Apple Exceeds Earnings Expectations, Driven by Strong Growth in Services

Apple AAPL announced its first-quarter fiscal 2025 adjusted earnings of $2.40 per share, surpassing the Zacks Consensus Estimate by 1.69%.

Discover the latest EPS estimates and surprises on Zacks Earnings Calendar.

In pre-market trading, Apple shares rose more than 3%.

Strong Services Growth Fuels Sales Increase

Net sales climbed 4% from the previous year, reaching $124.3 billion, which exceeded the Zacks Consensus Estimate by 0.24%.

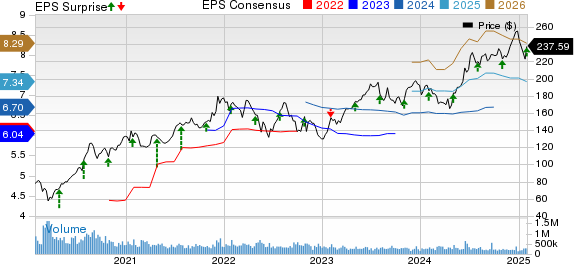

Apple Inc. Price, Consensus, and EPS Surprise

Apple Inc. price-consensus-eps-surprise-chart | Apple Inc. Quote

Services revenue surged 14% year-over-year to $26.34 billion, making up 21.2% of total sales, and surpassing expectations by 0.63%.

The company now has over 1 billion paid subscribers for its Services, more than double the amount from four years ago. The number of paid subscriptions grew by double digits annually during this quarter.

Meanwhile, iPhone sales saw a slight decline of 0.8% compared to the previous year, generating $69.14 billion, which accounted for 55.6% of total sales. Nonetheless, iPhone sales still exceeded the Zacks Consensus Estimate by 0.07%.

Overall, product sales, which represented 78.8% of total sales, increased by 1.6% year-over-year, totaling $97.96 billion. Apple now boasts an installed base of over 2.35 billion active devices.

Weak China Sales Offset by Gains in Europe and Japan

In Greater China, sales fell by 11.1% compared to last year, but this dip was balanced by strong sales increases in Japan and Europe, which saw gains of 15.7% and 11.4%, respectively.

Sales in America rose modestly by 4.4%, while the Rest of Asia Pacific saw a sales uptick of 1.3%.

Mac and iPad Sales Rise, Wearables Decline

Sales from non-iPhone products, including iPad, Mac, and Wearables, rose by 7.7% year-over-year.

Mac sales reached $8.99 billion, up by 15.5% from the same quarter last year, making up 7.2% of total sales and exceeding estimates by 7.94%.

iPad sales also increased, reaching $8.09 billion, representing a 15.2% rise and accounting for 6.5% of total sales, beating the consensus estimate by 9.49%.

In contrast, sales from Wearables, Home, and Accessories decreased by 1.7% year-over-year to $11.75 billion, representing 9.5% of net sales, yet still exceeding the consensus mark by 6.37%.

Improved Margins Reflect Operational Efficiency

The gross margin increased to 46.9%, expanding by 100 basis points (bps) on a year-over-year basis and 70 bps sequentially, aided by a favorable product mix.

The gross margin for products rose 300 bps sequentially to 39.3%, while the Services segment reached a gross margin of 75%, an increase of 100 bps sequentially.

Operating expenses climbed 6.6% year-over-year, totaling $15.44 billion, driven by a 7.4% rise in research and development expenses and a 5.7% increase in selling, general, and administrative costs.

The operating margin improved by 70 bps year-over-year to 34.5%.

A Strengthened Balance Sheet

As of December 28, 2024, Apple’s cash and marketable securities stood at $141.37 billion, while its term debt amounted to $94.8 billion.

During this quarter, Apple returned nearly $30 billion to shareholders through dividend payouts of $3.9 billion and share repurchases totaling $23.3 billion.

Outlook for Q2: Steady Growth Anticipated

Apple projects that second-quarter fiscal 2025 revenues will grow in the low to mid-single digits year-over-year, although unfavorable foreign exchange rates may hinder revenues by 2.5% on a year-over-year basis.

For the Services segment, the company expects revenue to rise in the low double digits year-over-year.

Projected gross margins are expected to be between 46.5% and 47.5% in the upcoming quarter, with operating expenses estimated to range from $15.1 billion to $15.3 billion.

Market Position and Stock Recommendations

Currently, Apple holds a Zacks Rank #4 (Sell).

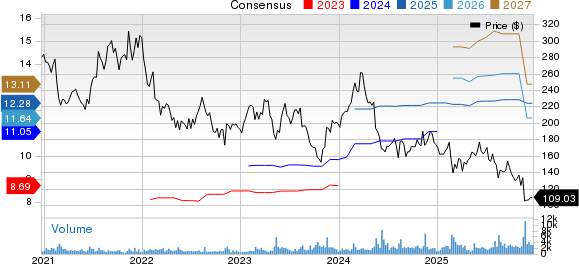

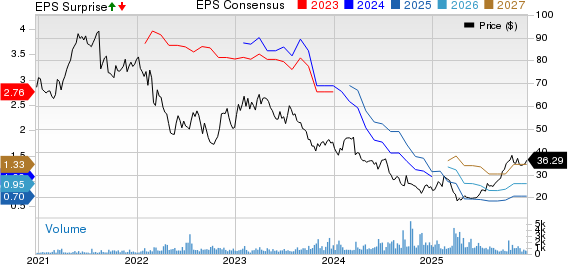

BILL Holdings BILL, Twilio TWLO, and AMETEK AME are some better-ranked stocks in the broader Zacks Computer & Technology sector. BILL and TWLO sport a Zacks Rank #1 (Strong Buy) each, while AME has a Zacks Rank #2 (Buy). You can find the complete list of today’s Zacks #1 Rank stocks here.

BILL is scheduled to report its second-quarter fiscal 2025 results on February 6. Twilio will report fourth-quarter 2024 results on February 13, while AMETEK is set to release fourth-quarter 2024 results on February 4.

Zacks’ Research Chief Highlights “Stock Most Likely to Double”

Our expert team has identified five stocks with the potential to gain +100% or more soon. Among these, Director of Research Sheraz Mian notes one stock stands out as particularly poised for significant growth.

This top pick represents an innovative financial firm with a rapidly growing customer base (over 50 million) and a wide range of forward-thinking solutions, making it a strong candidate for impressive returns. While not all top picks succeed, this one could far exceed previous Zacks’ Stocks Set to Double, like Nano-X Imaging, which soared +129.6% in less than nine months.

Free: See Our Top Stock And 4 Runners Up

Apple Inc. (AAPL): Free Stock Analysis Report

AMETEK, Inc. (AME): Free Stock Analysis Report

Twilio Inc. (TWLO): Free Stock Analysis Report

BILL Holdings, Inc. (BILL): Free Stock Analysis Report

To read this article on Zacks.com, click here.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Nasdaq, Inc.