Global Payments Inc. Prepares for Q1 Earnings Amid Market Challenges

With a market capitalization of $17.6 billion, Global Payments Inc. (GPN) stands out as a significant player in payment technology and software solutions. The Atlanta-based company provides a wide array of services that enable merchants, financial institutions, and consumers to process digital payments in a secure and efficient manner.

Upcoming Earnings Report

GPN is slated to announce its fiscal Q1 earnings on Wednesday, May 7. Analysts anticipate a profit of $2.52 per share, representing a 1.6% increase from $2.48 per share in the same quarter last year. Over the past four quarters, GPN has exceeded Wall Street’s earnings expectations three times.

Annual Earnings Projections

For the current fiscal year, analysts expect an earnings per share (EPS) of $11.70, which marks a 5.9% rise from $11.05 in fiscal 2024. Looking ahead to fiscal 2026, EPS is projected to grow by 13.6% year-over-year to reach $13.29.

Stock Performance and Market Reaction

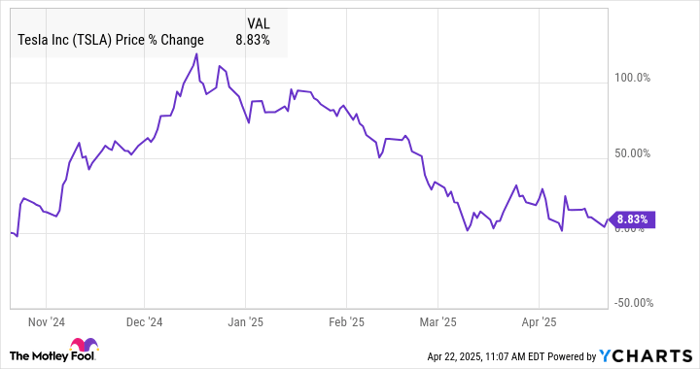

Over the past year, Global Payments shares have dropped by 43.5%, notably underperforming compared to the S&P 500 Index’s ($SPX) gain of 8.2% and the Technology Select Sector SPDR Fund’s (XLK) increase of 3.7% during the same timeframe.

On April 14, shares of GPN fell more than 17%, making it one of the largest decliners in the S&P 500 index. This decline followed the announcement of a $24.25 billion cash-and-stock acquisition of Worldpay from GTCR and Fidelity National Information Services, Inc. (FIS). The deal involves acquiring a 55% stake from GTCR and the remaining 45% from FIS while Global Payments will also sell its Issuer Solutions business to FIS for $13.5 billion.

Investor Concerns

Although this acquisition aims to enhance Global Payments’ presence in the fast-evolving digital payments sector and bolster its merchant acquiring capabilities, investor concerns have surfaced regarding the high costs, integration challenges, and potential debt implications associated with the deal.

Analyst Ratings and Price Targets

The consensus among analysts regarding GPN is moderately optimistic, carrying a “Moderate Buy” rating overall. Out of 34 analysts covering the stock, 13 recommend a “Strong Buy,” two suggest a “Moderate Buy,” 17 advocate for a “Hold,” and two propose a “Strong Sell.”

The average analyst price target for GPN stands at $111.14, suggesting a potential upside of 54.2% from current levels.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.