Analysts Anticipate Strong Q1 Earnings for Morgan Stanley Amid Market Fluctuations

With a market capitalization of $192.4 billion, Morgan Stanley (MS) operates as a multifaceted financial holding company, offering a range of financial products and services for governments, financial institutions, and individuals. Headquartered in New York, the firm’s services span investment banking, wealth management, asset management, and trading. On Tuesday, April 15, Morgan Stanley is set to disclose its fiscal Q1 earnings for 2025.

Analysts forecast that this investment banking leader will announce a profit of $2.32 per share, reflecting an increase of 14.9% compared to $2.02 per share from the same quarter last year. Importantly, the company has consistently achieved earnings surprises, surpassing Wall Street’s estimates in each of the last four quarters. In Q4 2024, Morgan Stanley’s EPS of $2.22 exceeded forecasts by an impressive 34.6%.

Looking ahead to fiscal 2025, analysts predict that Morgan Stanley will report a profit of $8.58 per share, marking a 7.9% increase from $7.95 in fiscal 2024. Additionally, EPS growth is anticipated to reach 9.1% year-over-year, climbing to $9.36 in fiscal 2026.

In the past 52 weeks, Morgan Stanley’s shares have appreciated almost 16.1%. This performance significantly outpaces the S&P 500 Index’s ($SPX) 3.6% rise and the Financial Select Sector SPDR Fund’s (XLF) 14.5% return within the same timeframe.

However, on April 3, shares plummeted by 9.5% following President Trump’s announcement of new tariffs. These new levies include a 34% tax on Chinese goods, a 20% tax on European Union imports, and a baseline 10% tax on goods from other countries. The announcement caused widespread turmoil in financial markets, leading to significant declines in both the SPX and Nasdaq Composite ($NASX). Morgan Stanley’s notable international exposure makes it vulnerable to potential economic repercussions, which contributed to the steep decline in its stock price.

Encouragingly, Morgan Stanley’s shares rose 4% on January 16 following a stronger-than-expected Q4 earnings report. The company recorded an EPS of $2.22 alongside revenue of $16.2 billion, both of which surpassed Wall Street estimates. Year over year, earnings surged by 161.2%, while revenue increased by 25.8%, bolstered by strong performances across all segments. Specifically, investment banking revenue climbed 24.5%, powered by robust growth in advisory and underwriting fees. Additionally, wealth management revenue rose by 12.5% compared to the prior year, as solid asset increases in wealth and investment management enhanced overall results.

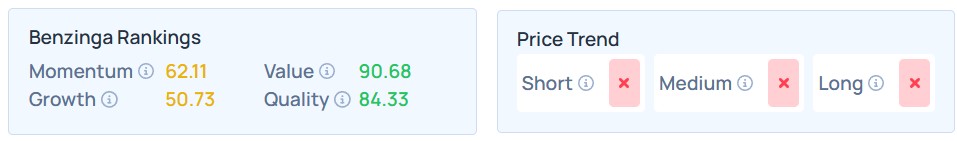

Market analysts exhibit moderate optimism regarding Morgan Stanley’s stock, assigning it a “Moderate Buy” rating overall. Among the 24 analysts following the stock, six suggest “Strong Buy,” one recommends “Moderate Buy,” and 17 advocate for a “Hold.” The average analyst price target stands at $136.68, indicating a potential upside of 26.6% from current levels.

On the date of publication, Neharika Jain did not hold (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article are strictly for informational purposes. For more information, please view the Barchart Disclosure Policy here.

More news from Barchart

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.