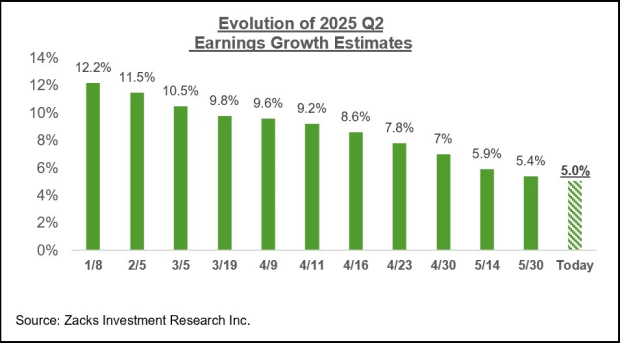

Q2 earnings are projected to increase by 5% from last year, with revenues up 4%, marking the lowest growth pace since Q3 2023. As of early April, earnings estimates had declined due to tariff announcements, with cuts occurring in 13 of the 16 Zacks sectors, notably in Conglomerates, Autos, Transportation, and Energy. The Tech and Finance sectors, pivotal to the S&P 500, have also seen reductions but exhibit a stabilizing trend.

From 18 S&P 500 members reporting thus far, total earnings are up 3.1% year-over-year on revenue gains of 6.5%, with 83.3% beating EPS estimates and 88.9% surpassing revenue expectations. Noteworthy companies include Nike, which beat estimates despite challenges, and FedEx, which faced a mixed reaction. Constellation Brands, with a year-to-date stock decline of 27%, is set to report results amid pressures from tariffs and consumer spending trends.