Meta Platforms Prepares for Earnings Announcement Amid Market Fluctuations

Overview of Meta Platforms

Meta Platforms (META), the largest social media platform globally, is set to report earnings on Wednesday, April 30th, after market close. Initially known as Facebook, Meta has diversified significantly through strategic acquisitions, including the Instagram app and the popular messaging service WhatsApp.

Approximately 97% of Meta’s revenues come from advertising. Despite facing fierce competition from Alphabet (GOOGL), Amazon (AMZN), and Snap (SNAP), Meta has successfully expanded its business through synergies, innovation, and a large user base. Additionally, the company is investing in the virtual reality (VR) landscape with its Oculus division.

Upcoming Earnings Preview

Year-to-date, META shares have been affected by the broader tech stock sell-off within the “Magnificent 7,” experiencing a decline of approximately 8%. Recently, losses have diminished, and compared to the past year, the stock has increased by about 27%, with a five-year growth of around 171%.

Image Source: Zacks Investment Research

META’s Implied Stock Movement

The options market indicates a potential price movement of plus or minus 9.2% following the earnings announcement.

Expectations for META Earnings

According to Zacks Consensus Analyst Estimates, earnings for this quarter are expected to grow by approximately 10.83%, with projections showing stability in 2025.

Image Source: Zacks Investment Research

Positive EPS Surprise Record

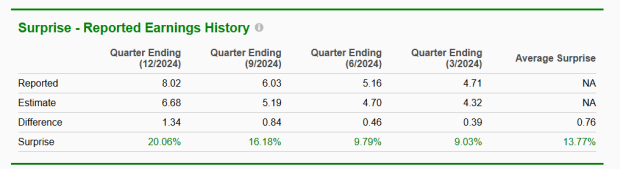

Despite recent slowdowns in earnings growth, META has consistently surpassed Wall Street’s expectations, achieving positive surprises in nine consecutive quarters. On average, the social media giant has exceeded projections by 13.77% over the last four quarters.

Image Source: Zacks Investment Research

Attractive Valuation Metrics

With the recent correction in META’s stock price, the valuation has become more appealing. Currently, shares are trading at about 23 times earnings, close to their lowest valuations in two years.

Image Source: Zacks Investment Research

Artificial Intelligence at Meta

While artificial intelligence is often associated with large language models and chatbots like ChatGPT, Meta is leveraging AI in unique ways. The company has integrated AI into its services like WhatsApp and Messenger, enhanced features for creating content on Facebook and Instagram, and optimized advertising strategies. Future plans include incorporating AI for customer support and video experiences.

Instagram Reels and AI Influence

Instagram’s performance has significantly improved, with around 40% of the content users engage with being curated through AI. This optimization has led to a 24% increase in user time spent on the platform, particularly with Instagram Reels (short videos).

Conclusion

Despite challenges during the tech sell-off, Meta has solidified its position as a leader in social media. The company’s history of strong earnings and commitment to integrating AI presents a promising outlook for future growth.