Apple and Broadcom Team Up in the AI Chip Race

As artificial intelligence continues to transform industries, Apple (AAPL) is entering the fray by developing its first server processor designed specifically for AI applications. The company is partnering with Broadcom (AVGO) to integrate advanced networking components crucial for AI functionality. Reports from The Information suggest this collaboration marks a significant milestone in Apple’s AI journey.

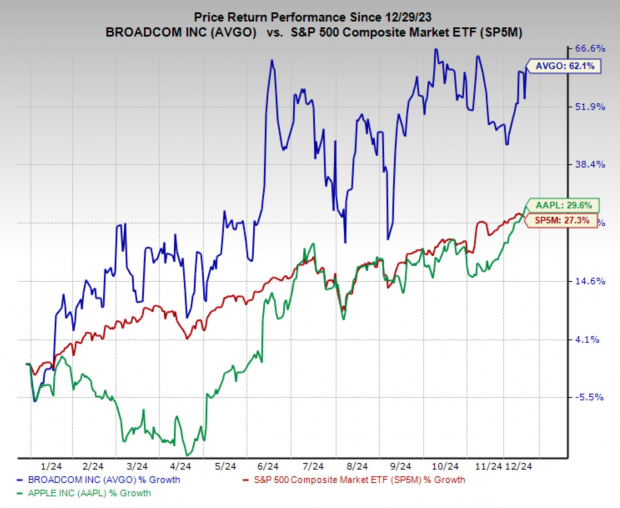

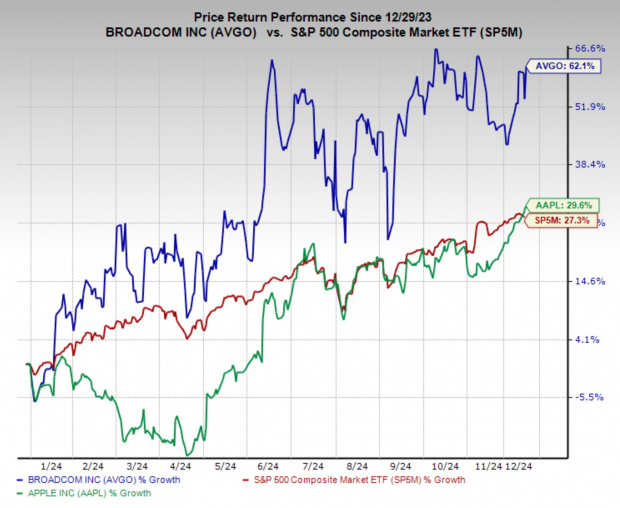

Following the announcement, both companies saw an increase in stock prices, with Broadcom rising over 5% and Apple climbing 0.75%, marking new record highs. This reaction illustrates the market’s positive outlook on their AI endeavors.

This partnership indicates Apple’s ambitions in the AI space. The demand for specialized AI chips is growing, opening doors for semiconductor companies beyond just Nvidia (NVDA). Broadcom’s action is reminiscent of Marvell’s (MRVL recent agreement with Amazon (AMZN) for custom AI chips, showcasing the competitive drive to meet the increased demand for tailored AI hardware.

Both Apple and Broadcom have outperformed the market this year and over the past five years. Broadcom is scheduled to report earnings on Thursday, December 12, after the market closes, and investors are eager to gain insights into the implications of this collaboration.

Image Source: Zacks Investment Research

Demand for Customized AI Chips Soars

The increasing reliance on AI is driving demand for custom-designed chips optimized for these specific needs. Companies like Marvell and Broadcom are emerging as key players in this landscape, providing specialized solutions alongside industry giants like Nvidia.

Marvell has shown impressive growth, with data center revenue soaring 98% year-over-year. The demand for its ASIC chips, tailored for cloud and enterprise applications, positions Marvell as an essential partner in AI infrastructure. Its new five-year contract with Amazon further emphasizes the importance of these specialized technologies.

Apple’s alliance with Broadcom to create AI server chips reflects the industry’s pivot toward incorporating custom hardware essential for advanced AI systems. These innovations enhance computing performance while reducing reliance on Nvidia’s GPUs, thus accommodating the increasing demands of AI applications.

With competition intensifying, the customized AI chip market is poised to become a pivotal segment in the semiconductor industry.

