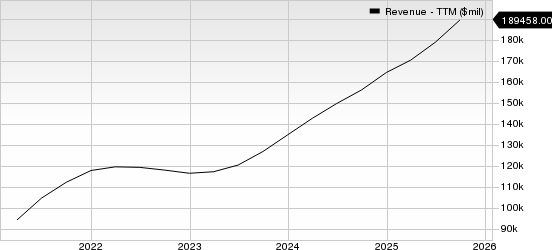

Alibaba Group Holding Limited (BABA) reported a 25% decline in revenue from its “All Others” segment for Q2 fiscal 2026, marking consecutive quarterly losses. This contraction was primarily attributed to the sale of Sun Art and Intime and underperformance in its logistics arm, Cainiao. The overall growth of Alibaba’s core businesses—China e-commerce, international commerce, and cloud operations—failed to offset these losses, leading to a forecasted revenue growth of only 6.2% for fiscal 2026.

In the logistics sector, Alibaba faces intensified competition from JD.com and Amazon, with JD Logistics seeing over 24% revenue growth year-over-year in Q3 fiscal 2025. Both competitors are enhancing their operational efficiencies, posing challenges to Alibaba’s logistics offerings that are constrained by a partner-driven network. As a result, the pressure on profitability is exacerbated by ongoing investments in technology and AI initiatives.

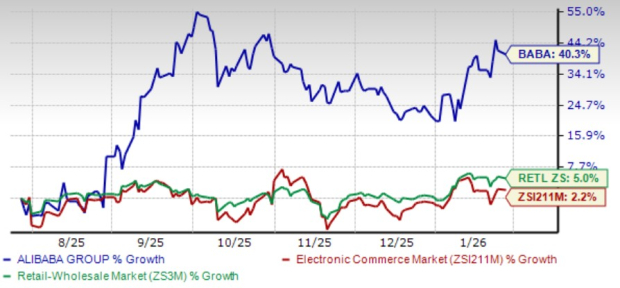

As of now, Alibaba shares have increased by 40.3% over the past six months, outpacing the Zacks Internet – Commerce industry growth of 2.2%. However, the Zacks Consensus Estimate predicts a declination in earnings, projecting a $6.05 per share outcome, reflecting a year-over-year drop of 32.85%.