S&P 500 Earnings Projected Growth Amid Shifting Market Dynamics

Note: The following is an excerpt from this week’s earnings Trends report. To access the full report with detailed historical data and future estimates, please Click here>>>

Key Earnings Highlights for the S&P 500

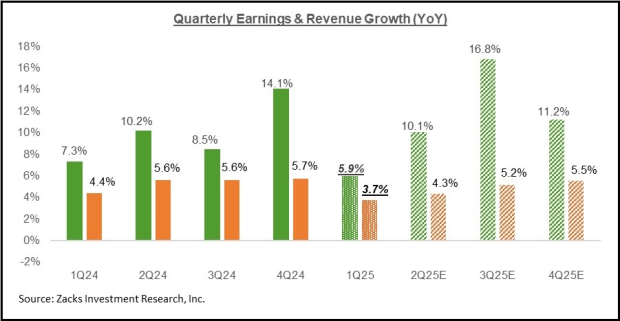

- Total earnings for the S&P 500 index in Q1 2025 are projected to rise by +5.9% compared to the same quarter last year, driven by a +3.9% increase in revenues. This follows a robust +14.1% earnings growth with +5.7% revenue growth in the prior quarter.

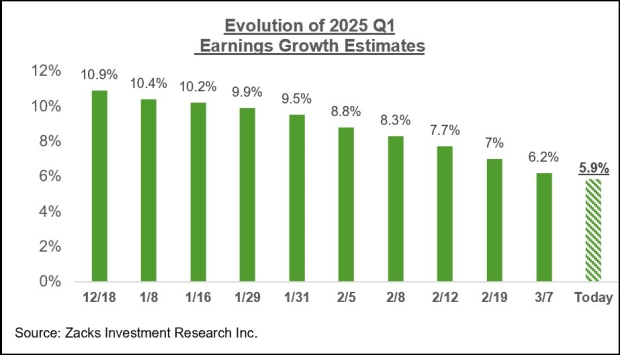

Furthermore, Q1 earnings estimates have seen a gradual decline, now reflecting a growth pace of +5.9%, down from an earlier +10.4% at the start of January 2025.

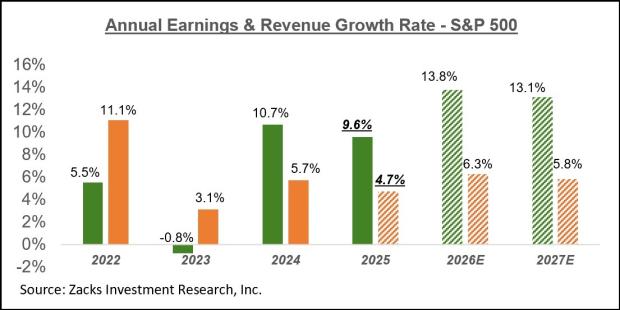

- For the entirety of 2025, S&P 500 earnings are anticipated to grow by +9.6% with 12 of the 16 Zacks sectors expected to record positive growth. Noteworthy sectors projected to achieve double-digit earnings increases this year include Aerospace (+53.3%), Consumer Discretionary (+19.4%), Medical (+17.2%), and Tech (+12.1%).

- Collectively, the “Magnificent 7” (Mag 7) group is forecasted to see earnings boost by +12.6% alongside +9.3% higher revenues in 2025. Excluding this group, the remaining S&P 500 companies are expected to grow earnings by +8.7% in 2025, a marked improvement from +4.0% growth in 2024 and a decline of -5.1% in 2023.

Decline in Leadership Among the Magnificent 7 Stocks

Recently, the Magnificent 7 stocks have experienced a downturn. The DeepSeek breakthrough has highlighted increasing capital expenditures that have generated market apprehension.

