Home Depot Readies for Q3 Earnings: What to Expect

Atlanta’s Home Depot, Inc. (HD), a leader in home improvement retail, is set to report its fiscal third-quarter earnings for 2024 on Tuesday, November 12. The company, with a market cap of $403 billion, is known for a vast array of building materials, home improvement, lawn, and garden products, alongside its installation and repair services.

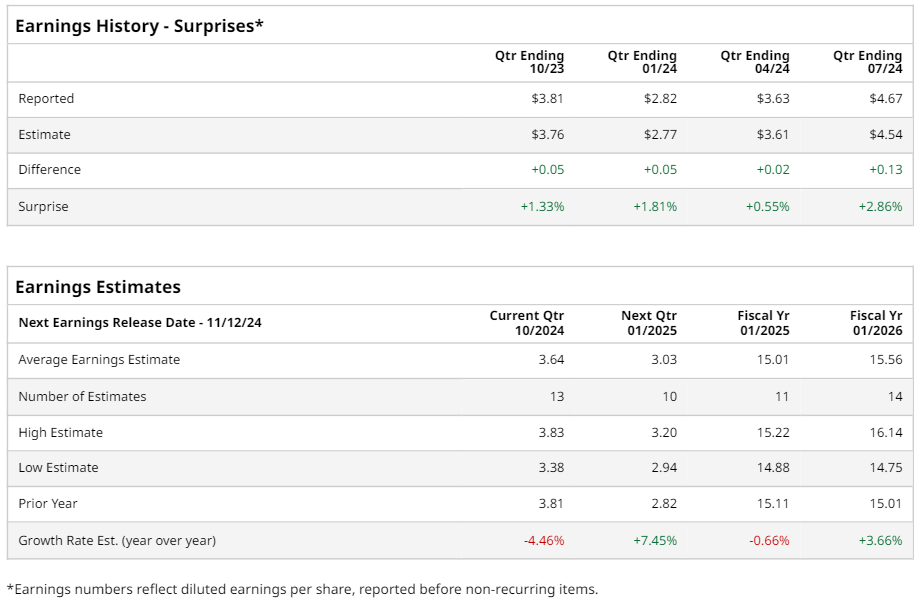

Analysts predict that HD will post earnings of $3.64 per share on a diluted basis. This figure reflects a decline of 4.5% from last year’s $3.81 per share. Notably, Home Depot has consistently exceeded Wall Street’s earnings per share (EPS) estimates in its last four quarterly reports.

Looking at the broader financial picture, the company is estimated to report EPS of $15.01 for the full fiscal year, a slight drop from $15.11 in fiscal 2023. However, projections indicate that EPS will rise by 3.7% year-over-year, reaching $15.56 by fiscal 2026.

Over the past 52 weeks, HD stock has shown resilience, outperforming the S&P 500, which saw gains of 38.5% with a rise of 40.3% in HD shares during the same period. Additionally, it fared better than the Consumer Discretionary Select Sector SPDR Fund (XLY), which gained 30% in that timeframe.

Investors remain optimistic about Home Depot’s future, bolstered by recent interest rate cuts, which may enhance consumer demand and support growth in the housing market.

On August 13, after announcing its Q2 results, HD shares rose by over 1%. The company reported an adjusted EPS of $4.67, exceeding expectations of $4.54, alongside revenue of $43.2 billion, surpassing forecasts of $42.6 billion.

The consensus among analysts regarding HD stock leans towards bullish, with an overall “Strong Buy” rating. Out of 34 analysts covering the company, 25 recommend a “Strong Buy,” one suggests a “Moderate Buy,” and eight propose a “Hold.” The average price target among analysts is $405.87, suggesting a potential upside of 1% from current levels.

More Stock Market News from Barchart

On the date of publication,

Neha Panjwani

did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.