Today’s episode of Full Court Finance at Zacks breaks down the recent market comeback during the wave of tech sector earnings results from Alphabet, Microsoft, Tesla, and more. The episode then shifts its focus to two of the biggest companies in the world—Apple (AAPL) and Amazon (AMZN)—before they report to explore why investors might want to buy these mega cap tech stocks for possible near-term breakouts and long-term upside.

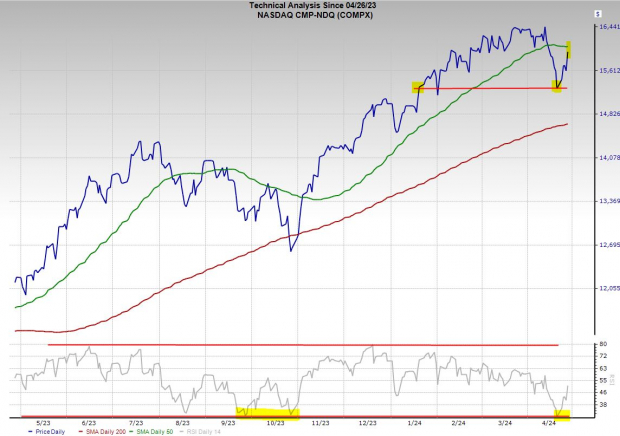

The bulls stepped up right at the S&P 500 and the Nasdaq’s 21-week moving averages. The comeback came after both major indexes fell to their most oversold levels since the market bottomed in October.

The market then looked poised to chop around a bit more after divergent reactions to Meta and Tesla. Then Alphabet (GOOGL) surged on Friday following its report to help the Nasdaq inch closer to its 50-day moving average.

Image Source: Zacks Investment Research

Alphabet followed Meta’s lead earlier this year and declared its first-ever dividend, highlighting big tech’s commitment to profits and returning value to shareholders in our new interest rate environment. It also touted its ongoing AI efforts and growth outlook.

The two stocks we dive into today are prime examples of companies that could send the market higher in the near term. Even if Apple and Amazon fail to break out after earnings, both stocks appear to be worthy long-term investments.

Apple (AAPL) – Earnings on Thursday, May 2

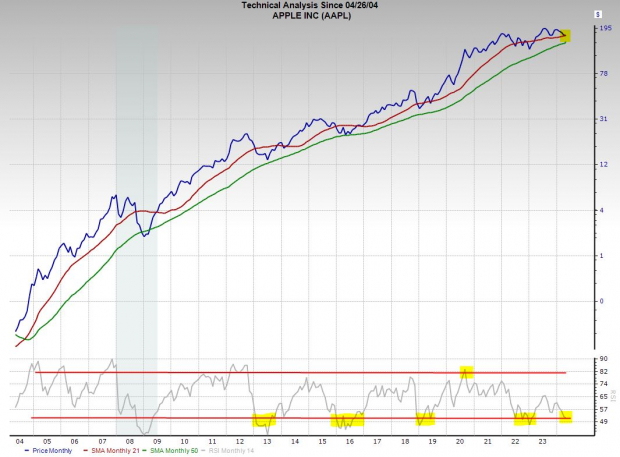

Apple shares have fallen almost 15% from their records. Worse yet, AAPL has climbed just 1% in the last 12 months, lagging the Zacks Tech sector’s 37% run, Alphabet’s 60%, and Microsoft’s (MSFT) 35%. Wall Street worries about Apple’s slowing growth in China and its lack of blockbuster AI expansion. On top of that, the DOJ is suing Apple for what it views as the iPhone’s monopoly over the U.S. smartphone market.

Despite the fears, Apple has doubled the tech sector over the last five years and outperformed GOOGL and MSFT, up 230%. AAPL appears to be finding support at its long-term 21-month moving average while trading at historically oversold RSI levels.

Apple stock trades 20% below its average Zacks price target heading into its upcoming earnings release and at a 26% discount to its 10-year highs at 24.8X forward 12-month earnings.

Image Source: Zacks Investment Research

Apple is a cash cow that buys back a ton of stock and pays dividends. Apple is exploring new growth avenues such as AI and beyond to deploy its $65 billion of net cash. Tim Cook’s company also remains committed to reaching net cash-neutral over time. Apple is projected to grow its adjusted earnings by 7% in FY24 and 9% in FY25, with flat sales in 2024 and 5% expansion next year.

Apple has more than doubled its paid subscriptions over the last four years across its services ecosystem to well over 1 billion, helping cash in on its over 2.2 billion active devices. It might be time for investors to consider buying Apple during its disappointing stretch to take advantage of the tried-and-true mantra of being greedy when others are fearful.

Amazon (AMZN) – Earnings on Tuesday, April 30

Amazon shares soared 63% in the last 12 months and 115% off their lows. AMZN slipped from its recent all-time highs and trades 20% below its average Zacks price target. Amazon stock has climbed over 1,000% in the last 10 years vs. Tech’s 281% and Alphabet’s 550%. Amazon could be ready to break out of a trading range (see nearby chart) if it wows Wall Street this week.

On the valuation front, Amazon trades 90% below its highs and at a 50% discount to its 10-year median. The rapidly improving earnings multiple is driven by Amazon’s commitment to streamlining operations at every turn to churn out profits. The company is also rapidly expanding its AI efforts and its cloud computing business stands to profit from the AI super cycle no matter what.

Image Source: Zacks Investment Research

Amazon is the largest cloud computing company and the biggest e-commerce player. Plus, its digital advertising business is booming and it is committed to boosting its streaming efforts. Amazon is projected to post 12% revenue growth in FY24 and FY25 and expand its bottom line by 42% and 31%, respectively. AMZN’s EPS outlook soared after its Q4 release to extend an impressive stretch of upward revisions that lands it a Zacks Rank #2 (Buy).

Only $1 to See All Zacks’ Buys and Sells

We’re not kidding.

Several years ago, we shocked our members by offering them 30-day access to all our picks for the total sum of only $1. No obligation to spend another cent.

Thousands have taken advantage of this opportunity. Thousands did not – they thought there must be a catch. Yes, we do have a reason. We want you to get acquainted with our portfolio services like Surprise Trader, Stocks Under $10, Technology Innovators,and more, that closed 228 positions with double- and triple-digit gains in 2023 alone.

See Stocks Now >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Amazon.com, Inc. (AMZN) : Free Stock Analysis Report

Apple Inc. (AAPL) : Free Stock Analysis Report

Microsoft Corporation (MSFT) : Free Stock Analysis Report

Alphabet Inc. (GOOGL) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.