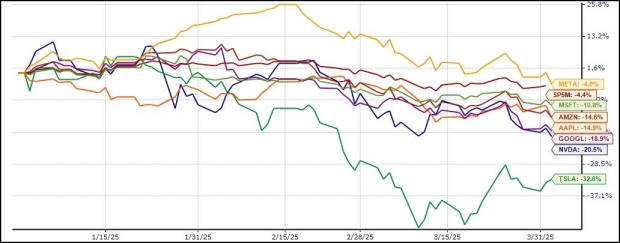

The chart below illustrates the year-to-date performance of these stocks compared to the S&P 500 index.

Image Source: Zacks Investment Research

Meta Platforms (META) stands as the only stock in the group maintaining close proximity to positive growth for 2025, outperforming the S&P 500 index (which is down -4.4%). In contrast, Tesla (TSLA) has lost about a third of its value, placing it at the bottom of the list. The other stocks exhibit mixed performance, with Nvidia (NVDA) and Alphabet (GOOGL) closer to the bottom, while Microsoft (MSFT), Amazon (AMZN), and Apple (AAPL) fall in the top half.

Regarding Tesla’s struggles, it is tempting to attribute this to Elon Musk’s political engagements, but there are inherent issues concerning the company’s exposure to China, trade vulnerabilities, and the evolving competitive landscape in the electric vehicle market. Apple too faces significant risks associated with its exposure to these same issues.

Outside of Tesla and Apple, the outlook for the remaining five companies hinges on the overall sentiment surrounding artificial intelligence. While stocks related to AI have faced headwinds recently, the Mag 7’s significant investments in this area may render them particularly susceptible to these shifts.

Future Earnings Outlook for the Magnificent 7

A standout feature of the Mag 7 group was its strong earnings potential and growth trajectory previously. Analysts had consistently revised their earnings expectations upwards.

Looking ahead to Q1 2025, Mag 7 earnings are anticipated to grow by +13.1% accompanied by +11.7% higher revenues, following robust +31.0% earnings growth on +12.8% revenue growth in the last quarter.

Throughout 2025, Mag 7 earnings are expected to increase by +12.6%, supported by +9.3% greater revenues, building on the group’s +40.4% earnings rise and +16.8% revenue growth achieved in 2024.

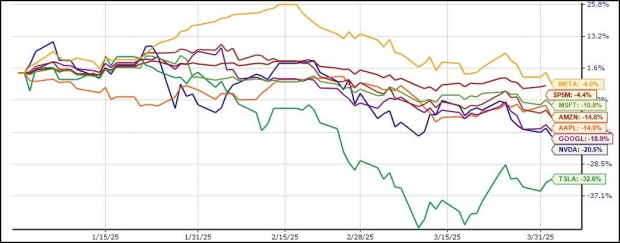

Collectively, the Mag 7 is anticipated to generate $555.7 billion in earnings, a notable increase from the previous year’s total of $493.7 billion. The chart below illustrates the evolution of these earnings estimates over recent months.

Image Source: Zacks Investment Research

The recent stabilization in revisions indicates the varying outlooks for Tesla, Apple, and Meta, although prospects for the remainder of the group remain relatively optimistic.

Tech Sector’s Role as a Growth Engine

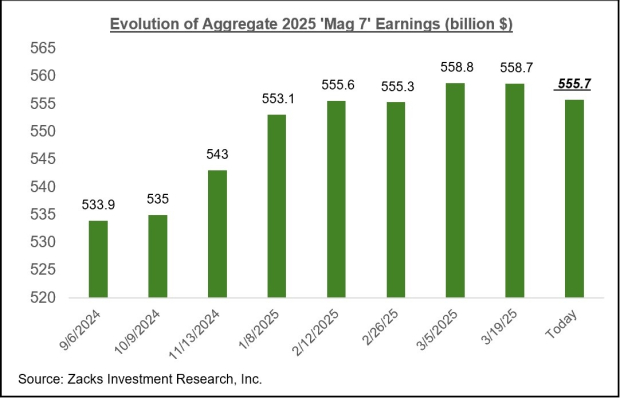

The Tech sector has consistently driven growth recently, a trend that persisted into Q4 of 2024. For Q1, Tech earnings are expected to rise by +12.6% year-over-year, buoyed by +10.6% higher revenues, marking the seventh consecutive quarter of double-digit earnings growth.

