“`html

The average one-year price target for Apartment Investment and Management (NYSE:AIV) has been lowered to $7.14 per share, representing a 39.13% decrease from the previous estimate of $11.73 on November 18, 2024. The new target range from analysts is between $7.07 and $7.35, indicating a potential increase of 28.42% from the latest closing price of $5.56.

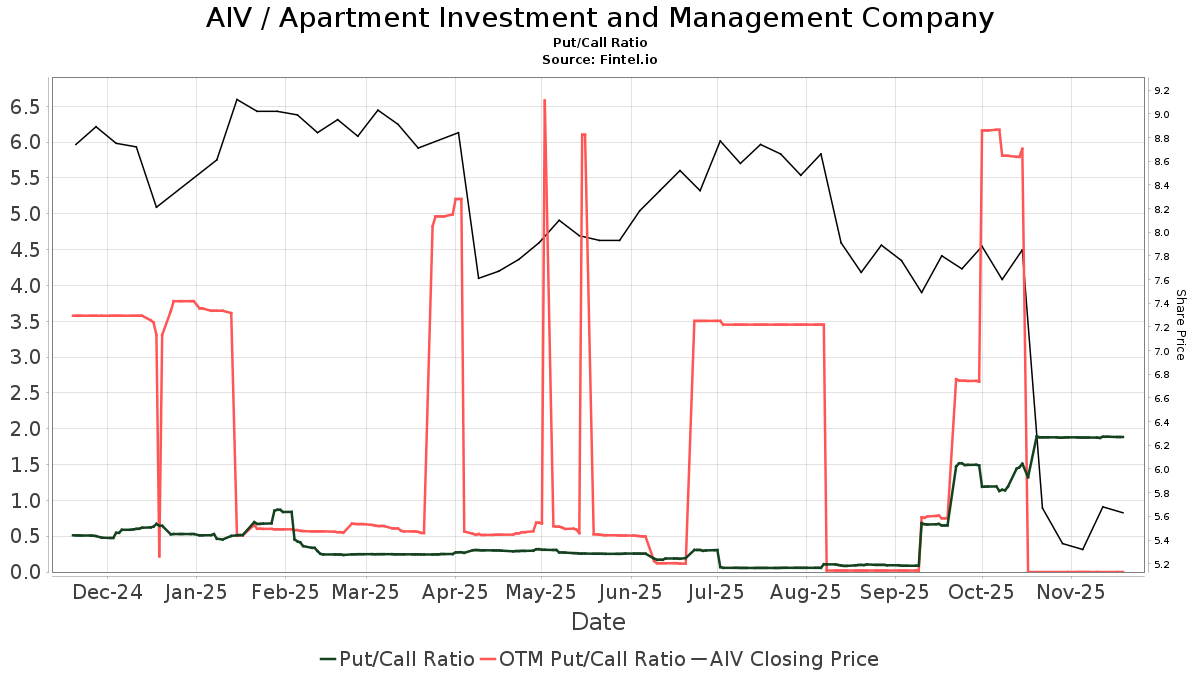

As of the last quarter, there are 382 funds or institutions reporting positions in AIV, with a decrease of 1.80% in ownership from the previous quarter. Total shares owned by institutions dropped by 3.69% to 134,746K shares, while the average portfolio weight for funds dedicated to AIV increased by 28.50% to 0.25%. The put/call ratio of AIV stands at 1.77, suggesting a bearish outlook.

Price T Rowe Associates, the largest shareholder, holds 17,296K shares (12.01% ownership), marking a 0.74% decrease from previous holdings. Goldman Sachs Group significantly increased its stake by 94.08% to 5,597K shares (3.88% ownership). Conversely, Newtyn Management raised its position by 33.13% to 7,762K shares (5.39% ownership).

“`