“`html

Federal Reserve’s Rate Decision: Key Market Move Expected Today

Today, the financial world is focused on the Federal Reserve as Americans eagerly anticipate the central bank’s latest interest rate decision.

Analysts predict significant market shifts, suggesting that a $7 trillion panic could potentially impact stocks later today. Interestingly, it is not the decision itself that is expected to trigger this response.

Market participants largely anticipate the Fed’s announcement will be straightforward: ‘We’re staying the course.’ It is widely believed the central bank will maintain current interest rates, avoiding both hikes and cuts. The accompanying press release is expected to echo sentiments from previous communications, particularly without any surprising revelations.

However, this does not rule out the possibility of Wall Street reacting strongly to today’s events.

In fact, the meeting could pave the way for a major rally centered on what analysts refer to as the “MAGA 7” (“Make AI Great in America”)—seven stocks that embody both Trump-era policies and the burgeoning AI landscape.

If today’s rate decision is likely uneventful, what might trigger substantial market reactions?

The press conference following the announcement.

Could the Fed Indicate a Rate Cut Today?

During the press conference, Board Chair Jerome Powell will provide insights regarding future Fed plans, especially for the upcoming June meeting. This could lead to increased market volatility.

Why such concern? Clearly, the U.S. economy shows signs of needing assistance.

For example, the labor market displays indicators of weakness. The national unemployment rate remained steady at 4.2% in April, which is an increase from January 2023’s low of 3.4%. Additionally, initial weekly jobless claims soared to 241,000 as of the week ending April 26, marking their highest level in two months. Continuing claims also reached 1.9 million, the highest since November 2021.

Consumer confidence, long viewed as a pillar of American economic stability, has fallen to levels not seen in years. The Conference Board’s Consumer Confidence Index dropped to 86, marking its lowest since May 2020. Furthermore, the expectations index, reflecting short-term consumer outlook, fell to 54.4, the lowest since October 2011.

Recent shifts in consumer spending further illustrate these trends, as it accounts for approximately 70% of U.S. GDP. While the situation does not appear dire yet, data from Fiserv’s Small Business Index indicates consumers are now prioritizing essential goods over discretionary spending.

Corporate leaders are also sounding alarms. Companies like McDonald’s (Stock-ticker”>MCD), Marriott (Stock-ticker”>MAR), Amazon (Stock-ticker”>AMZN), and Starbucks (Stock-ticker”>SBUX) have all reported declining demand alongside their recent earnings updates.

The economy appears to be faltering. Rate cuts may provide a remedy, and the outcome hinges on Powell’s statements this afternoon.

Market Response to Potential Rate Easing by the Federal Reserve

If Powell indicates that rate cuts are off the table for June, a swift decline in stock prices could occur. Conversely, suggestions of potential easings could prompt a sigh of relief from markets, allowing risk assets to gain momentum.

Luckily, we lean toward the latter scenario being the most probable.

The Federal Reserve has indeed been data-driven, and current metrics suggest that a rate cut is on the horizon.