This follows a substantial +26.2% earnings growth on +11.3% increased revenues for Q4 2024. The chart below demonstrates that this growth trajectory is projected to continue in the upcoming quarters.

Image Source: Zacks Investment Research

Overall, the Tech sector remains one of the few areas experiencing a continually improving earnings outlook, despite broader challenges in the market.

Shifts in Earnings Estimates: Q1 2025 Under Pressure

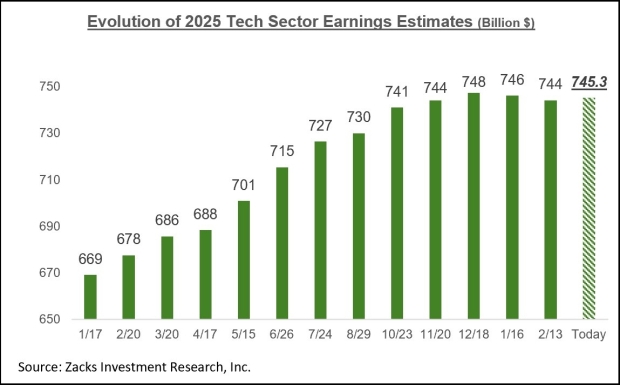

Over the past year, earnings estimates have been steadily increasing. However, recent data indicates a change in this trend. Since January, Q1 estimates have come under modest pressure, although they stay positive for the entire year of 2025. The following chart illustrates the aggregate earnings estimates for this sector in 2025.

Image Source: Zacks Investment Research

Earnings Overview for Q1 2025

The chart below depicts expectations for Q1 2025 against the performance of the previous four quarters, as well as projections for the next three quarters.

Image Source: Zacks Investment Research

Current expectations indicate that total S&P 500 earnings for Q1 2025 will rise by +5.9% year-over-year, supported by a +3.7% increase in revenues.

However, estimates for this quarter have been decreasing since the start of the year, as the next chart demonstrates.

Image Source: Zacks Investment Research

The trend of revisions shows that 14 out of 16 sectors have seen their estimates decline since January. Notably, only the Medical and Construction sectors have shown growth in their estimates. Sectors facing the largest cuts include Conglomerates, Aerospace, Construction, Basic Materials, and Autos. Interestingly, the Tech sector also faces pressures, unlike in recent periods.

The chart below illustrates the annual earnings outlook.

Image Source: Zacks Investment Research

Projected expectations indicate double-digit earnings growth for the next two years, with a more extensive range of sectors poised for strong growth compared to recent times. However, it is essential to recognize that these projections are likely to be revised downward as slowing U.S. economic growth and tariffs impact corporate profitability.

Market Insights: Stocks with Growth Potential

Finance experts from Zacks have identified five stocks anticipated to double in value. These selections are singled out as the top picks for achieving gains of +100% or more in 2024. While individual stock performance varies, past selections have shown impressive gains of +143.0%, +175.9%, +498.3%, and +673.0%.

Interestingly, many stocks included in this report are currently under the radar of Wall Street, presenting an excellent opportunity for early investment.

Discover these 5 Potential Home Runs >>

For those interested in more insights, Zacks Investment Research offers the chance to download their latest report featuring the “7 Best Stocks for the Next 30 Days.” Click here for this complimentary report.

For analysis on significant stocks such as:

- Amazon.com, Inc. (AMZN): Free Stock Analysis report

- Apple Inc. (AAPL): Free Stock Analysis report

- Microsoft Corporation (MSFT): Free Stock Analysis report

- NVIDIA Corporation (NVDA): Free Stock Analysis report

- Tesla, Inc. (TSLA): Free Stock Analysis report

- Alphabet Inc. (GOOGL): Free Stock Analysis report

- Meta Platforms, Inc. (META): Free Stock Analysis report

This article originally published on Zacks Investment Research (zacks.com).

Zacks Investment Research

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.