Newmont’s Earnings Report Projected for April 2025, Key Metrics Revealed

Newmont (NYSE:NEM) plans to report its earnings on Wednesday, April 23, 2025, after the market closes. Analysts estimate revenues to reach approximately $4.6 billion, with earnings projected at about $2.86 per share. In Q4 2024, Newmont’s gold production increased by 9.2% year-over-year, totaling 1.90 million ounces. This rise, combined with higher gold prices, is expected to lead to improved earnings in Q1 2025.

The company’s current market capitalization stands at $62 billion. Over the past twelve months, Newmont generated $19 billion in revenue, achieving operational profitability with $5.9 billion in operating profits and a net income of $3.3 billion.

Post-Earnings Return Trends

Understanding historical performance can offer insights into expected market reactions. The following observations detail Newmont’s odds of positive returns following earnings announcements:

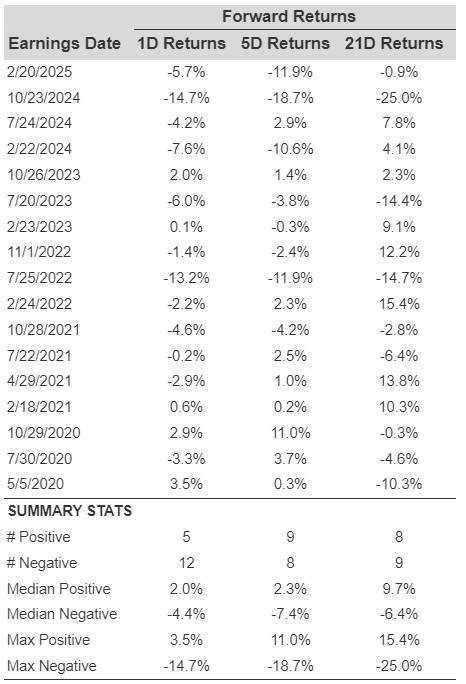

- Over the past five years, there have been 17 recorded earnings data points, with 5 positive and 12 negative one-day (1D) returns, resulting in positive returns approximately 29% of the time.

- Considering data from the last three years, this positive return percentage drops to 22%.

- The median of the 5 positive returns is 2.0%, while the median of the 12 negative returns stands at -4.4%.

Short-Term and Medium-Term Return Correlations

Traders can strategize by examining the correlation between 1D, 5D, and 21D earnings returns. For example, finding a strong correlation between 1D and 5D returns allows a trader to go long if the 1D post-earnings return is positive. Data regarding these correlations from both 5-year and 3-year periods is provided below.

NEM observed 1D, 5D, and 21D returns post earnings

NEM Correlation Between 1D, 5D, and 21D Historical Returns

For those seeking less volatility compared to individual stocks, strategies like the Trefis RV strategy offer alternatives that have outperformed their benchmarks, including a combination of S&P 500 and mid-cap indexes. Investors looking for smoother growth might consider portfolios designed to outperform market averages.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.