Freeport-McMoRan Earnings Report Due April 24, 2025

Freeport-McMoRan (NYSE: FCX) will report its earnings on Thursday, April 24, 2025. As of now, the company boasts a market capitalization of $47 billion. Over the last twelve months, it generated $25 billion in revenue, achieving operational profits of $6.9 billion and a net income of $1.9 billion.

View earnings reaction history for all stocks

Historical Performance of Freeport-McMoRan

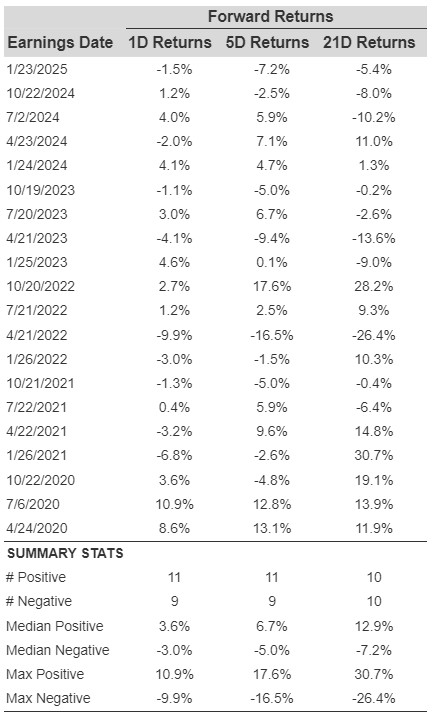

Reviewing Freeport-McMoRan’s post-earnings returns, we find insightful data over the past five years:

- There were 20 recorded earnings reports, with 11 positive and 9 negative one-day (1D) returns. This indicates a positive return approximately 55% of the time.

- This percentage increases to 64% when considering only the last three years.

- The median of the 11 positive returns is 3.6%, while the median of the 9 negative returns is -3.0%.

Additional statistics on observed 5-Day (5D) and 21-Day (21D) returns following earnings are summarized in the table below.

Correlation Between Returns

Exploring the correlation between various return periods can yield a more structured investment strategy. If a trader finds high correlation between 1D and 5D returns, they might choose to go “long” for the next five days following a positive 1D post-earnings report. The correlation data, based on five-year and three-year histories, is outlined in the figure below.

The Influence of Peer Earnings on Stock Reaction

It’s also valuable to consider how the performance of peers can influence Freeport-McMoRan’s stock reaction after earnings announcements. Historical trends indicate that the market may start to price in expectations before the actual earnings are disclosed. The chart below presents Freeport-McMoRan’s post-earnings performance alongside its peers who reported earnings shortly before.

Overall, understanding the trends surrounding Freeport-McMoRan and its peers can provide investors with valuable insights ahead of the upcoming earnings report.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.