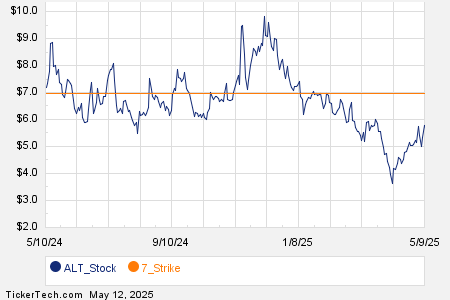

Applied Optoelectronics Sees Mixed Investor Sentiment Amid Earnings Report

Investors displayed fluctuating sentiment regarding Applied Optoelectronics (NASDAQ: AAOI) over the past two trading days. The optical communications specialist’s shares fell by 0.6% on Friday following the release of its latest quarterly earnings report. However, the stock rebounded sharply, surging 24% on Monday.

Strong Revenue Growth

This earnings report marked Applied’s first set of figures for 2025, showing revenue just under $100 million for the fourth quarter. This figure represents a substantial increase from the $40.7 million recorded during the same quarter in 2024.

In terms of profitability, the company narrowed its non-GAAP (adjusted) loss significantly. The reported shortfall was $900,000—or $0.02 per share—compared to a loss of $12 million in the same quarter a year ago. The top-line figure closely matched the average analyst estimate of $99.4 million, while Applied precisely met the consensus projection of a net loss of $0.02 per share.

Looking ahead, the company provided guidance for its current (first) quarter of the fiscal year. Applied anticipates revenue between $100 million and $110 million, with a projected adjusted net loss ranging from $0.09 to $0.03 per share. However, this outlook contrasts with analyst expectations, which forecast a profit of $0.07 per share on $114 million in revenue.

Positive Response to Market Dynamics

Investor sentiment was also influenced by Applied’s manufacturing operations in China. The announcement of a pause or reduction in tariffs imposed by the Trump administration brought relief to investors, contributing to a notable 24% increase in the stock price on Monday.

Analysts highlight the company’s growth potential, particularly in the data center segment. However, there is a pressing need for Applied to return to profitability, as investors will expect a turnaround soon.

Investment Considerations for Applied Optoelectronics

Before investing in Applied Optoelectronics, investors should consider the following:

Notably, the Motley Fool analyst team has identified their list of top stocks for investment, and Applied Optoelectronics isn’t among them.

Investment success stories include past recommendations like Netflix on December 17, 2004, where a $1,000 investment would now be worth $614,911, and Nvidia on April 15, 2005, with a similar investment growing to $714,958.

The Stock Advisor has achieved an average return of 907%, significantly outperforming the S&P 500’s 163% return.

Eric Volkman holds no positions in any of the mentioned stocks. The Motley Fool also holds no positions in these stocks.

The opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.