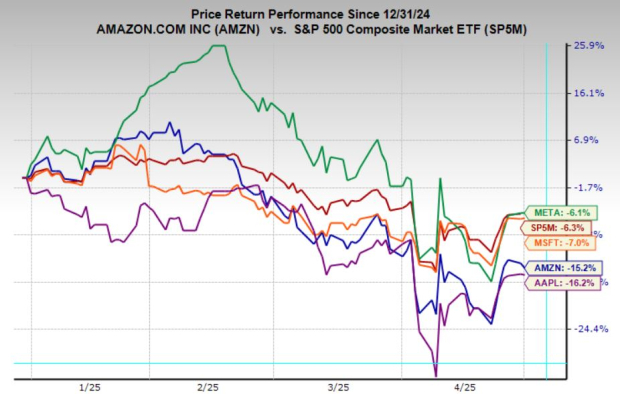

Despite their elite status, the Magnificent 7 has struggled this year, with all but Meta Platforms trailing the S&P 500. However, recent pullbacks have made valuations more appealing. These firms continue to hold promising earnings growth forecasts. Is now the right moment to consider investing in big tech?

Meta Platforms and Microsoft will announce their results Wednesday after market close, while Amazon and Apple will present their figures Thursday afternoon.

Image Source: Zacks Investment Research

Earnings Projections for the Magnificent 7

Currently, all four companies have a Zacks Rank #3 (Hold), indicating mixed earnings estimate revisions as they approach their reports. Market uncertainty and macroeconomic exposure contribute to varied forecasts from analysts.

Historically, these firms have taken a cautious stance on forward guidance, often surpassing Wall Street estimates. For instance, Amazon has achieved an average earnings surprise of 25.4% over the last four quarters.

However, this quarter sees a notable shift. Three out of four companies report negative earnings ESP (Expected Surprise Prediction), suggesting potential downside surprises. Amazon’s ESP stands at -2.67%, Microsoft at -0.51%, and Apple at -0.85%. Meanwhile, Meta Platforms has a positive ESP of +3.0%, indicating a possible earnings beat.

Long-term earnings growth expectations for these giants remain robust. Amazon is anticipated to grow earnings at an annual rate of 22.3% over the next three to five years. Meta follows with a growth rate of 17.6%, Microsoft at 14.4%, and Apple, although slower, still aims for a respectable 12.8% annual growth.

Impact of Tariffs on Q3 Earnings for MSFT, AMZN, AAPL, and META

While recent tariff policies likely haven’t directly impacted the quarterly results of Microsoft, Amazon, Apple, or Meta, management discussions will be pivotal. Investors will scrutinize commentary for signs that rising trade tensions may affect future forecasts, particularly around AI infrastructure investments and consumer demand.

Apple and Amazon are at the forefront of tariff exposure. Apple’s hardware supply chain is heavily reliant on China, and disruptions could compress margins. For Amazon, tariffs might complicate inventory costs and pricing strategies for resellers on its platform.

Conversely, Microsoft and Meta may feel secondary effects from tariffs through broader economic slowdowns. A reduction in enterprise spending, slower advertising budgets, or delays in AI-related capital expenditures could hinder growth for both companies.

If management teams express caution about the latter half of the year or tone down guidance, it may indicate that protectionist policies are beginning to take their toll. Given the current focus on AI spending and consumer demand, any signs of hesitation could lead to significant stock movement.

Ultimately, this quarter’s figures may hold, but the executives’ tones and forward guidance will be crucial in shaping market reactions.

Do MSFT, AAPL, META, and AMZN Shares Trade at a Discount?

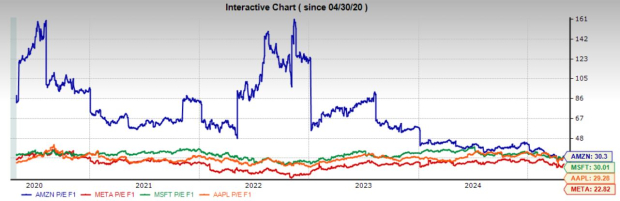

Following a robust performance in 2023 and into 2024, the recent pullback in large-cap tech has led to compressed valuations. Currently, Microsoft, Apple, Meta, and Amazon are trading below their respective five-year median forward earnings multiples. This reset aligns with broader market trends.

Investors Find Value Amidst Market Uncertainty from Tech Giants

Uncertainty in the market is opening doors for investors willing to overlook short-term fluctuations.

Meta and Amazon Stand Out for Investors

Among the key players, Meta Platforms offers an especially attractive valuation relative to its peers. Currently, it trades at just 22.8 times forward earnings, significantly below its historical average. This favorable valuation stands in contrast to its strong earnings momentum and improved monetization across its platforms. Amazon also presents a notable opportunity; it trades further below its five-year average multiple and boasts the highest long-term earnings growth forecast in this group, projected at over 22% annually.

The combination of diminished valuation and robust earnings potential makes both Meta and Amazon appealing choices right now. On the other hand, while Microsoft and Apple might be pricier in absolute terms, they also present improved entry points following recent declines.

Image Source: Zacks Investment Research

Anticipating Earnings from the Magnificent 7

This week’s earnings reports from Microsoft, Apple, Meta, and Amazon are poised to offer crucial insights into the health of the tech sector and the broader economy. While short-term expectations have moderated, the long-term growth narratives remain strong, particularly for Meta and Amazon, which offer attractive combinations of valuation and momentum.

Investors should be mindful of tariff risks and macroeconomic uncertainty that may impact commentary. However, key focus areas should include guidance, AI-related capital plans, and signals regarding enterprise and consumer demand. Strong earnings reports could reinvigorate momentum in big tech and possibly uplift broader market indices.

For long-term investors, recent pullbacks may be presenting valuable opportunities to selectively accumulate shares of the Magnificent 7 in anticipation of future growth.

This article originally published on Zacks Investment Research (zacks.com).

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.