Stryker Corporation Set to Report Strong Earnings This May

Founded in 1941 and headquartered in Portage, Michigan, Stryker Corporation (SYK) is a leading medical technology firm. The company specializes in manufacturing surgical equipment, navigation systems, endoscopic tools, communications systems, and patient handling equipment. Stryker also provides emergency medical products, intensive care disposables, clinical communication solutions, and artificial intelligence-assisted virtual care platforms. With a current market capitalization of $134.9 billion, Stryker operates primarily through two segments: MedSurg and Neurotechnology, along with Orthopaedics.

Anticipated Earnings Report

The company plans to release its Q1 earnings on Thursday, May 1, after market hours. Analysts predict that SYK will achieve a profit of $2.73 per share, reflecting a 9.2% increase compared to last year’s profit of $2.50 per share. Notably, Stryker has exceeded analysts’ earnings estimates in each of the last four quarters. In its most recent quarter, the company reported earnings per share (EPS) of $4.01, surpassing the consensus estimate by 3.6%, driven by robust growth across all segments.

Yearly Earnings Outlook

For the fiscal year, analysts project SYK’s EPS to reach $13.46, marking a 10.4% increase from $12.19 in fiscal 2024. Forward-looking estimates suggest that earnings could rise further to $14.84 per share in fiscal 2026, an increase of 10.3% year-over-year.

Stock Performance Overview

Over the past year, Stryker’s shares have gained 2.3%. In comparison, this performance lags behind the S&P 500 Index’s 6.6% increase, though it has fared better than the Health Care Select Sector SPDR Fund (XLV), which experienced a slight decline during the same period.

Recent Financial Developments

Following its Q4 earnings announcement on January 28, SYK shares fell by 1.2%. During this quarter, the company reported a 10.7% increase in net sales, totaling $6.4 billion. Additionally, Stryker achieved a 200 basis point improvement in its adjusted operating income margin, which now stands at 29.2%. Looking ahead, Stryker anticipates organic net sales growth of 8% to 9% for fiscal 2025, with EPS projected between $13.45 and $13.70.

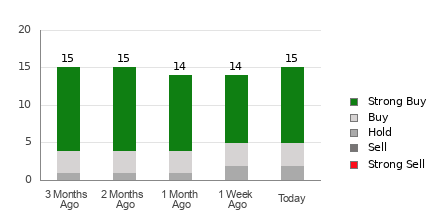

Analyst Sentiment

Analysts remain optimistic about Stryker’s future. Current ratings reflect a “Strong Buy” consensus, with 19 out of 28 analysts advocating for a “Strong Buy,” 2 suggesting a “Moderate Buy,” and 7 recommending a “Hold.” The average price target of $427.31 indicates a potential upside of 23.2% from the current share price.

On the date of publication, Kritika Sarmah did not hold any positions in the securities mentioned. All information and data in this article are for informational purposes only. For further details, please see the Barchart Disclosure Policy here.

More news from Barchart

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.