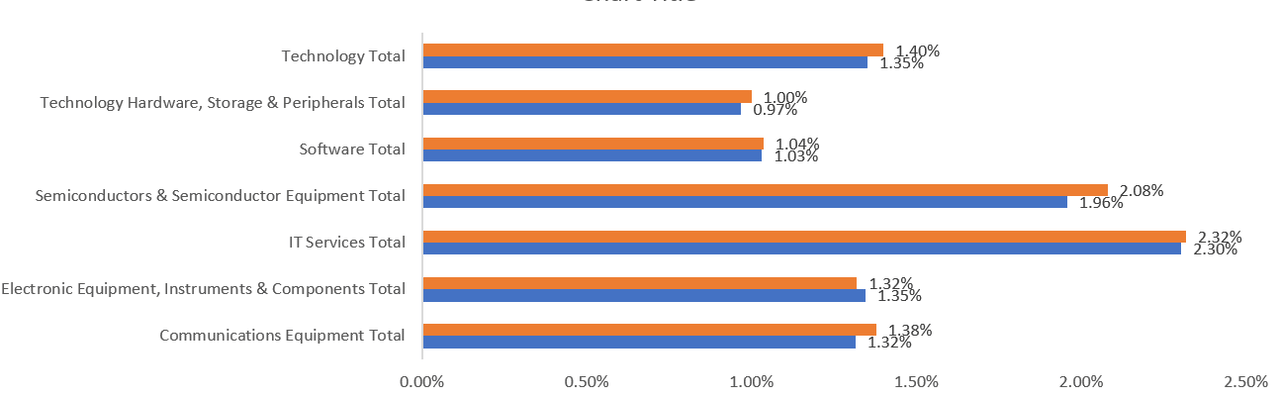

The information technology sector, which carries the most significant heft on the S&P, witnessed a slight downtick in short positions during mid-January when compared to December. The average short interest across S&P 500 information technology stocks hovered around 1.35% during this period.

Market Performance

The S&P 500’s information technology sector (NYSEARCA:XLK) reflected a 4% year-to-date increase, outperforming the broader S&P 500, which registered a 2.9% gain.

Industry Analysis

Average short interest as a percentage of floating shares:

Within the information technology sector, IT Services continued to be the most shorted industry, with a short interest of 2.30% as of mid-January, a minor decline from 2.32% at the end of 2023.

Semiconductors & Semiconductor Equipment emerged as the second most shorted industry within the sector, with a short interest of 1.96% in mid-January, down from 2.08% in December 2023.

Stock Short Positions

The most shorted information technology stock was Enphase Energy (ENPH), with 9.4 million shares sold short as of January 12, 2024, representing 7.16% of the shares float. Following closely was Akamai Technologies (AKAM) as the second most-shorted information technology stock at 6.31% of shares float, trailed by Seagate Technologies (STX) with a short interest of 5.52% and On Semiconductor (ON) at 5.51%.

Conversely, Apple (AAPL) stood out as the least shorted stock, with only 101.26 million shares sold short, accounting for a mere 0.66% of the shares float. This was accompanied by Microsoft (MSFT) and Motorola Solutions (MSI) with short interest of 0.70% and 0.73%, respectively.