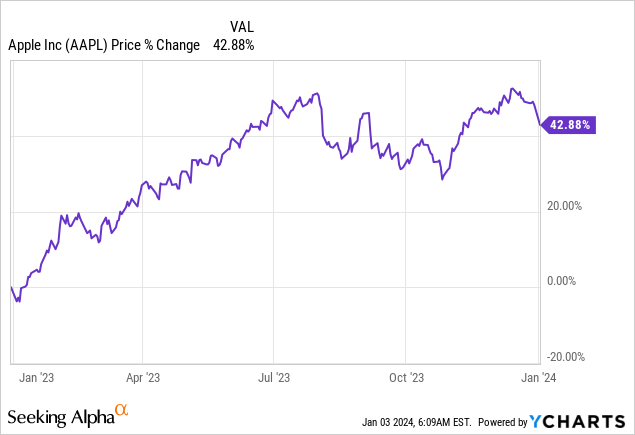

Apple’s (NASDAQ:AAPL) recent share price weakness presents an intriguing opportunity for investors to consider a long position in the iconic consumer electronics company. Despite a recent downgrade citing iPhone weakness as a potential impediment to Apple’s valuation growth, research firm Gartner’s forecast of a surge in chip demand in the coming year suggests a possible recovery in the consumer electronics industry. Given that Apple still derives nearly 80% of its revenues from hardware-related sales, a revival in device shipments could serve as a significant catalyst for the company’s growth. Could 2024 be a year of resurgence for Apple and the broader consumer electronics sector? The signs are pointing in that direction.

Data by YCharts

Revisiting the Previous Rating

Last summer, I maintained a ‘hold’ rating on Apple’s shares due to weaknesses in iPhone, Mac, and iPad growth, reflecting broader challenges in the slowing consumer electronics market. Since then, Apple’s share price has exhibited volatility, with a modest 3% increase. However, the potential for a rebound in consumer electronics demand in 2024 could breathe new life into Apple’s hardware product categories.

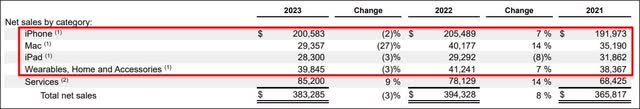

Hardware vs. Services: Striking a Balance

Although Apple’s Services business has emerged as its fastest-growing segment, offsetting some of the weakness in hardware sales over the past two years, the company’s hardware-related revenues faced a decline in fiscal year 2023. Particularly, the Mac business experienced a substantial drop. While Services reached a record-high revenue of $22.3 billion in the fourth quarter, non-Services revenue streams still accounted for 78% of Apple’s total revenues in FY 2023, emphasizing the predominance of hardware in Apple’s revenue mix. Ultimately, while Services is seeing growth, Apple’s core business will continue to be driven chiefly by its hardware product categories.

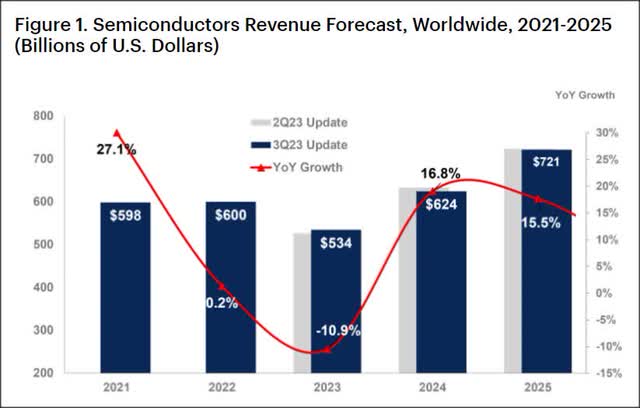

Predicting a Rebound in Device Shipments for 2024

The consumer electronics market faced negative growth in 2023, largely due to a downturn in device sales, making it a challenging period for companies like Apple. However, 2024 is showing promise as consumers appear more willing to invest in PCs and smartphones. Gartner forecasts a robust recovery in semiconductor revenues, with a projected 17% growth in FY 2024 to $624 billion. A rebound in semiconductor revenue would augur well for the consumer electronics industry, potentially benefitting from improved economic fundamentals and a waning inflationary environment.

