Nasdaq, Inc. Anticipates Strong Q1 Earnings Ahead of Release

With a market cap of $41.4 billion, Nasdaq, Inc. (NDAQ) operates as a technology company that serves capital markets and other industries globally. Established in 1971 and headquartered in New York, the company is divided into three key segments: Capital Access Platforms, Financial Technology, and Market Services.

Upcoming Fiscal Q1 Earnings Report

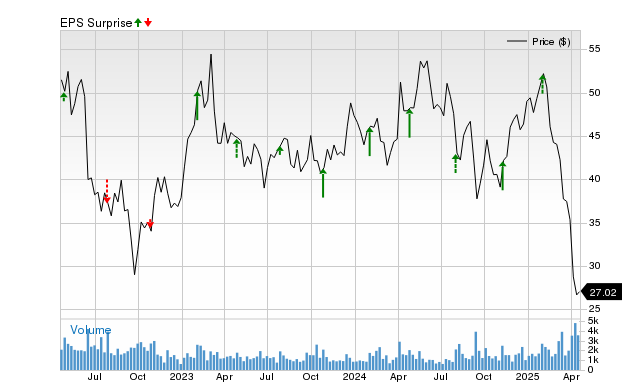

NDAQ is set to unveil its fiscal Q1 earnings results on Thursday, April 24, prior to the market opening. Analysts predict that the company will report earnings of $0.76 per share, reflecting a 20.6% increase from $0.63 per share in the same quarter last year. Notably, Nasdaq has exceeded Wall Street’s EPS expectations in three out of the last four quarters, with only one miss. In the fourth quarter, the company recorded EPS of $0.76, beating consensus estimates by 1.3%, largely due to strong revenue growth from its Solutions, Financial Technology, and Index segments.

Future EPS Expectations

For fiscal 2025, analysts forecast an EPS of $3.19 per share for NDAQ, representing a 13.1% increase from $2.82 in fiscal 2024. Additionally, EPS is anticipated to grow 12.9% year-over-year, reaching $3.60 per share in fiscal 2026.

Stock Performance Overview

Over the past year, NDAQ shares have appreciated by 11.6%, outperforming the S&P 500 Index’s ($SPX) gains of 2.1%, albeit trailing behind the Financial Select Sector SPDR Fund’s (XLF) 12.3% rise during the same period.

NDAQ stock experienced a slight boost after its Q4 earnings release on January 29. The company noted a 10% year-over-year revenue increase to $1.2 billion. Additionally, Annual Recurring Revenue (ARR) grew by 7%, reaching $2.8 billion, while NDAQ’s non-GAAP operating income rose 10% to $671 million compared to the previous year’s quarter.

Analysts’ Consensus

The consensus opinion among analysts for NDAQ’s stock is moderately bullish, holding a “Moderate Buy” rating overall. Of the 20 analysts covering the stock, 11 recommend a “Strong Buy,” three favor a “Moderate Buy,” and six suggest a “Hold” rating.

The average analyst price target for NDAQ stands at $86.28, indicating a potential premium of 22.7% from current market prices.

On the date of publication, Kritika Sarmah did not hold any positions in the securities mentioned in this article, either directly or indirectly. All information and data in this article are intended solely for informational purposes. For more details, please view the Barchart Disclosure Policy here.

More news from Barchart

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.