Understanding Charlie Munger’s Investment Approach with Apple and Moving Averages

Lessons from Charlie Munger and Warren Buffett

Warren Buffett is often recognized as one of the most successful value investors in Wall Street history, achieving remarkable results over decades. However, his success is largely attributed to his partnership with Charlie Munger. Until his passing in November 2023 at the age of 99, Munger brought immense wisdom, humor, and investment acumen to their collaboration.

Do Buffett and Munger Utilize Technical Analysis?

“Simplicity is the ultimate sophistication” is a quote that resonates deeply in investing. Through years of experience in various strategies, I have learned that effective investing often involves eliminating distractions and concentrating on what truly matters.

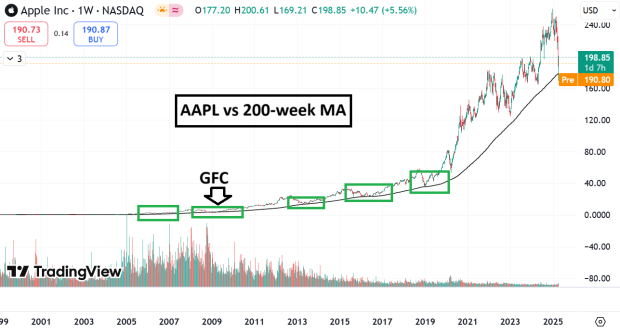

Even though my approach leans toward trend-following and growth investing, I never underestimate the effectiveness of Buffett and Munger’s methods. Munger once stated, “If all you ever did was buy high-quality stocks on the 200-week moving average, you would beat the S&P 500 by a large margin over time.” This idea resonates with me, as I have been applying this strategy for long-term investments, though I discovered this quote only recently.

While few can analyze balance sheets like Munger and Buffett, we can certainly adopt their insights to improve our investing strategies. Although well-known for their fundamental analysis, Munger’s insight suggests they also harness long-term technical analysis to enhance their investments.

Apple’s Consistent Position Relative to the 200-Week Moving Average

Until recently, Nvidia (NVDA) somewhat eclipsed it, but Apple (AAPL) had held the title of “true market leader” for two decades. This stock became so essential to investors that not holding it was viewed negatively by many hedge funds and mutual funds.

However, despite its strong performance, Apple is still subject to market dynamics. No stock can defy gravity indefinitely—as valuations can become inflated or market corrections can occur. In fact, approximately 75% of a stock’s price movement generally tracks the overall market direction. The following chart illustrates Apple’s long-term performance against its 200-week moving average.

Image Source: TradingView

This week, AAPL touched the 200-week moving average and experienced a strong rebound. Historically, the stock only interacts with the moving average once every four to five years, yet the outcomes are compelling. Notably, even during the Global Financial Crisis of 2008, AAPL shares maintained their position around the 200-week MA.

Assessing Apple’s Current Valuation

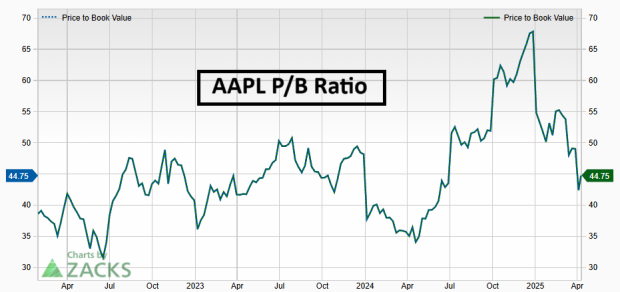

Following the “DeepSeek” and tariff-related correction, Apple’s price-to-book ratio has significantly decreased from over 65x to approximately 44x as of today.

Image Source: Zacks Investment Research

Apple’s Response to Tariff Concerns

Recently, the Trump Administration initiated a 90-day suspension of stringent tariffs on Chinese imports, a development beneficial to Apple. Investors may also underestimate that many customers rushed to buy ahead of potential price hikes, resulting in frontloaded revenue.

Conclusion

All stocks, including Apple, are subject to market forces. Yet, as of yesterday, the stock has retraced to a level that has provided support for over two decades.

7 Best Stocks for the Next 30 Days

Experts have identified seven elite stocks from the current pool of 220 Zacks Rank #1 Strong Buys, predicting they are “Most Likely for Early Price Pops.” Since 1988, the full list has surpassed market performance with an average annual gain of +23.9%. It’s worth monitoring these seven carefully.

see them now >>

For the latest recommendations from Zacks Investment Research, you can download the report on the 7 Best Stocks for the Next 30 Days. Click for free access to this insightful report.

Apple Inc. (AAPL) : Free Stock Analysis report

NVIDIA Corporation (NVDA) : Free Stock Analysis report

This article originally published on Zacks Investment Research (zacks.com).

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.