Molson Coors Prepares for Q3 Earnings: Analysts Predict a Drop

Molson Coors Beverage Company (TAP), based in Chicago, Illinois, is gearing up to announce its Q3 earnings on Thursday, Nov. 7, before the market opens. With a market cap of $11.8 billion, this global brewer offers a diverse range of renowned beer and beverage brands to customers across North America and Europe.

Analysts forecast that TAP will report a profit of $1.66 per share for the third quarter, which represents a 13.5% decrease from $1.92 during the same period last year. Notably, Molson Coors has successfully exceeded Wall Street’s earnings expectations in the last four quarters.

In its last quarter, the company reported adjusted earnings of $1.92 per share, which was 14.3% higher than the analysts’ consensus estimate. Key factors contributing to this positive outcome included a favorable price and sales mix that helped mitigate volume declines and negative impacts from currency fluctuations.

Looking ahead to fiscal 2024, analysts anticipate that TAP’s earnings per share (EPS) will rise to $5.71, marking a 5.2% increase from $5.43 in fiscal 2023.

Year-to-date, TAP stock has declined by 8.7%, underperforming the overall market. In contrast, the S&P 500 Index ($SPX) has posted 22.7% gains, while the First Trust Nasdaq Food & Beverage ETF (FTXG) has seen a 3.1% increase. This underperformance can be attributed to rising inflation and increased production costs that have pressured profit margins. Additionally, Molson Coors faces tough competition from craft breweries and the growing trend towards non-alcoholic beverages.

Interestingly, on Sept. 3, despite a broader market downturn, defensive consumer durable stocks—including Molson Coors—experienced gains, with TAP rising over 5%. Furthermore, on Aug. 6, the company’s stock closed up more than 5% following a report of Q2 net sales reaching $3.25 billion, surpassing expectations of $3.18 billion.

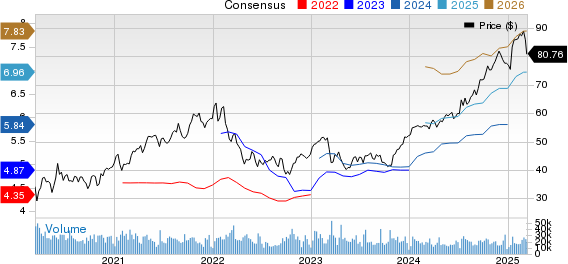

The overall consensus on TAP stock is cautious, earning an overall “Hold” rating. Among 16 analysts, three recommend a “Strong Buy,” while ten suggest a “Hold,” and three advise a “Strong Sell.”

Currently, TAP’s average analyst price target sits at $59.78, indicating a potential upside of 7% from its current trading levels.

More Stock Market News from Barchart

On the date of publication, Rashmi Kumari did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.