Heico Set to Report Earnings Amid Mixed Historical Performance

Heico (NYSE:HEI), an aerospace and electronics firm, will report its earnings on Tuesday, June 3, 2025. For event-driven traders, analyzing historical stock performance around earnings releases is crucial. There are two primary strategies to implement:

- Pre-earnings Positioning: Traders can assess historical probabilities and take positions before the earnings announcement.

- Post-earnings Positioning: Alternatively, traders should review the correlation between immediate and medium-term returns after the earnings release and adjust positions accordingly.

Over the past five years, Heico has had negative one-day returns after earnings announcements 53% of the time. The median drop was -3.1%, with a maximum decline of -8.7%.

Analyst Forecasts and Financial Performance

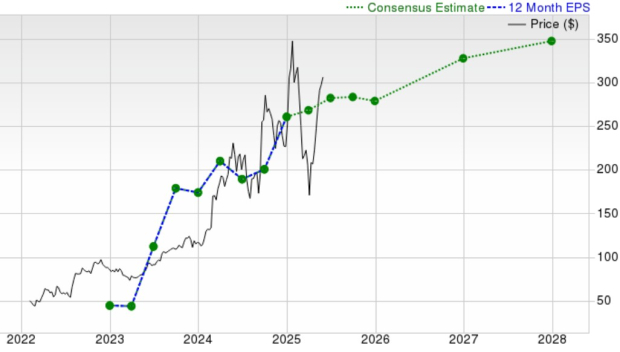

Analysts expect Heico to report earnings of $1.12 per share on sales of $1.11 billion, up from the previous year’s $0.97 per share on $992 million in sales. Currently, Heico’s market capitalization stands at $42 billion. The company generated $4.0 billion in revenue over the last year, achieving $871 million in operating profits and a net income of $567 million.

Heico’s Historical Odds of Positive Post-Earnings Return

Reviewing one-day post-earnings returns reveals:

- Over the last five years, Heico recorded 19 earnings announcements, resulting in 9 positive and 10 negative one-day returns. Positive returns occurred approximately 47% of the time.

- This percentage improves to 50% when considering data from the last 3 years.

- The median of the 9 positive returns was +0.6%, while the median of the 10 negative returns was -3.1%.

Correlation Between 1D, 5D, and 21D Historical Returns

Understanding the correlation between short-term and medium-term returns post-earnings can inform less risky trading strategies. A high correlation between 1D and subsequent 5D returns may prompt traders to position themselves long for the next five days following a positive 1D return.

Correlation with Peer Earnings

Peer performance may influence post-earnings stock reactions. Pricing could begin to reflect peer earnings results even before Heico’s announcement. Historical data on Heico’s stock performance compared to peers reporting earnings prior showcases these dynamics.

Investors should weigh these factors and strategies as Heico approaches its earnings announcement.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.