Booking Holdings Gears Up for Q3 Earnings: Analysts Project Strong Growth

Booking Holdings Inc. (BKNG), based in Norwalk, Connecticut, stands out as a leading force in the online travel service industry. The company operates multiple brands including Booking.com, Priceline, Agoda, and Kayak. With a market capitalization of $147.6 billion, Booking Holdings is recognized for its innovative strategies and commitment to enhancing travel experiences. The company is set to announce its fiscal Q3 earnings after the market closes on Thursday, October 30.

Analysts Expect Positive Earnings Report

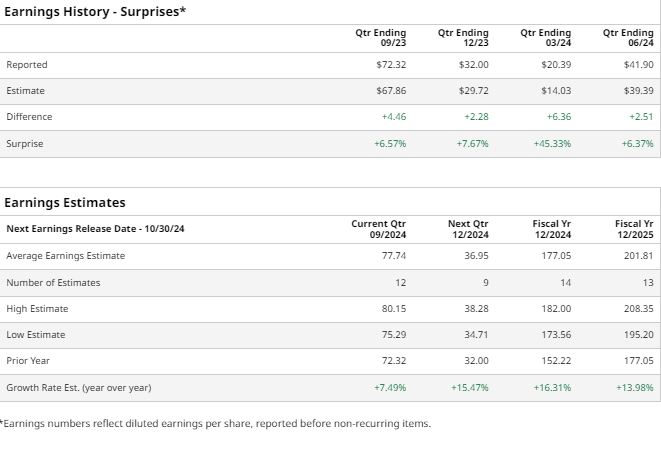

Ahead of the earnings announcement, analysts forecast that BKNG will report a profit of $77.74 per share, reflecting a 7.5% increase from $72.32 in the same quarter last year. Notably, Booking Holdings has consistently exceeded Wall Street’s earnings per share (EPS) estimates in its last four quarterly reports. The uptick in travel demand has bolstered their performance; the company reported adjusted earnings of $41.90 per share last quarter, exceeding expectations by 6.4%.

Future Projections Brighten for Booking Holdings

Looking ahead to fiscal 2024, analysts predict BKNG will generate an EPS of $177.05, marking a 16.3% rise from $152.22 in fiscal 2023.

Stock Performance and Market Context

BKNG stock has increased by 22.7% year-to-date, slightly trailing behind the broader S&P 500 Index’s impressive 23% gains. However, it has outperformed the Consumer Discretionary Select Sector SPDR Fund’s (XLY) returns of 11.6% within the same period.

Market Sentiment Bolsters Stock Value

On October 8, BKNG experienced a rise of over 1%, aided by favorable market conditions in the travel sector after a decline in crude oil prices and positive remarks from New York Fed President Williams regarding the U.S. economy.

Stock Reaction to Previous Earnings

When BKNG released its Q2 earnings on August 1, the company exceeded revenue and profit expectations. Despite this, the stock fell by 9.2% in the subsequent trading session due to forecasts indicating slower room night growth for Q3.

Analyst Ratings Show Mixed Signals

The consensus on BKNG stock leans toward cautious optimism, currently holding an overall “Moderate Buy” rating. Among 33 analysts, 20 recommend a “Strong Buy,” 2 a “Moderate Buy,” and 11 suggest a “Hold.”

Though RMD is trading above its average price target of $4,189.42, the highest target of $5,000 indicates a potential rise of 14.9% from current levels.

More Stock Market News from Barchart

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.