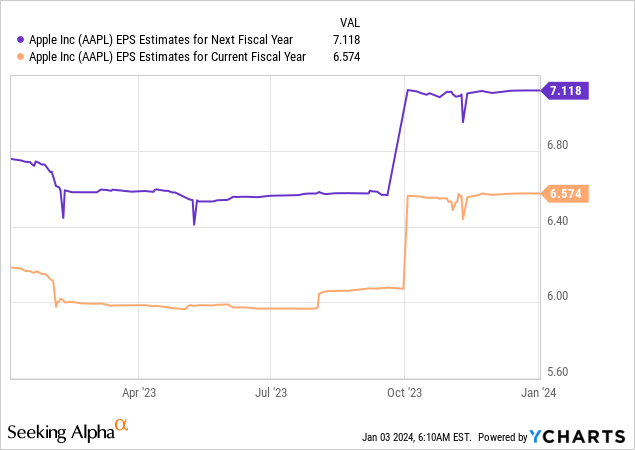

Assessing Apple’s Valuation and Earnings Potential

The current earnings per share (EPS) estimate for Apple stands at $6.57 in FY 2024 and $7.12 in FY 2025, implying an 8% growth rate. However, there is a possibility of an upward revision in these figures, especially if the anticipated rebound in consumer electronics materializes. In FY 2023, headwinds in the device market, affecting iPhone, Mac, and iPad sales, restrained Apple’s growth potential, with a mere 0.3% year-over-year increase in diluted EPS. The positive trend in EPS revisions indicates a potential for upward corrections.

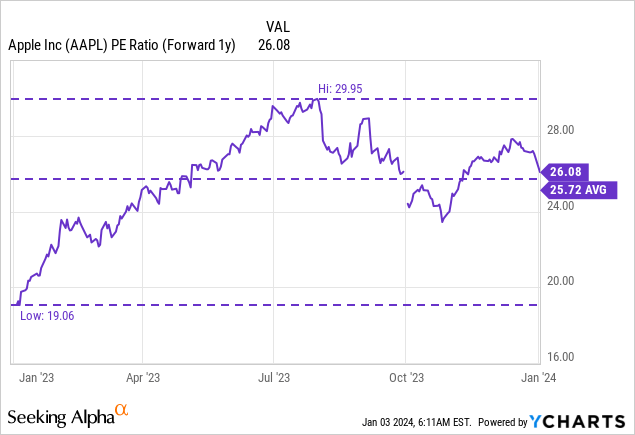

Data by YCharts

Currently, Apple’s shares are trading at a price-to-earnings (P/E) ratio of 26.1X, slightly above the one-year average of 25.7X. Looking ahead, a P/E ratio of 30X seems plausible for Apple in the long term, underscoring the potential for expansion in the company’s valuation.

Apple’s Promising 2024 Outlook

The equity research provided by Jones indicates that Apple’s stock is undervalued and has significant potential for appreciation in 2024. The analysis suggests that Apple stock is poised to reach a fair value of ~$214 based on a 30X P/E ratio, conditional on the rebound of the device market and improvements in consumer sentiment.

Risks to Apple’s Bright Prospects

Contrary to earlier projections, the U.S. economy did not succumb to a recession in 2023. A survey conducted by the National Association for Business Economics revealed that the probability of a recession in 2024 is estimated at 50% or lower by three in four respondents.

The Federal Reserve’s indication of a lower federal fund rate in 2024 implies a potential soft landing. These favorable economic conditions bode well for a recovery in the consumer electronics market. However, failure of this optimistic economic outlook could pose severe challenges for Apple, a company heavily reliant on consumer spending for its electronics segment.

Closing Perspective on Apple’s 2024

If consumer spending remains robust and the U.S. manages to avert a recession, 2024 is anticipated to be a breakthrough year for Apple. Hardware-related segments are expected to witness growth catalysts as consumers allocate more funds to new consumer electronics and crucial IT equipment upgrades. Reduced inflation should also provide consumers with financial relief, potentially leading to increased consumer spending. With an accommodative stance by the Federal Reserve and optimistic Gartner projections for the device market, Apple, bolstered by its hardware-related revenues, stands to benefit significantly from the anticipated rebound in device sales throughout 2024.