Micron Technology Anticipates Strong Q3 Earnings Announcements

Micron Technology, Inc. (MU), valued at a market cap of $72.3 billion, specializes in designing, developing, manufacturing, and selling memory and storage products, both domestically and internationally. Established in 1978 and headquartered in Boise, Idaho, the company operates through various units: Compute and Networking, Mobile, Embedded, and Storage. The anticipation builds as MU is set to announce its Q3 results on Wednesday, June 25.

Analysts’ Expectations for Q3 Results

Ahead of the earnings announcement, analysts predict an adjusted profit of $1.41 per share, showing a remarkable increase of 227.9% compared to last year’s profit of $0.43 per share. MU has consistently outperformed analysts’ earnings estimates in each of the last four quarters.

Fiscal Growth Projections

For the entirety of fiscal 2025, analysts forecast an adjusted earnings per share (EPS) of $6.21, an impressive rise of 970.7% from $0.58 reported in fiscal 2024. Additionally, projections for fiscal 2026 indicate a year-over-year earnings growth of 69.6%, reaching $10.53 per share.

Recent Stock Performance

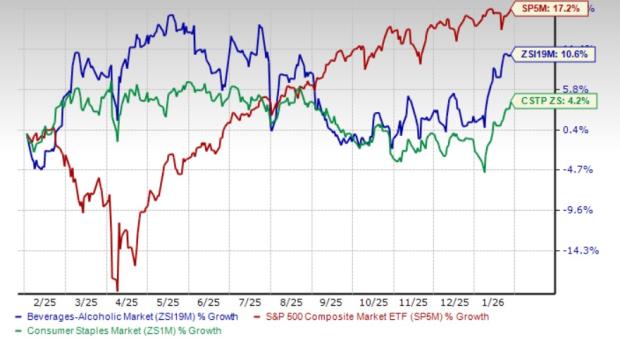

Over the past year, MU shares have faced a decline of 31.6%. This contrasts sharply with the S&P 500 Index’s gain of 8.4% and the Technology Select Sector SPDR Fund’s return of 4.2% during the same period.

Impact of Q2 Earnings on Investor Sentiment

Following the Q2 earnings release on March 20, Micron’s shares dipped by 8%. In that report, the company achieved a noteworthy revenue increase of 38.3%, totaling $8.1 billion, surpassing analyst projections. Non-GAAP gross profit saw a significant jump of 162.5%, amounting to $3.1 billion. Furthermore, the company registered a staggering 883.8% increase in non-GAAP operating income, reaching approximately $2 billion, while non-GAAP net income surged 274.6% year-over-year to $1.8 billion.

Despite these impressive numbers, the company’s non-GAAP gross margin has been on a downward trend, decreasing from 39.5% in Q1 to 37.9% in Q2, with expectations of dropping further to 36.5% for the current quarter. This downward trajectory may have generated concerns among investors regarding profitability.

Analyst Ratings Overview

Despite recent challenges, the consensus on MU stock remains strongly positive, currently holding a “Strong Buy” rating. Out of 30 analysts covering the stock, there are 23 “Strong Buys,” three “Moderate Buys,” three “Holds,” and one “Strong Sell.” The average price target of $127 implies a substantial 61.7% upside from current levels.

On the date of publication, Aditya Sarawgi did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article are solely for informational purposes. For more details, please view the Barchart Disclosure Policy here.

More news from Barchart

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.