Disney Earnings Report: Revenue Growth Amid Economic Challenges

Walt Disney (NYSE:DIS) is scheduled to report its earnings on May 7, 2025. Analysts predict a revenue increase of approximately 5% year-over-year, reaching $23.1 billion. Earnings are expected to be around $1.21 per share, remaining roughly unchanged from last year. The company’s Experiences division, which includes parks, resorts, and cruise lines, may encounter challenges due to decreased tourism in the United States and a decline in the post-COVID-19 surge. In contrast, Disney’s Direct-to-Consumer media segment could perform better, benefiting from new user additions and higher pricing per user. However, investors are likely to prioritize Disney’s future outlook, especially as recent tariffs have heightened recession fears in the U.S. Almost all of Disney’s sectors—including theme parks, cruises, video streaming, and TV advertising—rely heavily on discretionary spending, which could diminish during an economic downturn.

Disney currently holds a market capitalization of $165 billion. Over the last twelve months, the company reported revenue of $93 billion, achieving operating profits of $13 billion and a net income of $5.6 billion. For those looking for potentially lower volatility than typical stock investments, the Trefis High-Quality portfolio may present a desirable alternative, having outperformed the S&P 500 and yielding returns exceeding 91% since its inception.

See earnings reaction history of all stocks

Walt Disney’s Historical Performance After Earnings Releases

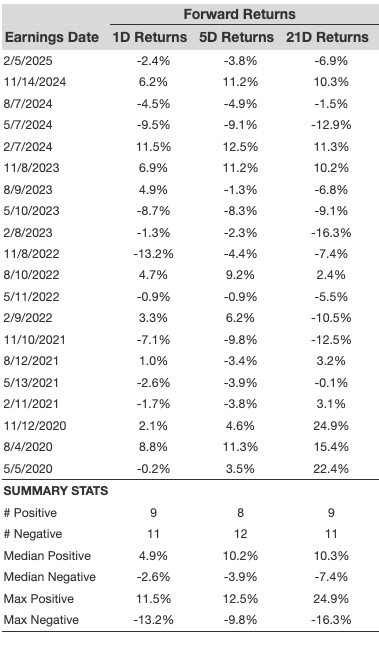

Examining the reaction to Disney’s earnings announcements over the past five years reveals the following statistics:

- Twenty earnings data points recorded, with 9 positive and 11 negative one-day returns. Overall, this indicates a 45% chance of a positive return within one day post-announcement.

- This likelihood decreases to 42% when considering just the last three years.

- The median increase among positive returns stands at 4.9%, while the median decrease for negative returns is -2.6%.

Further insights on 5-Day (5D) and 21-Day (21D) returns following earnings releases are summarized in the accompanying table below.

Understanding Return Correlations

A less risky strategy involves examining the correlation between short-term and medium-term returns after earnings releases. Finding pairs with the highest correlation can inform trading decisions. For instance, if the one-day post-earnings return is positive and 1D and 5D show strong correlation, a trader may opt for a long position over the next five days. Correlation data drawn from both five-year and three-year periods has been made available.

Influence of Peer Earnings on Disney’s Performance

Performance of competitors can impact Disney’s stock reaction following its earnings announcement. Sometimes, market adjustments begin prior to the official release. Historical data illustrating Disney’s post-earnings performance compared to peers that reported immediately before Disney is available for review. Peer stock returns are also represented through one-day post-earnings returns, allowing for fair comparisons.

The strategies discussed offer valuable insights for investors looking to navigate post-earnings dynamics effectively.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.