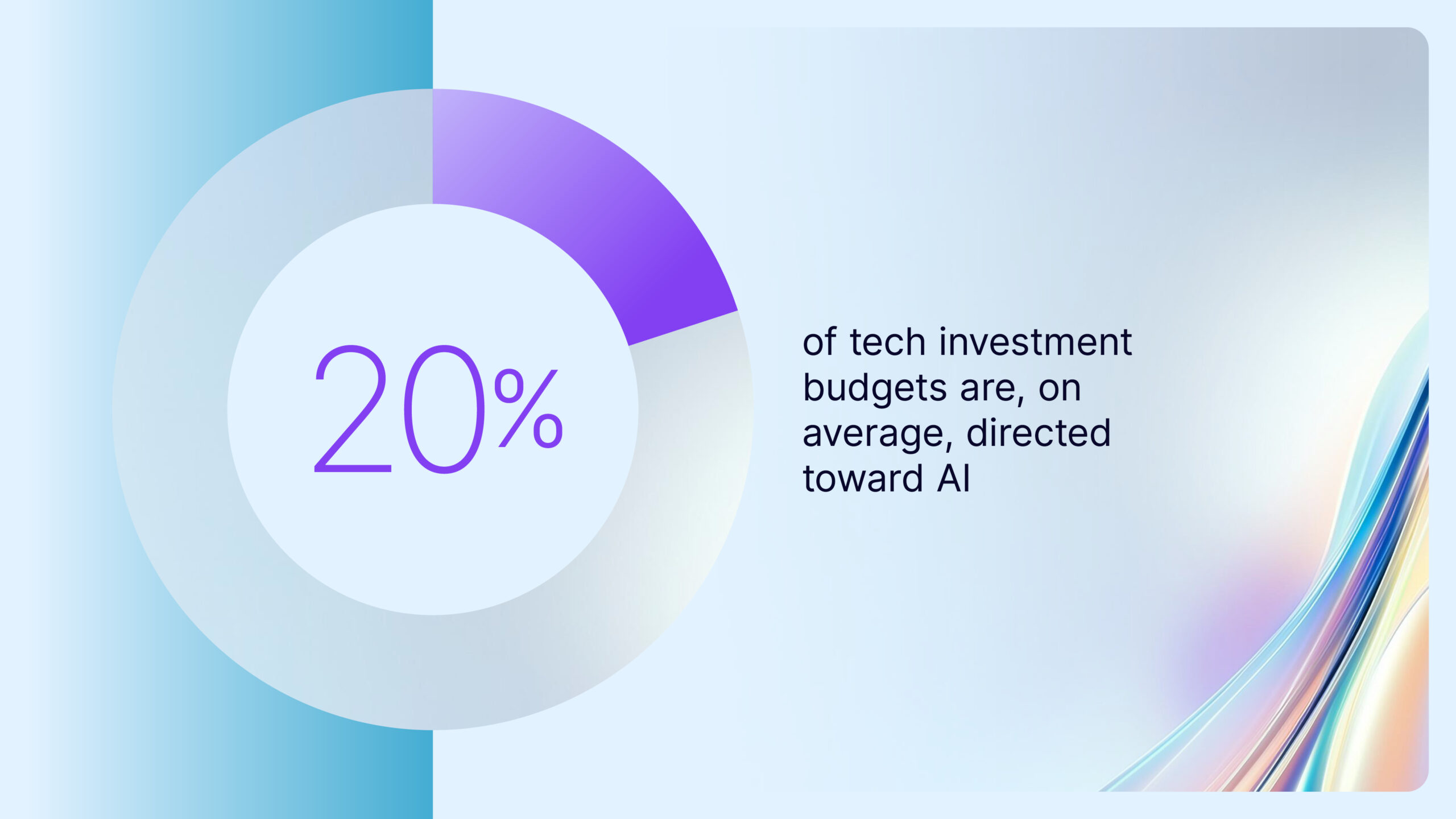

Broadcom’s Earnings Forecast

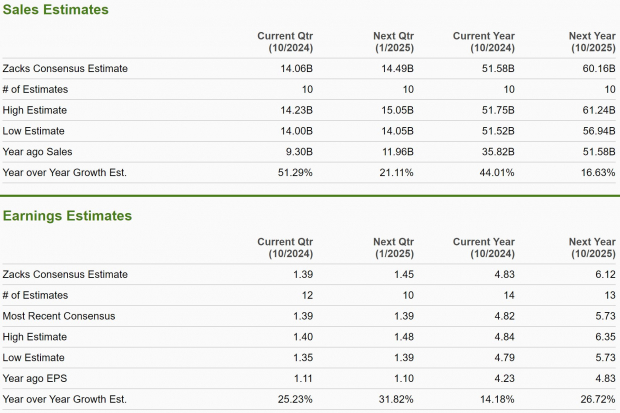

Broadcom currently holds a Zacks Rank #3 (Hold) rating. This reflects a stable earnings revision trend, but growth estimates are robust with sales expected to rise 44% this year and 16.6% next year. The recent initiative in AI chips could further enhance these forecasts.

Earnings projections are also promising, anticipating a growth of 14.2% this year, 26.7% next year, and an average annual increase of 16.5% over the next three to five years. With strong expectations for the current quarter, it will be crucial to monitor if AVGO can meet these targets. The Zacks Earnings ESP currently suggests a 0.84% earnings beat for Thursday.

Image Source: Zacks Investment Research

Is AVGO Stock a Buy Before Earnings?

Broadcom has established itself as a key player in the booming AI and semiconductor market. Its collaboration with Apple to produce custom AI server chips emphasizes its influence in shaping AI infrastructure’s future. Given Broadcom’s strong growth forecasts, the stock appears attractive ahead of the earnings announcement on December 12.

Nevertheless, earnings reports can be unpredictable. While positive results are often anticipated, the outcome can vary. Investors considering purchasing AVGO shares might find it more prudent to wait for the earnings results to assess the sustainability of the growth trend. If the AI and growth narratives prove solid, Broadcom may be a strong addition to any portfolio in the months and years to come.

Just $1 for Access to Zacks’ Recommendations

No gimmicks here.

A few years ago, we surprised our members by offering a 30-day access to all our stock picks for just $1—no obligation to spend more. Thousands took advantage of this offer, but some hesitated, thinking there must be a catch. Yes, there’s a reason: we want you to explore our portfolio services like Surprise Trader, Stocks Under $10, Technology Innovators, and others, which recorded 228 positions with double- and triple-digit gains in 2023.

Download the latest free stocks report from Zacks Investment Research.

Amazon.com, Inc. (AMZN) : Free Stock Analysis Report

Apple Inc. (AAPL) : Free Stock Analysis Report

NVIDIA Corporation (NVDA) : Free Stock Analysis Report

Marvell Technology, Inc. (MRVL) : Free Stock Analysis Report

Broadcom Inc. (AVGO) : Free Stock Analysis Report

For more details, visit Zacks.com.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.