Tech Giants Struggle Amid Tariff Fallout: Apple’s Key Position

The recent stock market sell-off triggered by the Trump administration’s tariff announcements on April 2 has significantly impacted top technology companies. The group of firms, dubbed the “Magnificent Seven” stocks—Apple (NASDAQ: AAPL), Microsoft, Amazon, Alphabet (Google), Meta Platforms (Facebook), Nvidia, and Tesla—has experienced noticeable declines from their peak values. Of these, Apple has seen the steepest drop in response to the new tariffs.

Where should you invest $1,000 today? Our analyst team has identified the 10 best stocks to buy now. Learn More »

The question remains: is the stock‘s decline justified? How will the tariffs influence Apple and its popular iOS products? Most crucially, should investors consider buying the dip or waiting for a better moment?

Apple’s Tariff Challenges

The announced tariff plan by the Trump administration is expected to have wide-ranging effects on both the economy and manufacturing sectors. Beginning on April 5, President Donald Trump’s plan implemented a 10% tariff on U.S. imports. Subsequently, starting April 9, the government aims to impose “reciprocal tariffs” on imports from countries considered to have unfair trade practices against the United States.

The U.S. has a considerable trade deficit, importing significantly more than it exports. This policy shift signals a dramatic change in the trade landscape, possibly raising prices for American consumers.

If the reciprocal tariff rates take effect, Apple stands to be profoundly affected. Much of Apple’s supply chain is located internationally, with manufacturing spread across China, India, Japan, South Korea, Taiwan, and Vietnam. Here are the announced reciprocal tariff rates for these nations:

- China: 34%

- India: 26%

- Japan: 24%

- South Korea: 25%

- Taiwan: 32%

- Vietnam: 46%

Additionally, Apple sources most hardware components from abroad. This situation raises the possibility that the cost of an iPhone could increase by as much as 43%. Consequently, Apple may need to absorb these costs or pass them on to consumers, which could adversely affect sales.

Pre-existing Pressures on Apple

The tariffs are a definitive trigger for Apple’s stock decline, yet they are not the sole reason. Analysts argue that Apple has stumbled in its initial foray into artificial intelligence (AI). The integration of AI features into Siri and iOS last year, branded as Apple Intelligence, failed to boost iPhone sales as anticipated, leading the company to reorganize its AI leadership.

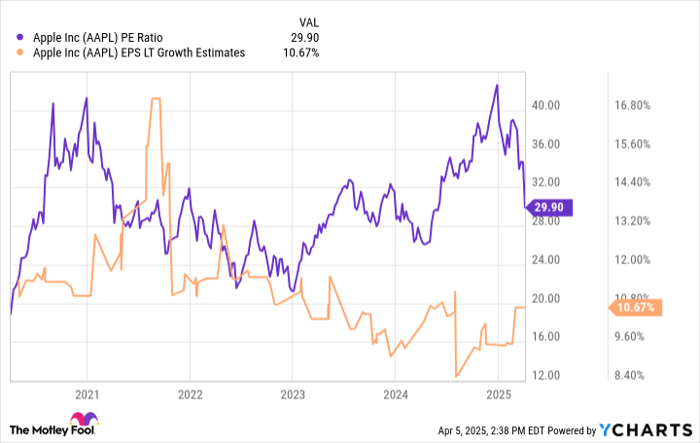

This backdrop does not inspire much confidence. Moreover, Apple’s stock began the year trading at a price-to-earnings (P/E) ratio exceeding 40, even as analysts have consistently revised earnings growth estimates downwards since early 2022:

AAPL PE Ratio data by YCharts.

Notably, multibillionaire Warren Buffett, CEO of Berkshire Hathaway, has been reducing his company’s substantial stake in Apple over the past year. Although it remains Berkshire’s largest position, Buffett’s well-known acumen for valuations suggests that he identified issues before the recent tariff-related downturn.

Thus, while tariffs served as the catalyst for Apple’s decline, the groundwork for this drop had already been laid.

Is Now the Time to Invest in Apple?

Apple is universally acknowledged as a leading company and could fit well in any long-term investment portfolio. Unfortunately, the timing may not be ideal for purchasing shares at present. The stock currently trades at 30 times earnings, and prospective growth might be jeopardized if tariffs impact margins or reduce demand for new iPhones.

That said, Apple may find a way to navigate this landscape; it recently announced a plan to invest $500 billion in the U.S., potentially aiding in negotiations concerning the tariff rates.

However, Apple’s price appears high given its stagnant growth, especially considering potential tariff implications. Investors might reconsider when the situation stabilizes and the stock is closer to a P/E of 20, which would better reflect its growth prospects. Until then, Apple may not be the best investment choice.

Should You Invest $1,000 in Apple Immediately?

Before making an investment in Apple’s stock, take note:

The Motley Fool Stock Advisor analyst team has recently outlined their top 10 stock picks for investors right now—none of which include Apple. These selected stocks show potential for substantial returns in the years ahead.

Consider Nvidia, which made this list on April 15, 2005… If you had invested $1,000 at that recommendation, you would have $578,035 today!

Stock Advisor offers investors a straightforward road map to success, featuring portfolio-building guidance, analyst updates, and two new Stock picks each month. The Stock Advisor service has more than quadrupled the return of the S&P 500 since 2002.* Access the latest top 10 list by joining Stock Advisor.

*Stock Advisor returns as of April 5, 2025

Suzanne Frey, an executive at Alphabet, serves on The Motley Fool’s board of directors. Randi Zuckerberg, a former Facebook executive and sister to Mark Zuckerberg, also holds a board position. John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a board member as well. Justin Pope has no positions in any mentioned stocks. The Motley Fool maintains positions in and recommends Alphabet, Amazon, Apple, Berkshire Hathaway, Meta Platforms, Microsoft, Nvidia, and Tesla. The Motley Fool also suggests the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool adheres to a disclosure policy.

The views and opinions expressed herein are solely those of the author and do not necessarily reflect the views of Nasdaq, Inc.