Stock Market Faces Turbulence Ahead of Tariff Announcement

Recent violent fluctuations have left equities in a precarious, yet potentially promising, technical condition.

Welcome to the ultimate Tariff Week, a notable saga in global economic dynamics reminiscent of the tumultuous period following the COVID lockdowns of 2020.

Mark your calendars for Wednesday, April 2—referred to in trading circles as “Liberation Day.” On this date, U.S. President Donald Trump is anticipated to unveil a sweeping series of tariffs that could reshape the entire global economic landscape.

Investor sentiment is understandably anxious. The latest market data reflects this anxiety.

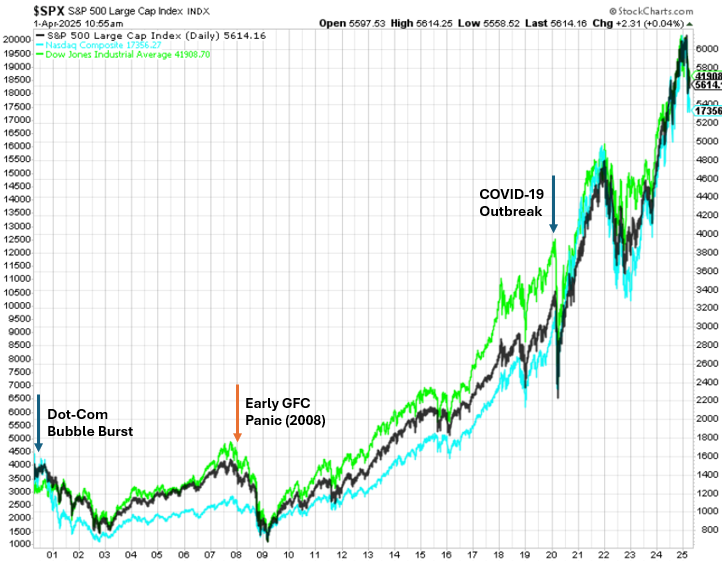

The S&P 500 has declined over 10% from its peak, while the Nasdaq has slipped roughly 15%. The Russell 2000 is nearing a 20% drop.

This situation represents the largest market correction since 2022. While volatility is familiar to Wall Street, the current circumstances feel distinct due to their unprecedented nature.

Unlike previous downturns influenced by interest rates or earnings misses, this event is fundamentally altering the rules of global commerce in real time.

Examining the Impact of Tariffs on Markets

Observing the markets over the past month has felt like navigating an emotional rollercoaster without any safety gear.

The tumult began in February when Trump proposed universal tariffs on all nations, triggering a significant decline in stock values as investors reacted to the potential of a global trade war.

However, by mid-March, the focus shifted to more targeted trade policies, specifically tariffs on the “Dirty 15”: the 15 countries with whom the U.S. has substantial bilateral trade deficits. This adjustment brought about a brief rally as investors regained some optimism.

Unfortunately, the narrative shifted again over the weekend. Reports indicated that Trump’s administration might reconsider the notion of blanket tariffs, causing market values to plummet back to March’s lows. The cycle of panic and hope has left many uncertain about future developments.

These erratic swings have placed stocks in a challenging—yet potentially opportune—technical situation.

Expectations for Tomorrow’s Announcement

The S&P 500 has officially dipped below its 250-day moving average for only the second time since the AI-driven bull market began. Historically, this threshold has served as a trampoline for market recovery; falling below it typically leads to swift and severe declines.

Historically, dips to this point have led to one of two outcomes:

- A significant rebound rally that catches short sellers off guard; or

- The onset of a true bear market collapse.

This represents a technical tipping point. With “Liberation Day” approaching, the upcoming announcements will either affirm or disrupt current market trends.

Amidst this volatility and uncertainty surrounding tariffs, are panic-induced responses warranted?

Not entirely.

Our perspective is that Liberation Day will likely unfold with less severity than anticipated. We view Trump’s universal tariff threats as more strategic posturing than an inevitable outcome.

Our expectations include:

- Targeted tariffs, rather than blanket measures.

