Archer-Daniels-Midland (NYSE:ADM) touts itself as a titan in the nutrition industry, renowned for its processing of grains and crops, integral components in a multitude of food products. Headquartered in Chicago, IL, the company’s operations span the nation, collaborating with top food enterprises to produce consumables for humans and animals alike. Nonetheless, a recent pronouncement has unsteadied investors’ resolve.

The bombshell dropped on January 21, 2024, intimating that the company had placed its CFO on administrative leave and launched an investigation into certain accounting procedures within its nutrition division. Simultaneously, it pledged cooperation with the SEC. Archer-Daniels-Midland operates in three key segments: ag services and oilseeds, carbohydrate solutions, and nutrition. The latter, in particular, had been the company’s most rapidly expanding arm. Consequently, its current plight presents an intriguing opportunity for discerning investors. Let’s delve deeper into the repercussions of the recent turmoil:

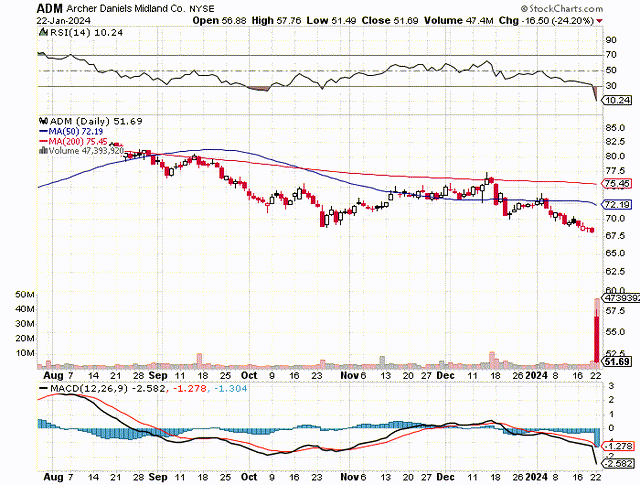

The Catastrophic Plunge:

The graph paints a dire picture. The stock, once comfortably perched at around $70 per share, careened on Monday, January 22, 2024, suffering a gut-wrenching descent – shedding approximately 25% of its value and bottoming out at a new 52-week low of $51.49 per share. The telltale relative strength index, or “RSI,” now languishes at an abysmal 10. When was the last time we witnessed such a woeful RSI? Surely, this portends a state of extreme overselling, given that stocks typically register as oversold when the RSI hovers around 30 or lower. An RSI of 10 signifies an egregiously oversold stock.

Prognostications:

With the stock languishing at such immoderate levels of overselling, a palpable upswing could be imminent. Yet, it would be judicious to brace for potential further tumult and unwelcome news. The imminent adversities may materialize in the form of a spate of analyst downgrades, some of which are already in evidence. Moreover, the specter of class action securities lawsuits looms ominously, with extant filings portending a flood of such litigations. This cumulative cascade of downgrades and legal wrangling could exert sustained downward pressure on the stock. Nevertheless, a juncture is expected where the stock will demonstrate resilience against downgrades and litigation, prompting a partial rebound, possibly propelled by short covering as the market recognizes that the stock has plumbed the nadir. The stock might then find a modicum of relief, albeit remaining ensnared within a trading range until the company emerges unscathed from the accounting malaise and the SEC inquiry, a process that may span a couple of quarters or more. The company is optimistic about concluding the accounting scrutiny by late February 2024. Chronicling this development, Seeking Alpha’s news editor Joshua Fineman penned a recent illuminating article, detailing:

“The probe is looking at inter-segment transactions at Archer-Daniels-Midland (ADM), according to CNBC’s David Faber. ‘The numbers may not change,’ Faber said.”

This relatively expeditious resolution to the accounting imbroglio and the tantalizing prospect that “the numbers may not change” could be viewed as a boon for shareholders, possibly casting the almost 25% slump in the stock as an overreaction.

