Apple’s Stock Faces Challenges Amid Tariff Uncertainty

Apple (NASDAQ: AAPL) has been unable to escape the recent market sell-off, with shares down about 20% from their all-time highs. Investors have been particularly concerned about Apple’s dependency on China for manufacturing its electronics. Further complicating matters, any increase in base product prices would exacerbate Apple’s struggles to grow sales.

Fortunately for the company, a recent announcement provided some relief. Over the weekend, it was confirmed that smartphones and other electronics would be exempt from the reciprocal tariffs. This means the iPhone’s price won’t face an increase of 145%, the current tariff on China—though it’s important to note that this situation can change.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Learn More »

Partial Tariff Relief for iPhones Offers Temporary Comfort

As is often the case with U.S. tariff announcements, not all details are immediately clear. Commerce Secretary Howard Lutnick indicated that the exemptions for electronic devices are only temporary. A semiconductor-specific tariff is expected to be announced within a month or two, suggesting that while Apple may have short-term relief, a new form of tariff could reappear soon.

This uncertainty keeps Apple’s stock from rallying, as investors are still in a “wait and see” holding pattern with respect to tariffs.

President Donald Trump has voiced his concerns regarding tech manufacturing being predominantly offshore, citing national security risks. In response, Apple is working to shift more manufacturing back to the United States. The company announced a significant $500 billion investment over the next four years to establish U.S. facilities for production.

Whether this effort will yield favorable treatment from the Trump administration remains uncertain. Based on recent comments from Trump, it appears that exemptions may not be easily granted. This could lead to further price increases for Apple’s products to compensate for the impact of tariffs, potentially hindering sales.

Apple Maintains Premium Valuation Despite Stagnant Growth

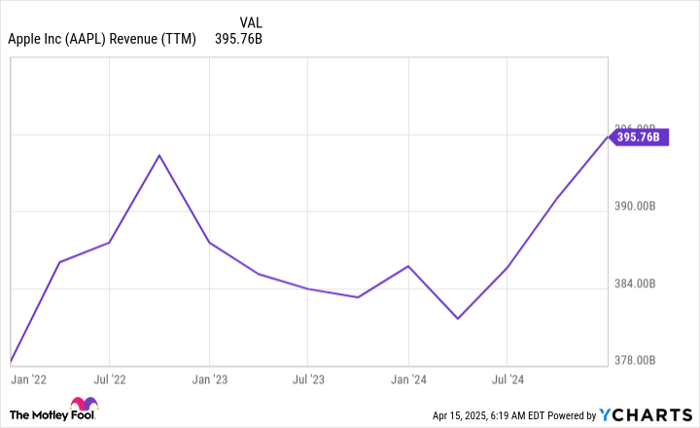

Over the last three years, Apple’s sales growth has virtually stagnated:

AAPL Revenue (TTM) data by YCharts.

Reaching its COVID-era sales peak only recently, Apple faces the challenge of tariffs as it strives to regain momentum. Clarity on how tariffs will affect its sales is expected when Apple reports fiscal second-quarter results for the quarter ending in March 2025, set for May 1.

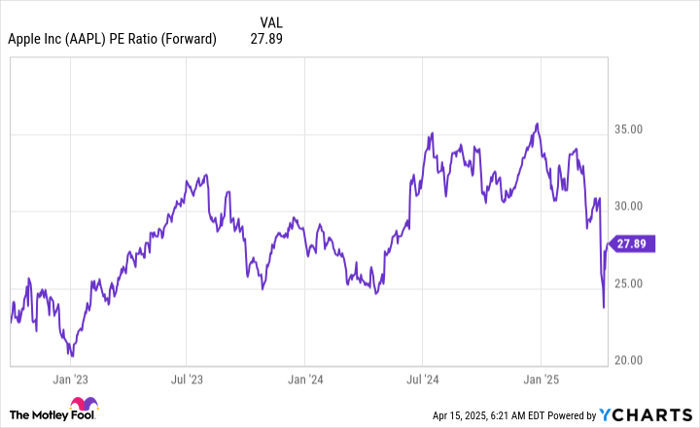

Despite the 20% decline in stock prices and stagnant sales, Apple still commands a premium valuation in terms of price-to-earnings ratio:

AAPL PE Ratio (Forward) data by YCharts.

With a forward P/E ratio of 28, Apple’s valuation remains high, though it appears more attractive than it has over the past year. Additionally, it continues to trade at a significant premium compared to the broader market, which has a forward P/E of 20.1 (as measured by the S&P 500).

Until further clarification from management post-Q2 earnings or updates on semiconductor tariffs, investors may want to be cautious with Apple stock. New products or features driving growth are currently lacking, and with consumers feeling financially strained, any price increases could be problematic. Apple may ultimately need to raise prices to counteract the tariff impacts, which would compress margins.

Is Now the Right Time to Invest in Apple?

Before investing $1,000 in Apple, consider this:

The Motley Fool Stock Advisor team has identified their top 10 investment picks, and Apple is notably absent from this list. The chosen stocks have the potential to deliver significant returns in the coming years.

For example, if you had invested $1,000 in Netflix when it made this list on December 17, 2004, you’d have $524,747!

Similarly, if you had invested $1,000 in Nvidia when it was featured on April 15, 2005, you’d now have $622,041!

Additionally, note that Stock Advisor’s average return is 792%, vastly outperforming 153 % for the S&P 500.

see the 10 stocks »

*Returns as of April 14, 2025

Keithen Drury has no position in the stocks referenced. The Motley Fool holds positions in and recommends Apple. For more information, please see the Motley Fool’s disclosure policy.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.