- The Dirty 15 being affected, while comprehensive tariffs are avoided.

- Rapid negotiations commencing post-announcement.

Tariffs, while challenging for the U.S., would impose even greater hardships on numerous other economies involved. Nations such as Europe, Canada, South Korea, and Japan have more at stake and are acutely aware of their vulnerabilities.

Given their high reliance on exports, these economies are positioned to respond quickly to protect their trade interests. Thus, we anticipate swift agreements, immediate adjustments, and broader de-escalation through April.

We have arrived at the height of this trade conflict narrative.

Current Market Fundamentals Remain Strong

Aside from the tariff-related concerns, it is vital to recognize that the fundamentals of the market have not deteriorated. Instead, they have been obscured by prevailing market anxieties.

- The S&P 500 is currently trading at 24X trailing earnings, aligned with its five-year average and approximately 10% less expensive than earlier this year.

- Forward earnings projections appear solid, indicating resilience in corporate profitability.

Market Correction: Earnings Estimates and Future Projections Remain Strong

- Earnings estimates are rising, not falling. The consensus forward 12-month EPS for the S&P 500 stands at $278, up from $275 recorded in mid-February, even amid this correction.

- Wall Street anticipates double-digit earnings growth: projecting a 10.2% increase in 2025 and 12.5% in 2026.

Such figures are not typically indicative of an impending recession, which fuels our belief that the current market correction is fear-based and not rooted in fundamental issues.

Historically, fear tends to create investment opportunities.

Market Outlook Amid Tariff Developments

We face a challenging scenario; however, we believe the market will stabilize before significant downturns occur.

Liberation Day may bring excitement along with some unsettling headlines and ongoing market fluctuations. Nevertheless, the worst-case scenario is unlikely to happen.

Instead, we anticipate:

- Targeted tariffs

- Accelerated negotiations

- A shift to risk-on sentiment by late April

When these expectations materialize, stocks are likely to rebound significantly.

However, it is important to note that if the tariff situation escalates or if aggressive trade policies are implemented, the market could experience substantial declines—potentially drastic.

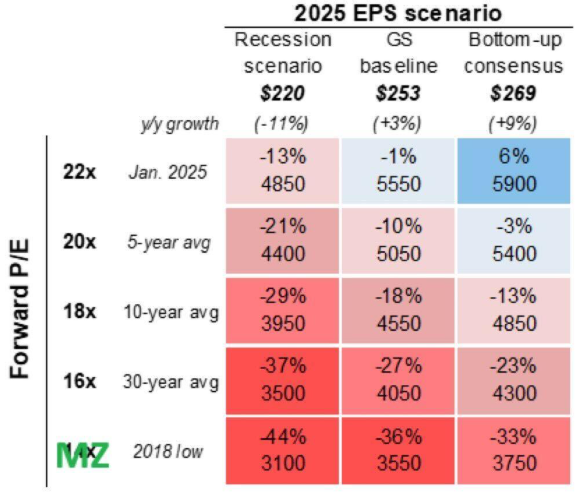

According to Goldman Sachs, there is a possibility of a ~50% market decrease in a worst-case outlook. Typically, in a recession, earnings estimates may decline by about 10%, accompanied by significant compression in valuation multiples.

Considering a scenario where profit estimates fall approximately 10% and the S&P’s valuation multiple shrinks to levels seen in 2018—during times of tariff fears—the combined effect could result in nearly a 50% drop in market values.

While we believe the odds of encountering this worst-case scenario are low, they are not zero. It is wise to be prepared for potential repercussions this week.

In response, we have developed a special report titled the Trade War Protection Playbook. This guide outlines our ten recommended stock market strategies designed to protect and potentially grow your wealth if the trade war intensifies.

Access it before tomorrow’s tariff announcements.

On the date of publication, Luke Lango did not hold any positions in the securities mentioned in this article, either directly or indirectly.

P.S. Stay updated with Luke’s latest market insights by reading our Daily Notes! Check out the most recent issue on your Innovation Investor or Early Stage Investor subscriber site.