PPG Industries Reports Earnings Amid Mixed Historical Returns

PPG Industries (NYSE:PPG) will announce its earnings on Wednesday, April 30, 2025. The company currently holds a market capitalization of $23 billion, with reported revenue of $16 billion over the past twelve months. PPG has maintained operational profitability, posting $2.3 billion in operating profits and a net income of $1.1 billion.

Understanding PPG Industries’ Historical Earnings Performance

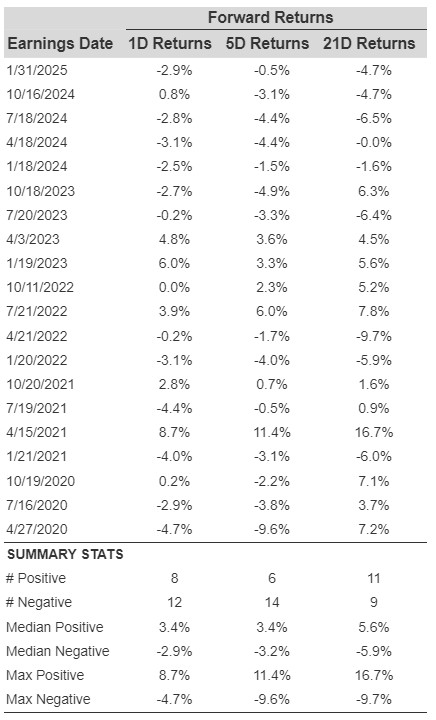

Over the last five years, PPG has recorded 20 earnings data points, resulting in 8 positive and 12 negative one-day (1D) return outcomes. This suggests that approximately 40% of the time, the company experienced positive 1D returns. When focusing on the last three years, the percentage rises slightly to 42%.

- The median of the 8 positive returns stands at 3.4%, while the median for the 12 negative returns is -2.9%.

Post-Earnings Returns: Additional Insights

The statistics for observed 5-day (5D) and 21-day (21D) returns post-earnings are compiled in the table below:

PPG One-Day, Five-Day, and Twenty-One-Day Returns Post Earnings

Correlation Analysis of Earnings Returns

Examining the correlation between short-term and medium-term returns post-earnings can provide traders with a less risky strategy. For effective trading, finding pairs with high correlations can facilitate decision-making. For example, if the 1D and 5D returns show a strong correlation and the 1D post-earnings return is positive, traders might go “long” for the following five days. Below is the correlation data based on both five-year and three-year histories.

PPG Correlation Between One-Day, Five-Day, and Twenty-One-Day Historical Returns

PPG Industries’ performance trends spotlight an important opportunity for investors. Analyzing these patterns may reveal strategic insights for trading alongside broader market trends.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.