A Stratagem for Acquisition:

Unfazed by the tempest catalyzed by the accounting conundrum, I have commenced accumulating shares at the $51 mark, with plans to incrementally bolster my position in the ensuing days. Additionally, I am contemplating the vantage of selling put options to capitalize on the premiums. If my holdings reach a significant magnitude and the stock undergoes a considerable rally, I might divest a portion of my holdings, but not without retaining a substantive tranche for the long haul. The edifice of food production ranks among the most resilient and pivotal segments inviting investment. I envision the accounting issue as an isolated and transient setback that will soon recede into oblivion. It is conceivable that this conundrum will exert negligible influence, being confined to a solitary arm (nutrition) of this colossal food producer, slated for resolution in the forthcoming quarters.

Projected Earnings and Financial Fortitude:

Archer-Daniels-Midland has been the architect of robust financial performances in recent years. Earnings for 2023 are poised to exceed $6.90 per share, and analysts foresee earnings of $6.08 for 2024, and $6.20 for 2025. Moreover, the balance sheet exudes solidity, flaunting a handsome cash reserve of approximately $1.5 billion and a debt load of $9.5 billion. Boasting an annual revenue north of $90 billion and entrenched in the relatively stable environs of the food industry, the company’s balance sheet radiates robustness. Prospective resurgence in the stock is underpinned by aspirational plans for share buybacks totaling nearly $5 billion, sanguine single-digit revenue escalation, and a pleasingly shareholder-oriented stance on dividends.

Archer-Daniels-Midland: A Strong Dividend Growth Stock for Investors

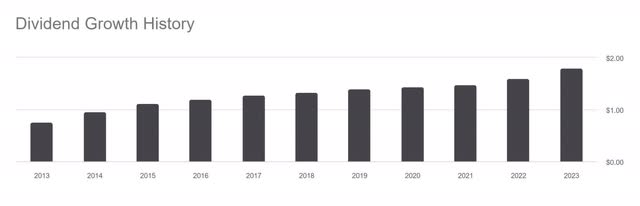

The Growth of a Dividend Stock

Archer-Daniels-Midland has a long history of consistently increasing its dividend payouts to shareholders. Over the past decade, the quarterly dividend has more than doubled, rising from 24 cents per share in 2014 to the current 50 cents per share, offering a yield of about 4%. The company proudly boasts a track record of paying dividends for 91 consecutive years and increasing dividends for over 50 years.

Furthermore, Archer-Daniels-Midland is honored to be a part of the S&P 500 Dividend Aristocrats Index, a group of select companies that have paid a dividend for 25 years or more. It is also recognized as a “Dividend King” for consistently raising dividends for 50 years or more. The recent announcement of an 11% increase in the quarterly dividend to 50 cents per share marks the 51st consecutive year of dividend growth. With a dividend yield of nearly 4%, the company’s strong commitment to rewarding shareholders remains evident.

Potential Downside Risks

Despite the impressive dividend growth, investors should approach with caution. The stock recently experienced a significant 25% decline, potentially attributed to factors such as weakening sales and profits expected in 2024. Additionally, an ongoing accounting issue presents a looming shadow over the stock. The resolution of this matter is crucial in mending investor sentiment. The company also faces risks from inflation and geopolitical events that may impact the production and shipping of essential crops.

In Summary

Despite the recent challenges, many investors view the current valuation of Archer-Daniels-Midland as an attractive opportunity for investment. The expected completion of the accounting investigation by the end of February and the recent dividend increase indicate a potential short-term setback, which may provide an opportune entry point for investors. With the stock deeply oversold and showing signs of impending stability, investment in this company presents a compelling case. The growth in food production as the global population increases, coupled with the company’s resilience in economic downturns, positions it as a promising investment. While the stock may be due for a rebound in the near term, patient accumulation of shares and holding into 2025 could yield substantial gains along with consistent dividend income.

No guarantees or representations are made. Hawkinvest is not a registered investment advisor and does not provide specific investment advice. The information is for informational purposes only. You should always consult a financial advisor.