Apple Faces Market Challenges Amid Tariff Concerns

Tech giant Apple Inc. AAPL started the week on a downward trend, experiencing significant selling pressure on Monday. Investors are increasingly worried that U.S. President Donald Trump’s tariffs impacting several of Apple’s global manufacturing centers could severely affect the company.

Market Overview: On Monday, Apple shares fell nearly 4%, marking a continuation of declines that have now persisted for three days. Over this period, Apple has lost 20% of its stock value, erasing approximately $640 billion from its market capitalization.

These financial losses occur amidst rising fears that the tariffs may adversely impact Apple’s sales, supply chain, and overall business operations, particularly compared to other members of the MAG 7 stocks. While Apple has sought to diversify its manufacturing locations from China to new facilities in India, Malaysia, and Indonesia, these regions are also subject to new tariffs imposed by the U.S. Government.

Additional Insights: According to a study from UBS Group AG, the price for Apple’s high-end iPhone model, currently retailing at $1,199, could increase by 30%, or $350, if tariffs remain unchanged. This scenario forces Apple to choose between lowering prices and sacrificing profit margins or maintaining prices but risking a drop in sales volume.

Tim Long, an analyst from Barclays PLC, predicts that if Apple opts not to reduce prices, its earnings per share could be reduced by at least 15% immediately. He notes that the company might find ways to adjust its supply chain, potentially rerouting imports to the U.S. through countries with lower tariffs.

One of the most concerning forecasts comes from Daniel Ives of Wedbush Securities. He has characterized the situation as a ‘tariff economic armageddon’ and views it as a significant threat to Apple due to its heavy reliance on China for both production and market sales.

‘No U.S. company is more negatively impacted by tariffs than Apple,’ Ives stated, revising the stock’s price target from $325 to $250.

Market Implications: China is not only a key production hub for Apple but is also its second-largest market after the United States. This positioning puts Apple at risk from retaliatory tariffs now being enacted by China against U.S. imports.

Analysts suggest that Apple may refrain from offering operational guidance during its upcoming second-quarter results, similarly to many other tech firms, until the tariff situation is more settled and clearer outcomes are visible.

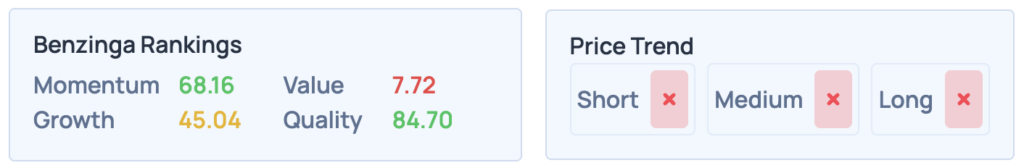

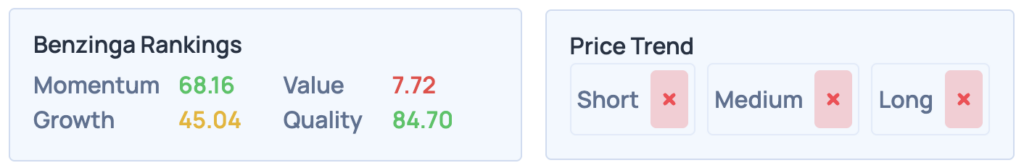

As noted by Benzinga Edge Rankings, Apple’s outlook appears unfavorable in the short, medium, and long term. Investors may wish to compare these trends against other technology stocks for a broader perspective on market performance.

Further Reading:

Photo courtesy: Shutterstock

Momentum68.16

Growth45.04

Quality84.70

Value7.72

Market News and Data brought to you by Benzinga APIs