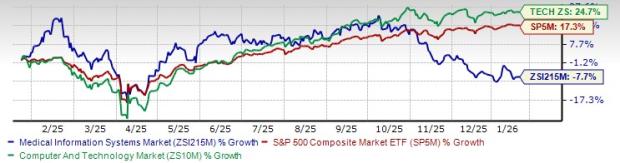

Apple Inc. (AAPL) and HP Inc. (HPQ) are navigating a challenging PC market, with a projected contraction in global shipments between 2.2% to 8.9% in 2026 due to a supply shortage of DRAM and NAND/SSD. IDC data indicates that rising demand for AI-enabled PCs could offset these declines, with revenue forecasts suggesting price increases as cost pressures mount.

In fiscal year 2025, Apple gained market share, rising to 9% with an 11.1% shipment increase to 25.6 million units. The Zacks Consensus Estimate for Apple’s Q4 fiscal Mac sales is $8.43 billion, marking a 9% growth from the prior year. Conversely, HP reported a market share of 20.2%, an increase of 10 basis points, with shipments reaching 57.5 million, though unit volumes are expected to decline in FY 2026 due to falling demand.

Looking ahead, HP expects to face a 30-cent impact on non-GAAP earnings from escalating memory costs, while Apple’s earnings estimate has slightly improved to $8.13 per share, signaling a 9% growth. Currently, Apple holds a Zacks Rank of #3 (Hold), while HP carries a #4 (Sell), reflecting differing outlooks in their respective markets.