AI Chip Market Outlook: Marvell Technology Poised for Growth Amidst Nvidia’s Challenges

The market for artificial intelligence (AI) chips has been dominated by Nvidia. This dominance was apparent as the semiconductor giant recently reported impressive third-quarter results for fiscal 2025, ending on October 27.

Nvidia Shines but Faces Stock Obstacles

Nvidia’s revenue skyrocketed 94% year over year, reaching $35.1 billion. Its ability to increase prices allowed the company to more than double its adjusted earnings to $0.81 per share. Despite these standout results, the stock’s response has been muted, with shares declining since the report was issued.

Several factors may explain this behavior. Nvidia’s high valuation raises concerns about its future growth. Additionally, the pressure on margins from the fast production ramp-up of its new AI chip generation may have left investors feeling uncertain.

Marvell Technology: A Compelling Alternative

Unlike Nvidia, there is another chip stock that has shown robust performance and remains more affordable. Marvell Technology (NASDAQ: MRVL) is expected to release its fiscal 2025 third-quarter results on December 3. The positive growth trajectory, aided by demand for custom chips, positions Marvell for a strong performance.

Marvell’s shares have jumped 33% since its previous quarterly report on August 29. This growth is primarily due to the increasing demand for its custom chips, which counteracts weaker performance in other areas. In fiscal Q2, overall revenue fell by 5% to $1.27 billion, and adjusted earnings decreased from $0.33 per share to $0.30. However, data center revenue climbed 92% year over year to $881 million, overshadowing the overall declines.

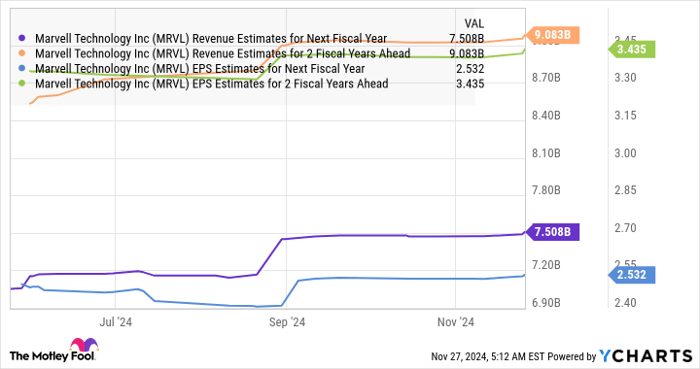

Looking ahead, Marvell anticipates earnings of $1.45 billion for fiscal Q3, a slight rise from the previous year. Analysts predict that Marvell will finish the current fiscal year with $5.54 billion in revenue, which is nearly flat compared to last year. Expected earnings are projected to dip from $1.51 per share to $1.46. Nevertheless, Marvell’s growth is set to accelerate in the following years.

MRVL Revenue Estimates for Next Fiscal Year data by YCharts

Promising Long-Term Outlook for Marvell

The market for custom AI chips is thriving, which bodes well for Marvell’s future. The company expects AI revenue to reach $1.5 billion by the end of fiscal 2025, with projections of $2.5 billion in fiscal 2026. Marvell anticipates its total addressable market (TAM) in data centers to grow from $21 billion in 2023 to $75 billion by 2028.

Of this market, $43 billion will be driven by demand for custom compute chips, while the remaining $26 billion will come from developments in data center switching and interconnect markets. Marvell’s advancements in these areas are promising, with CEO Matt Murphy noting the successful progression of AI custom silicon programs on their previous earnings call.

Is Marvell Technology a Good Investment?

Before investing in Marvell Technology, consider this: the Motley Fool Stock Advisor team recently identified their top 10 stocks, and Marvell was not included. The stocks that made the list are projected for significant returns in the coming years.

Take Nvidia, for example. When it made the list on April 15, 2005, a $1,000 investment at that time would now be worth approximately $847,211!*

Stock Advisor provides an easy-to-follow investment strategy with portfolio guidance, regular analyst updates, and two new stock picks each month. The Stock Advisor service has outperformed the S&P 500 fourfold since its inception in 2002.*

See the 10 stocks »

*Stock Advisor returns as of November 25, 2024

Harsh Chauhan has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Nvidia. The Motley Fool also recommends Marvell Technology. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.