“`html

Apple Faces Challenges Despite Strong Fiscal Quarter Performance

Apple (NASDAQ: AAPL) shares declined after the release of fiscal second quarter results for the period ending March 29. Although the iPhone maker exceeded analysts’ expectations for revenue and earnings, CEO Tim Cook acknowledged that new import tariffs will significantly impact the company. For the current quarter, these tariffs are projected to cost about $900 million, nearly 4% of last quarter’s net income of $24.8 billion.

However, tariffs represent just one of Apple’s hurdles. A lack of meaningful growth from its primary profit center, along with ongoing challenges in artificial intelligence (AI), pose greater long-term concerns for the company and its investors.

Quarterly Results Highlight Revenue Growth

For the three months ending in March, Apple reported $95.4 billion in revenue, equating to earnings of $1.65 per share. These figures surpassed last year’s performance of $90.8 billion and $1.53 per share and exceeded analysts’ expectations for $94.6 billion and $1.62, respectively. The iPhone continues to be a critical component of Apple’s business, accounting for approximately half of total revenue with sales reaching $46.8 billion.

Despite this, concerns arose primarily due to tariff implications. The estimated cost of $900 million during fiscal Q3 is significant, and while Apple might eventually reduce reliance on Chinese manufacturing, transitioning production to other countries is neither quick nor inexpensive. This backdrop adds complexity to the company’s operational landscape.

iPhone Revenue Growth Remains Stagnant

The first major concern is related to the iPhone itself. While some analysts praised last quarter’s revenue growth in this segment, the overall increase is not as remarkable as it seems. According to IDC data, unit sales increased by 10% year-over-year, but this is a rebound from a prior decline. Actual revenue growth was a modest 2%, suggesting that iPhone sales have plateaued.

Moreover, some consumers likely anticipated the tariff impacts and rushed to purchase new devices, potentially masking underlying demand weaknesses. Since the iPhone constitutes about 50% of Apple’s revenue, stagnation in this area raises serious questions about future profitability.

Artificial Intelligence Needs Improvement

Another pressing issue lies in Apple’s slow progress in artificial intelligence. The company entered the AI landscape later than competitors, missing out on early opportunities to capture market share. Although Apple’s virtual assistant Siri resembles offerings from rivals, the company has struggled to deliver updated features and capabilities.

Recent developments, including the departure of Apple’s AI chief, add to the concerns about Siri’s future. Tim Cook acknowledged the delays, remarking that improving Siri has taken longer than expected, which may indicate deeper issues in the development process.

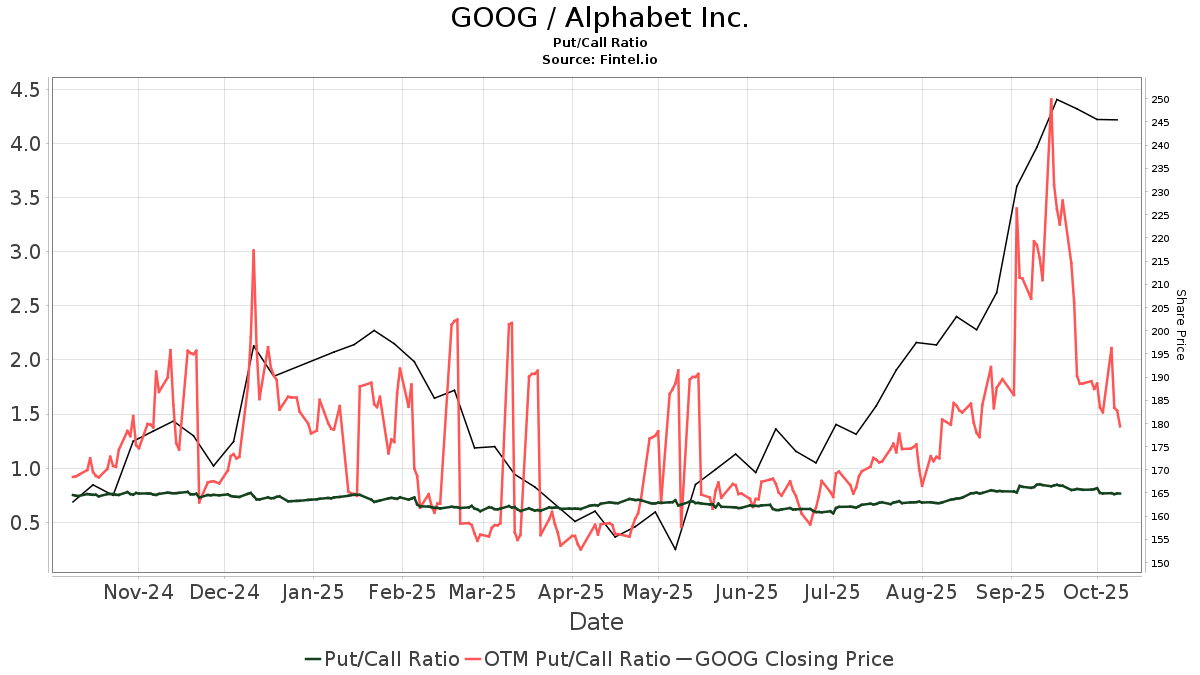

In a surprising twist, Alphabet CEO Sundar Pichai mentioned that Apple and Google are close to an agreement allowing Apple Intelligence users to utilize Google’s Gemini AI model. This partnership underscores Apple’s struggles and suggests it is falling behind in essential R&D initiatives.

Outlook and Market Position

Despite these concerns, Apple remains the world’s most profitable company. With substantial cash flow and approximately $133 billion in liquid assets, the company can invest in new technology or repurchase stock. Its services division continues to perform well, yet it constitutes just over one-fourth of total revenue and less than half of gross profits.

It is crucial to recognize the interconnected nature of Apple’s product and service sales. iPhone owners generate revenue through apps and subscriptions, but spending limits could cap future growth. This factor demands attention as Apple navigates its next steps.

In conclusion, while Apple is not necessarily a sell at this point, prospective investors should approach the stock with caution given the existing challenges and market dynamics.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Continue »

“`

Assessing Apple’s Investment Potential Amid Declining Performance

Despite being down more than 20% from its December peak, Apple may still attract investors who speculate that tariffs will ease instead of becoming permanent challenges. The company’s services division continues to impress, contributing positively to its overall portfolio, even if it doesn’t overshadow the flagship business.

However, it’s clear that Apple no longer stands as the essential investment it once was. The company has been losing ground in the competitive AI landscape, where rivals are effectively capturing market share. Additionally, the iPhone segment shows stagnant growth, with little indication of a resurgence.

Is Now the Right Time to Invest $1,000 in Apple?

Before making a decision to purchase Apple stock, it’s important to consider this:

The analyst team at Motley Fool Stock Advisor has highlighted what they believe are the 10 best stocks for current investment opportunities—and notably, Apple is not included. The recommended stocks are positioned for significant growth in the coming years.

Reflect on the past when Netflix was recommended on December 17, 2004. If you had invested $1,000 at that time, your return would now stand at an impressive $611,589*! Similarly, an investment in Nvidia, recommended on April 15, 2005, would be worth $697,613* today.

Furthermore, the Stock Advisor program’s total average return is a robust 894%, vastly outperforming the S&P 500’s 163% return. Don’t miss out on the latest top 10 list by joining Stock Advisor.

*Stock Advisor returns as of May 5, 2025

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. James Brumley has positions in Alphabet. The Motley Fool holds positions in and recommends Alphabet, Apple, and Microsoft. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.