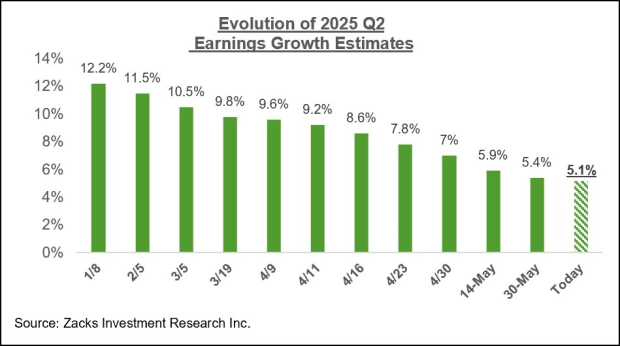

In Q2 2025, S&P 500 earnings are expected to increase by +5.1% year-over-year on +3.8% higher revenues, marking a significant slowdown from +11.9% earnings growth in Q1. If this growth rate is realized, it would be the lowest since Q3 2023’s +4.3% increase. Since April, earnings estimates have dropped for 14 of the 16 Zacks sectors, impacting key sectors like Conglomerates, Autos, and Energy.

Several companies are set to report earnings: Accenture (scheduled for June 20) is expected to report $1.97 per share, down -41.7% year-over-year, while Lennar is also facing challenges with expected revenues of $8.24 billion, representing a -5.97% decline. Oracle recently reported strong results, surpassing expectations and driving its shares up +29.3% this year.

So far, four S&P 500 companies have reported Q2 results, showing earnings growth of +4.7% on +8.6% revenue gains, with 75% beating EPS estimates. This marks an early indicator of earnings performance as the Q2 earnings season progresses.