Nvidia’s Upcoming Earnings Report: What Investors Need to Know

One of the most anticipated events in the tech and finance sectors is set for Nov. 20, when Nvidia (NASDAQ: NVDA) will release its latest earnings report. Investors are eager to see if the company can maintain its impressive momentum, having already achieved a remarkable 186% stock increase this year as of early last week.

Nvidia has consistently impressed analysts by exceeding earnings estimates for four consecutive quarters. With earnings growth in the triple digits and gross margins exceeding 70%, the company’s financial health looks strong. Additionally, being included in the Dow Jones Industrial Average and briefly becoming the world’s most valuable company earlier this month, surpassing Apple, has further fueled investor enthusiasm.

It’s clear why investors are eager for updates from this industry leader. While the report is still a few days away, Nvidia has provided some insights that hint at what to expect from its earnings call.

Image source: Getty Images.

Nvidia’s Dominance in the GPU Market

Nvidia is a leader in producing highly sought-after graphics processing units (GPUs), which are crucial for artificial intelligence tasks such as model training and analysis. Major tech companies, including Microsoft and Meta Platforms, are among its largest clients due to the superior speed of Nvidia’s chips.

In the last quarter, Nvidia reported a record revenue of $30 billion, exceeding its total revenue from just a couple of years prior. As the AI market continues to expand, Nvidia’s stock has skyrocketed, showing an increase of 2,600% over the past five years.

As Nvidia prepares for its earnings report, the company has already projected third-quarter revenue for fiscal 2025 to reach $32.5 billion, indicating healthy growth compared to the previous year.

Steady Gross Margins

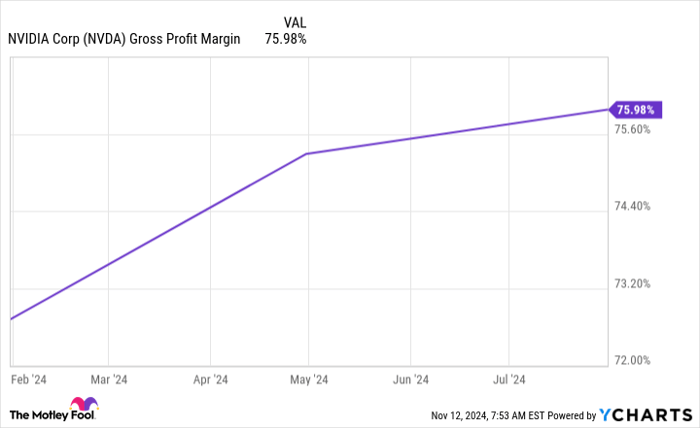

Nvidia has also forecasted its gross margins for the third quarter at 74.4% under GAAP and 75% on a non-GAAP basis. For the entire year, gross margins are expected to remain in the mid-70% range, a strong indicator of profitability.

NVDA Gross Profit Margin data by YCharts

During its last earnings call, Nvidia highlighted robust demand for its upcoming Blackwell architecture set to launch in the fourth quarter, reinforcing optimism about sales moving forward.

Comments from other tech leaders, such as Alphabet CEO Sundar Pichai, who expressed excitement about Nvidia’s new GB200s during his company’s earnings call, further support this positive outlook. Meanwhile, Meta has significantly invested in AI this year, emphasizing its dependability on Nvidia’s products. Additionally, reports from Taiwan Semiconductor Manufacturing, which fabricates Nvidia’s GPUs, indicated strong customer demand with double-digit revenue growth.

Demand on the Rise

“The demand is real, and I believe it’s just the beginning of this demand,” said Taiwan Semiconductor CEO C.C. Wei. Nvidia CEO Jensen Huang previously referred to the demand for the Blackwell chip as “insane,” underscoring the anticipation for this technology.

The insights from other companies in the tech sector suggest a continued strong demand for Blackwell and possibly its current Hopper architecture, which remains relevant as Nvidia products are designed to work together seamlessly. As Nvidia enters its fourth quarter, details about the Blackwell launch and its anticipated revenue could be significant topics during the earnings report.

However, potential concerns may arise regarding Super Micro Computer, an equipment maker and Nvidia customer, and whether it will affect the sale or delivery of Blackwell systems in the coming months. While high demand is a positive signal, Nvidia must also focus on its capacity to meet that demand effectively.

Despite these considerations, there are many reasons for optimism regarding Nvidia’s upcoming earnings. The company’s track record, endorsements from key players in the AI industry, and the promise of new products could signal another monumental moment for Nvidia and its investors.

Is Investing in Nvidia Worth It Right Now?

Before making any investment in Nvidia, consider this warning:

The Motley Fool Stock Advisor analyst team recently listed what they believe are the 10 best stocks to invest in right now—and Nvidia didn’t make the cut. The selected stocks are predicted to deliver impressive returns in the coming years.

For context, if you had invested $1,000 in Nvidia when it was included on the list on April 15, 2005, your investment would now be worth $870,068!

Stock Advisor offers investors a clear plan for success, including strategic portfolio guidance and two new stock picks each month. Since 2002, it has significantly outperformed the S&P 500, further solidifying its reputation.

See the 10 stocks »

*Stock Advisor returns as of November 11, 2024

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is also part of The Motley Fool’s board. Adria Cimino has no position in the mentioned stocks. The Motley Fool holds positions in and recommends Alphabet, Apple, Meta Platforms, Microsoft, Nvidia, and Taiwan Semiconductor Manufacturing. They also recommend long positions and short options for Microsoft. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.