The average one-year price target for Applied Digital (NasdaqGS: APLD) has been updated to $48.89 per share, marking a 10.90% increase from the prior estimate of $44.09 dated December 18, 2025. This new target reflects an average of projections from multiple analysts, with a range spanning from a low of $36.36 to a high of $103.95. The average price target indicates a potential increase of 33.23% compared to the last reported closing price of $36.70.

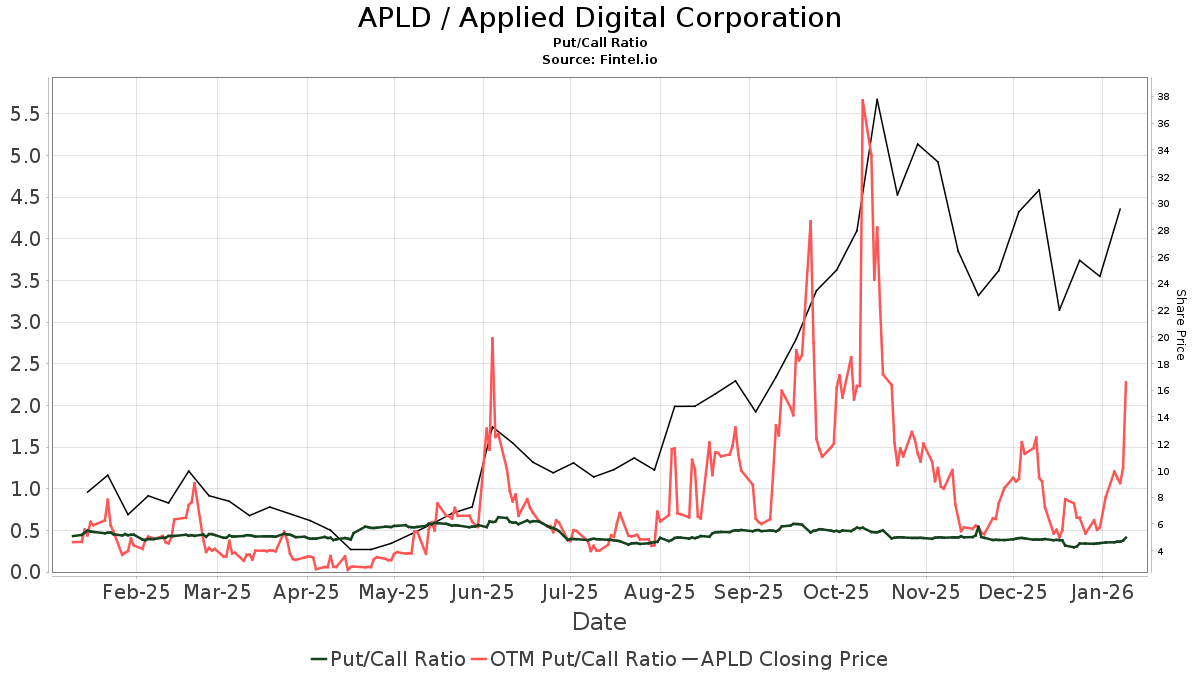

As of the last quarter, 551 funds or institutions are reporting positions in Applied Digital, a rise of 69 holders or 14.32%. Institutional ownership has increased by 16.99% to 206,157K shares, with an average portfolio weight of 0.39%, up 7.30%. The put/call ratio stands at 0.50, suggesting a bullish market outlook.

Notable shareholders include Hood River Capital Management with 21,047K shares (7.53% ownership), and D. E. Shaw, which increased its stake to 10,906K shares (3.90% ownership) after previously reporting zero ownership. Jane Street Group also increased its holdings to 7,199K shares (2.57% ownership), marking a 100% acquisition from prior filings.