McKesson Corporation Preps for Q1 Earnings: Analysts Expect Strong Results

McKesson Corporation (MCK), headquartered in Irving, Texas, provides healthcare services both in the U.S. and internationally. With a market capitalization of $65.7 billion, it operates across several segments, including U.S. Pharmaceutical, Prescription Technology Solutions (RxTS), Medical-Surgical Solutions, and International. The company will announce its Q1 earnings for fiscal 2025 after the market closes on Wednesday, November 6.

Anticipated Earnings and Growth Projections

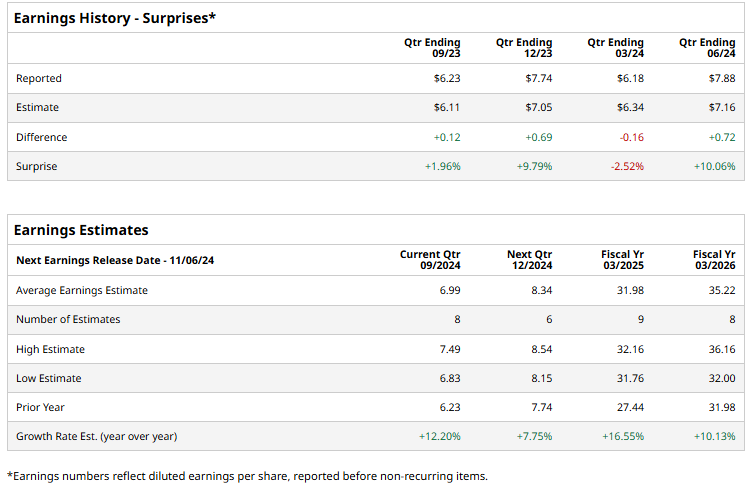

Analysts predict McKesson will report a profit of $6.99 per share for the quarter, a 12.2% increase from the $6.23 per share reported in the same period last year. Over the past four quarters, McKesson has exceeded Wall Street’s adjusted EPS expectations three times but has missed once. In the last reported quarter, the adjusted EPS rose by 8.4% year-over-year to $7.88, which surpassed consensus estimates by 10.1%.

Future Outlook for Fiscal Years 2025 and 2026

Looking ahead, analysts forecast an adjusted EPS of $31.98 for fiscal 2025, a significant 16.6% rise from $27.44 in fiscal 2024. For fiscal 2026, adjusted EPS is expected to further increase by 10.1% year-over-year to $35.22.

MCK Stock Performance Compared to Indices

This year, MCK stock has climbed by 9.2%, lagging behind the S&P 500 Index, which has increased by 22.7%, and the Health Care Select Sector SPDR Fund (XLV), which has grown by 10.8% within the same period.

Market Reactions to Past Earnings Report

Despite reporting earnings above expectations, McKesson’s shares fell by 11.3% following its Q1 earnings release on August 7. The company saw a year-over-year revenue increase of 6.4% to $79.3 billion, but it fell short of Wall Street’s revenue expectations, leading to a sell-off in its shares. Additionally, the net margin contracted by 13 basis points, dropping to 115 basis points compared to the previous year, resulting in a 4.5% decline in net income to shareholders, totaling $915 million.

Segment Performance and Guidance Revision

Notably, the U.S. Pharmaceutical segment, McKesson’s largest revenue and earnings contributor, reported a 5.7% rise in adjusted operating profit, amounting to $815 million. This growth was primarily driven by increased distribution of specialty products to healthcare providers and systems. Following this performance, the company also raised its adjusted EPS guidance to a range of $31.75 to $32.55, up from the previous range of $31.25 to $32.05.

Analyst Ratings and Market Sentiment

The overall consensus on MCK stock is moderately bullish, with a “Moderate Buy” rating. Among 16 analysts covering the stock, 10 advise a “Strong Buy,” one recommends a “Moderate Buy,” and five suggest a “Hold” rating. The mean price target stands at $560.47, indicating a potential upside of 10.9% from current levels.

More Stock Market News from Barchart

On the date of publication, Aditya Sarawgi did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.