Is Apple Stock a Smart Buy? A Close Look at Growth and Strategy

2024 proved to be a landmark year for Apple (NASDAQ: AAPL), boasting a total return of 33%. The company stands tall with a market capitalization of $3.7 trillion, the highest among publicly traded companies. Given its significant market position, investors may question how much further growth is possible for this tech leader.

Let’s analyze Apple’s current standing, management’s financial strategies, and the outlook for 2025 to determine if the stock is a buy, sell, or hold.

Where’s the Smartest Place to Invest $1,000 Today? Our analysts have identified the 10 best stocks to consider buying now. See the 10 stocks »

Apple’s Financial Performance: Impressive Yet Slowing Growth

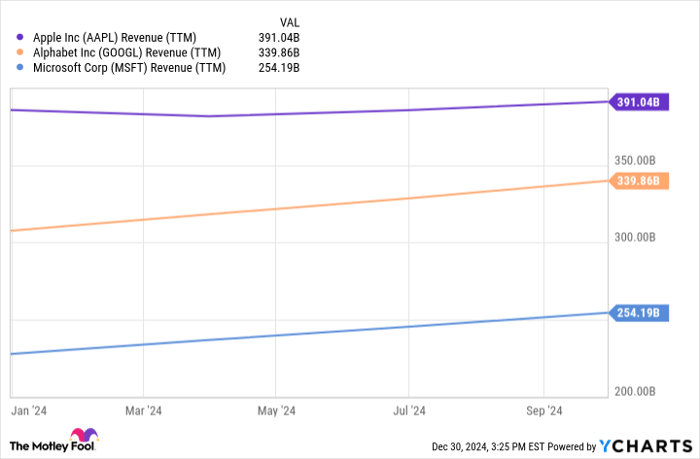

Apple’s latest financial performance reveals strong revenue metrics, generating $391 billion during fiscal year 2024. For context, Alphabet (NASDAQ: GOOG) (NASDAQ: GOOGL) and Microsoft (NASDAQ: MSFT) brought in $339.9 billion and $254.2 billion, respectively.

However, compared to its rivals, Apple’s revenue growth is stalling at just 2%. In contrast, Alphabet grew by 10.6% and Microsoft by 11.7% year-over-year.

AAPL Revenue (TTM) data by YCharts

A closer examination of sales by segment presents mixed results. iPhone sales, which are Apple’s largest source of revenue, totaled $201.2 billion in fiscal year 2024, showing slight growth of 0.3%. However, both the iPad and wearables/home accessories segments saw declines of 5.7% and 7.1%, respectively.

The positive highlight for Apple lies in its services segment, encompassing apps, subscriptions, Apple Pay, and advertisements. This segment achieved $96.2 billion in fiscal year 2024, demonstrating an impressive year-over-year growth of 12.9%.

Despite varied sales figures across categories, Apple displayed remarkable free cash flow generation, with $108.8 billion in fiscal 2024, a 9.3% rise from the previous year. For comparison, Alphabet and Microsoft reported $55.8 billion and $72.7 billion, respectively, over the past 12 months.

Return of Capital to Shareholders: A Core Strategy

Apple’s strong free cash flow allows management to return capital to shareholders via dividends and share repurchases. The company currently issues a quarterly dividend of $0.25 per share, leading to an annual yield of 0.4%. Even though this yield is lower than many other dividend-paying stocks, investors can anticipate annual increases for the foreseeable future, as management has raised dividends for 13 consecutive years while maintaining a low payout ratio of just 16.3%.

In addition to dividends, Apple actively engages in share buybacks, which increases each shareholder’s percentage ownership without requiring extra investment. Although buybacks incur a 1% tax, they typically offer more tax efficiency than dividends, which are taxed twice.

Remarkably, in 2024, Apple’s outstanding shares dropped by 2.2%, totaling an impressive 13.8% reduction over the last five years. In fiscal 2024, management allocated nearly $95 billion for share repurchases and introduced a new $110 billion buyback program in May.

AAPL Shares Outstanding data by YCharts

Investing in AI: Apple’s Path to Future Growth

Similar to other technology leaders, Apple is significantly investing in artificial intelligence (AI) as a promising growth avenue. During fiscal year 2024, the company spent $31.8 billion on research and development, marking a 4.9% increase from fiscal year 2023. In a recent earnings call, CEO Tim Cook highlighted that Apple Intelligence, the company’s AI system, “will transform how users interact with technology.”

This technology is currently only available on newer Apple hardware, potentially driving more customers to upgrade their devices.

While still in early stages, management believes that Apple Intelligence might boost its services revenue by “double digits” and overall revenue by “mid-single digits” in fiscal Q1 2025 compared to Q1 2024.

The Bottom Line on Apple Stock

When considering any stock purchase, it’s vital to evaluate its valuation. A great company like Apple can become a poor investment if its price point is too high.

One useful metric is price-to-free cash flow (P/FCF), which compares a company’s market capitalization to its free cash flow. Currently, Apple trades at nearly 36 times its trailing-12-month free cash flow of $108.8 billion. Examining this ratio against competitors and Apple’s historical valuations helps determine whether the stock is cheap, fairly valued, or overvalued.

AAPL Price to Free Cash Flow data by YCharts

In comparison, Alphabet and Microsoft trade at 44 times free cash flow, making Apple relatively cheaper. Nevertheless, its current P/FCF ratio is at a five-year high. While the excitement around the AI boom is palpable, much of this projected growth has yet to be realized, suggesting that Apple’s current valuation is high.

Despite this, Apple remains an attractive long-term investment, and current shareholders may benefit from holding. The company is likely to continue rewarding shareholders through increasing dividends and ongoing buybacks. If Apple’s AI strategy succeeds, it could usher in a significant growth phase.

Considering an Investment in Apple? Here’s What to Know

Before purchasing stock in Apple, keep this in mind:

The Motley Fool Stock Advisor analyst team has highlighted what they believe are the 10 best stocks to buy right now… and Apple didn’t make the list. The selected stocks have the potential to generate substantial returns over the coming years.

Think about when Nvidia was featured on this list back on April 15, 2005… if you had invested $1,000 then, you’d now have $823,000*.

Stock Advisor provides investors with straightforward strategies for success, including portfolio-building advice, regular analyst updates, and two new stock picks each month. Since 2002, the Stock Advisor service has achieved a return more than quadruple that of the S&P 500*.

See the 10 stocks »

*Stock Advisor returns as of December 30, 2024

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Collin Brantmeyer has positions in Alphabet, Apple, and Microsoft. The Motley Fool has positions in and recommends Alphabet, Apple, and Microsoft. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.