Apple’s CarPlay Ultra Debuts Amid Mixed Financial Trends

Apple (AAPL) has launched its next-generation infotainment system, CarPlay Ultra, in new Aston Martin models across the U.S. and Canada. Existing vehicles will also receive this update through software enhancements. Additionally, this system is anticipated to roll out in new models from Hyundai, Kia, and Genesis.

The global infotainment industry is poised for significant growth, with a projected compound annual growth rate (CAGR) of 7.2% from 2025 to 2032, reaching $58.18 billion by 2032, according to Fortune Business Insights. CarPlay, alongside Android Auto, remains a favored option among automakers. The latest iteration of CarPlay Ultra provides comprehensive information across driver screens, integrating maps, media, and data from the vehicle, which includes advanced driver assistance systems and tire pressure monitoring.

On the technology front, Apple is enhancing its service offerings linked to the iPhone. Recently, the company updated Apple Maps to allow users to easily find top-rated restaurants, hotels, and golf courses, incorporating rankings and insights from expert sources.

However, Apple is encountering challenges with iPhone demand, particularly in China. Competition from Huawei and Xiaomi has intensified, leading to a year-over-year sales decrease of 2.3% in the second quarter of fiscal 2025. Despite this, iPhone sales rose 1.9% year over year to $46.84 billion for the same quarter, buoyed by improved iPhone 16 sales in regions where Apple Intelligence is utilized.

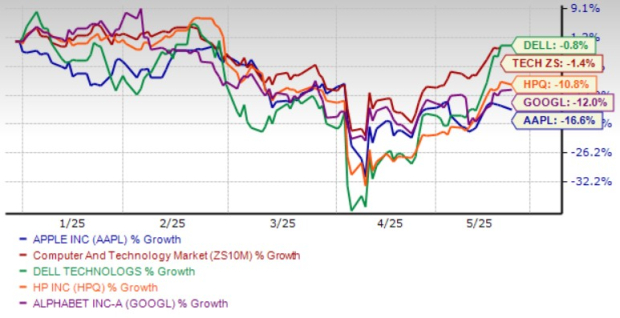

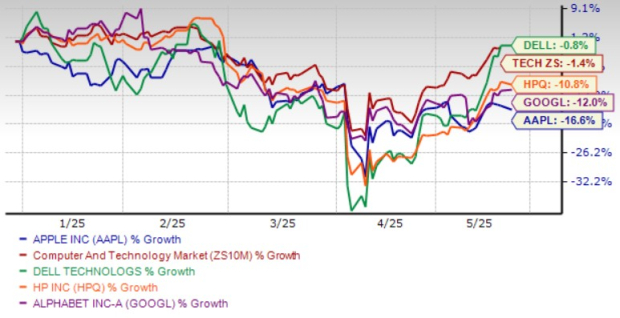

Regarding stock performance, Apple shares have declined 16.6% year-to-date (YTD), lagging behind the broader Zacks Computer & Technology sector and its closest competitors, including Dell Technologies (DELL), HP (HPQ), and Alphabet (GOOGL), which have seen drops of 0.8%, 10.8%, and 12%, respectively.

Apple Stock’s YTD Performance

Image Source: Zacks Investment Research

Apple Intelligence Expansion to Enhance Sales

With the updates to iOS 18.4, iPadOS 18.4, and macOS Sequoia 15.4, Apple has broadened the accessibility of Apple Intelligence, introducing it in various languages, including French, German, and Chinese (simplified). These features have been made available globally. Initially launched in U.S. English, Apple Intelligence has expanded since December 2024.

This enhancement adds functions such as Writing Tools and Notification Summaries, boosting productivity for Mac users. Features like the Clean Up Tool for Photos and the Image Wand in the Notes app for iPad help refine user experiences. Additionally, the vision OS 2.4 introduces key Apple Intelligence functionalities for Vision Pro users.

Can Strong Services Propel Apple Forward?

While Apple’s primary business continues to center on the iPhone, its Services portfolio has emerged as a significant growth driver. Services revenues increased by 11.6% year over year in the fiscal second quarter, with expectations of consistent low double-digit growth for the March-end quarter (fiscal second quarter 2025).

Apple now boasts over 1 billion paid subscribers across its Services, more than doubling their numbers from four years ago. Both transacting and paid accounts have reached record highs, with double-digit annual growth reported in paid subscriptions as well. The expanding offerings of Apple TV+, Apple Music, and Apple Arcade, along with the growing user base for Apple Pay, have fueled this growth.

AAPL Earnings Estimates Reflect Downward Trend

The Zacks Consensus Estimate for Apple’s fiscal 2025 earnings recently decreased by 0.8% to $7.12 per share, indicating a growth of 5.48% compared to fiscal 2024.

Apple Inc. Price and Consensus

Apple consistently outperformed the Zacks Consensus Estimate in each of the last four quarters, with an average earnings surprise of 4.68%.

Apple Shares May Be Overvalued

Currently, the AAPL stock is perceived as overpriced, reflected in a Value Score of D suggesting a stretched valuation. Apple’s forward 12-month price-to-earnings (P/E) ratio stands at 27.89, higher than the sector’s average of 25.5, and significantly above Alphabet’s 17.06, Dell Technologies’ 12.41, and HP’s 8.26, indicating potential overvaluation.

Price/Earnings (F12M)

Image Source: Zacks Investment Research

AAPL shares are presently trading below the 200-day moving average, highlighting a bearish trend.

Apple Trading Below 200-day SMA

Image Source: Zacks Investment Research

Apple Stock: Buy or Hold?

Apple faces intense competition in China and forthcoming tariff increases, which are expected to add $900 million to costs. Consequently, the current growth projections do not appear to warrant the premium valuation. However, the expansion of Apple Intelligence may enhance the company’s outlook.

AAPL is currently rated with a Zacks Rank #3 (Hold), indicating that investors may want to wait for a more opportune moment to enter the stock market.