United Rentals Prepares for Q1 Report Amid Analyst Expectations

United Rentals, Inc. (URI), recognized as the world’s largest equipment rental provider, is based in Stamford, Connecticut, boasting a market capitalization of $36.6 billion. The company delivers a wide range of equipment solutions to industrial and construction sectors, utilities, municipalities, and homeowners. URI is scheduled to release its Q1 earnings report on Wednesday, April 23.

Ahead of the earnings announcement, analysts project that URI will report earnings of $8.92 per share. This reflects a 2.5% decrease from the $9.15 per share recorded in the same quarter last year. Historically, the company has exceeded Wall Street’s EPS estimates in half of its last four quarterly reports, while falling short in the other half.

Future Earnings Forecasts

Looking towards fiscal 2025, analysts anticipate URI to report an EPS of $44.51, up 3.1% from $43.17 in fiscal 2024. Further projections estimate a 10.3% annual growth in EPS, reaching $49.11 by 2026.

Stock Performance Overview

Over the past year, URI Stock has declined by 21.5%. This stands in contrast to the S&P 500 Index ($SPX), which has seen a 4.2% dip, and the Industrial Select Sector SPDR Fund (XLI) with a 7.2% plunge during the same period.

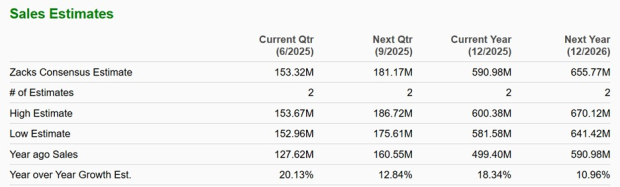

On January 29, URI shares dropped over 1% post the Q4 earnings announcement. The company reported adjusted EPS of $11.59, falling short of Wall Street’s expectation of $11.77. However, URI’s revenue of $4.1 billion exceeded forecasts of $3.9 billion. The company achieved a net income of $689 million, translating to a profit margin of 16.8%. URI’s outlook for full-year revenue estimates ranges from $15.6 billion to $16.1 billion.

Analyst Ratings and Market Outlook

The consensus on URI Stock remains relatively positive, earning an overall “Moderate Buy” rating. Among the 19 analysts tracking the Stock, eight recommend a “Strong Buy,” one opts for a “Moderate Buy,” seven suggest a “Hold,” and three advise a “Strong Sell.” The average price target set by analysts is $776.94, indicating that the stock trades at a 40.1% premium compared to current market prices.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information, please view the Barchart Disclosure Policy here.

More news from Barchart

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.