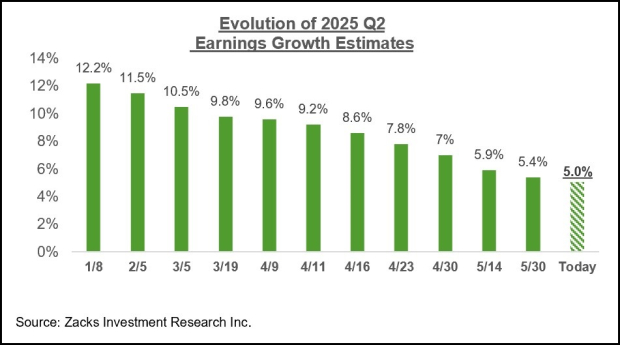

The expected Q2 earnings growth for the S&P 500 index is +5%, accompanied by a +3.9% increase in revenues. This growth rate would mark the lowest pace since +4.3% in Q3 2023. Estimates for 2025 Q2 earnings have also been declining, with cuts observed in 14 out of 16 sectors, particularly impacting Conglomerates, Autos, Transportation, Energy, Basic Materials, and Construction.

Key earnings releases this week include FedEx (FDX), Nike (NKE), and Micron Technology (MU). FedEx is projected to report earnings of $5.94 per share on revenues of $21.7 billion, reflecting a year-over-year decrease of -1.9%. Nike’s EPS is expected to drop -89.1% year-over-year, while Micron anticipates a leap in earnings to $1.57 per share, up +153.2% year-over-year, with revenues of $8.81 billion.

As of now, 9 S&P 500 companies have reported their fiscal Q2 results, showing a combined earnings growth of +2.4% compared to last year, with 77.8% exceeding EPS estimates. The earnings and revenue growth rates against historical data indicate a need for cautious interpretation due to the small sample size.