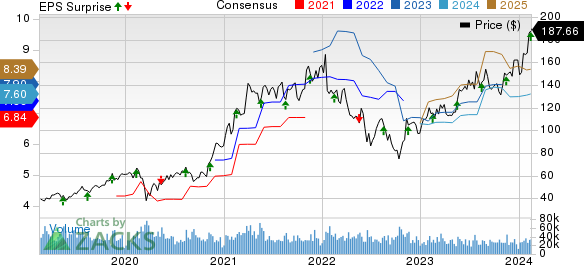

Applied Materials Inc. (AMAT) reported first-quarter fiscal 2024 non-GAAP earnings of $2.13 per share, exceeding the Zacks Consensus Estimate by 12.1%. Moreover, the figure improved 5% from the year-ago quarter’s reported number.

Net sales of $6.71 billion were down 0.5% from the year-ago quarter’s reported level. The figure surpassed the Zacks Consensus Estimate of $6.47 billion.

It’s like seeing a sprinter stumble but still cross the finish line in record time. Despite a slight decline in sales, Applied Materials managed to beat earnings estimates, showcasing resilience in the midst of market challenges.

Segments Paint a Complex Picture

Softness in the Semiconductor Systems segment remained a headwind. Weakening momentum across Taiwan, Southeast Asia, the United States, and Europe was a major negative. Nevertheless, the company’s strength in the Applied Global Services (“AGS”) segment was a positive. Further, improving the Display segment contributed well. AMAT also experienced solid momentum across China and Japan in the reported quarter.

Geographical Revenues: Peaks and Troughs

Sales in Japan and China increased 23.9% and 161.7%, respectively, from the year-ago quarter. Sales in the United States, Europe, Korea, Taiwan, and Southeast Asia fell 27.8%, 28.4%, 4.8%, 71.6%, and 26.5%, respectively, from the year-ago quarter.

Operating Results and Financial Health

The non-GAAP gross margin was 47.9%, which expanded 110 basis points (bps) from the year-ago quarter. Operating expenses were $1.23 billion, up 5.3% from the year-ago quarter. As a percentage of sales, the figure expanded 100 bps from the year-earlier quarter to 18.4%. The non-GAAP operating margin of 29.5% for the reported quarter remained flat year over year.

Guidance and Future Outlook

For the second quarter of fiscal 2024, Applied Materials expects net sales of $6.50 billion (+/-$400 million). The Zacks Consensus Estimate for the same is pegged at $6.28 billion. AMAT anticipates Semiconductor Systems, AGS, and Display sales to be $4.80 billion, $1.50 billion, and $150 million, respectively. Management expects non-GAAP earnings per share of $1.79-$2.15, with further projections for non-GAAP gross margin and operating expenses.

Conclusion and Zacks Rank

Despite the sales dip, Applied Materials remains a strong contender, as evidenced by its Zacks Rank #2 (Buy). For investors seeking alternatives, top-ranked stocks in the broader technology sector include CrowdStrike, Badger Meter, and AMETEK. The trio exhibits promising potential amidst broader market fluctuations.