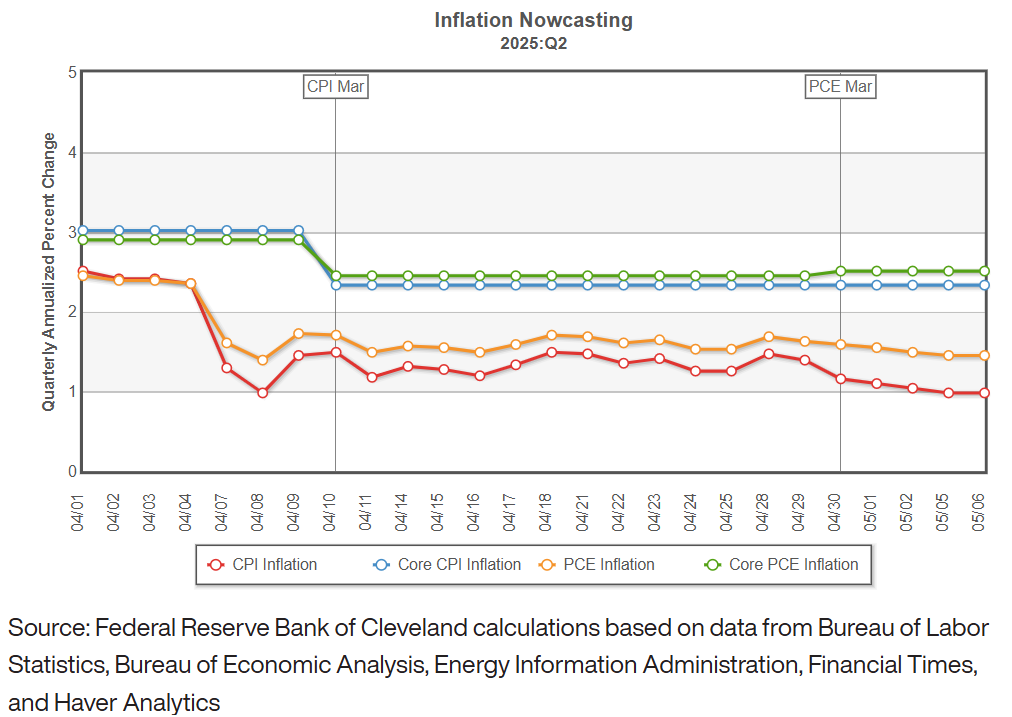

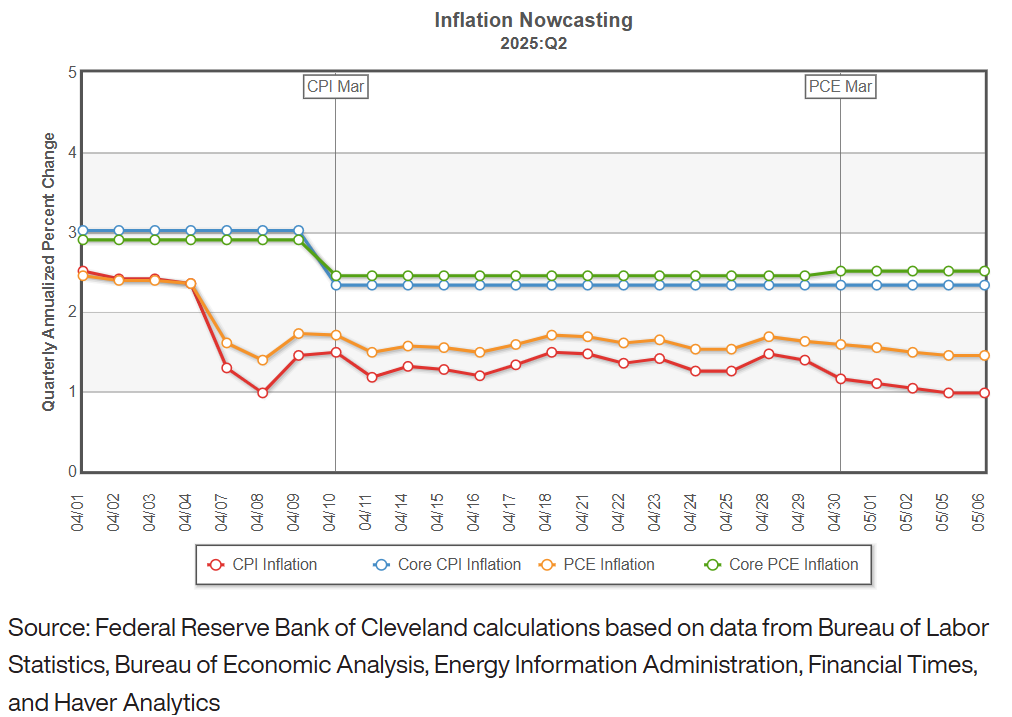

Inflation indicators are hovering around the Fed’s target of 2%.

The Cleveland Fed projects that both CPI and PCE will register at 2.2% in May.

Simultaneously, as noted, jobless claims have surged, reaching levels not observed since 2021, while consumer sentiment indicators have plummeted.

This is a clear signal—the urgency is palpable.

Historically, Powell has responded to such warnings.

He has consistently paid attention to market conditions, particularly the bond market’s movements.

As of now, the 2-year Treasury yield has experienced a downturn.

“`# Federal Reserve’s Potential Rate Cuts: Market Implications for AI Stocks

The current 2-year Treasury yield has dropped to 3.8%, significantly lower than the Federal Reserve’s 4.25% policy rate. This situation suggests that the Fed may be lagging in its monetary policy, indicating that rate cuts might be necessary sooner rather than later.

Historically, Federal Reserve Chair Jerome Powell has responded quickly to such discrepancies. In May 2019, the 2-year yield fell below the Fed rate, leading to a cut by July of that year. A similar scenario occurred in July 2024, leading to a cut in September of that year.

This pattern indicates that a rate cut could come as early as June this year.

If Powell hints at such a move during his speech today, we may see a strong rally in the stock market.

Identifying Opportunities: The MAGA 7 AI Stocks

The seven stocks we refer to as the “Make AI Great in America” (MAGA 7) are positioned to benefit not only from advancements in AI but also from a broader shift in America’s technological and industrial policy.

These companies align well with the trade and industrial priorities emphasized during the Trump administration, coinciding with the fast-paced growth curve of AI technologies.

If today’s Federal Reserve meeting signals a shift in monetary policy, these stocks could emerge as major winners in the months ahead.

Typically, lower interest rates lead to rising growth stocks, and AI stocks, in particular, tend to perform well during Fed-driven rallies. Historical trends from 2020 and late 2024 support this observation, suggesting that we might witness a similar upswing today.

For more insight, consider reviewing the recent presentation outlining the seven AI stocks that may thrive following today’s Fed meeting. These companies are well-aligned with the anticipated macroeconomic shift from high rates and trade challenges to rate cuts and AI-driven industrial growth.

The presentation also explores how the previous administration’s policies intersect with these stocks, potentially making the MAGA 7 a key investment theme over the next 18 months.

Positioning oneself strategically in sectors influenced by politics, policy, and rapid technological advancement is crucial at this moment.

On the date of publication, Luke Lango did not hold any positions in the securities mentioned in this article.

For questions or comments about this issue, please reach out at [email protected].