Eastman Chemical to Announce Q1 Earnings with Positive Forecasts

Eastman Chemical Company (EMN), a specialty materials leader, is based in Kingsport, Tennessee. Established in 1920 and currently valued at a market capitalization of $9.4 billion, Eastman operates globally in over 100 countries. The company utilizes advanced technology and strong customer relationships to provide sustainable and innovative solutions across various industries. EMN plans to release its fiscal Q1 earnings results on Thursday, April 24.

Earnings Expectations and Recent Performance

In anticipation of this announcement, analysts predict that EMN will report a profit of $1.89 per share, representing a 17.4% increase from $1.61 per share in the same quarter last year. Notably, Eastman has exceeded Wall Street’s earnings estimates in each of the last four quarters.

In its most recent quarter, Eastman achieved an EPS of $1.87, surpassing the consensus estimate by 18.4%. This strong performance was driven by effective pricing strategies, cost management, and robust growth in key segments, including Advanced Materials and Additives & Functional Products.

Future Earnings Projections

Looking ahead, analysts project that EMN will report an EPS of $8.41 for the current fiscal year, a 6.6% increase from $7.89 in fiscal 2024. For fiscal 2026, EPS is expected to grow further by 10.2% year-over-year, reaching $9.27.

Stock Performance Insights

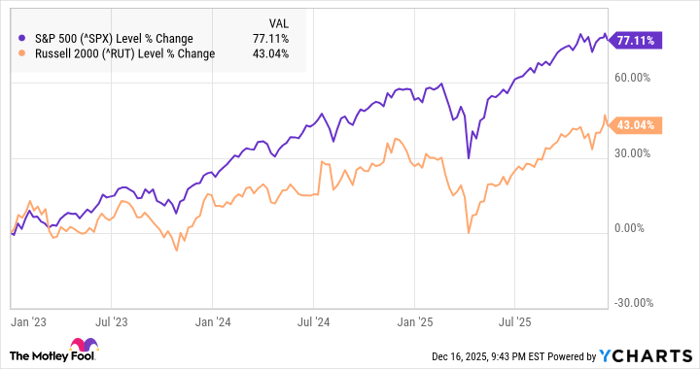

Over the past year, EMN shares have decreased by 24.5%, underperforming compared to the S&P 500 Index’s increase of 2.1% and the Materials Select Sector SPDR Fund’s (XLB) decline of 14.7% during the same period.

On April 9, Eastman Chemical saw its shares rise more than 12%, marking a significant recovery following a four-day losing streak. This rally coincided with a broader rebound in the U.S. markets, signaling renewed investor interest. The uptick was also buoyed by the announcement that Eastman™ Turbo Oil 2330 (ETO 2330) received MIL-PRF-7808 Grade 3 approval from the U.S. Air Force, a milestone as the first new product to meet this military specification since 1983.

Analyst Ratings and Price Targets

The consensus rating for Eastman Chemical stock is generally positive, currently labeled as a “Moderate Buy.” Among the 16 analysts covering the stock, recommendations include nine “Strong Buys,” two “Moderate Buys,” and five “Holds.” The average price target for EMN stands at $111.47, indicating a potential upside of 46.6% from current levels.

On the date of publication, Kritika Sarmah did not hold (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article are for informational purposes only. For further details, please view the Barchart Disclosure Policy here.

More news from Barchart

The views and opinions expressed in this article are those of the author and do not necessarily reflect the views of Nasdaq, Inc.